Treasurers,

Measures

Cultures

Let’s get your organization’s finances -- organized

Save time and money with one platform that merges nonprofit payment collection, banking, expenses,and fundraising.

- No subscription fees or minimum balances.

- Trusted by 700+ independent & multi-chapter orgs.

One platform

for all your nonprofit financial needs

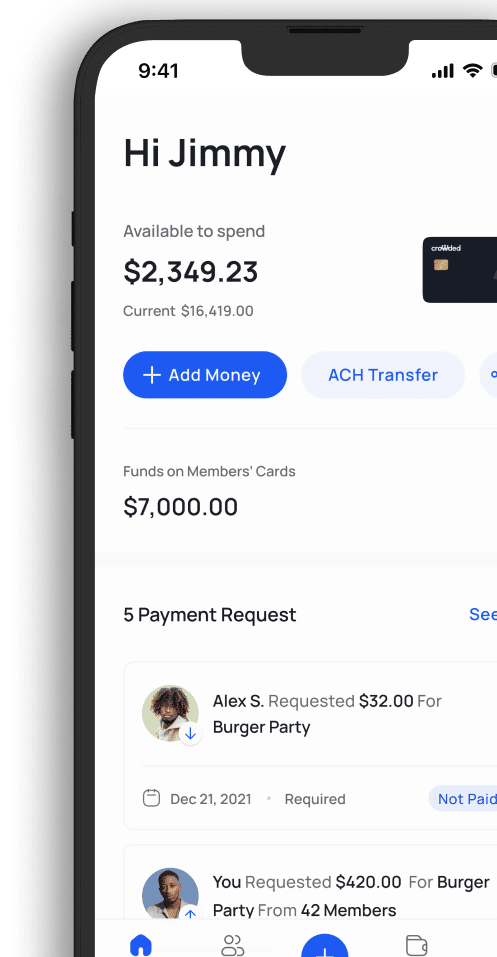

Control Spending

Allocate funds with digital & physical cards with just a few clicks. Track member spending, redeem unused funds and never deal with a reimbursement again.

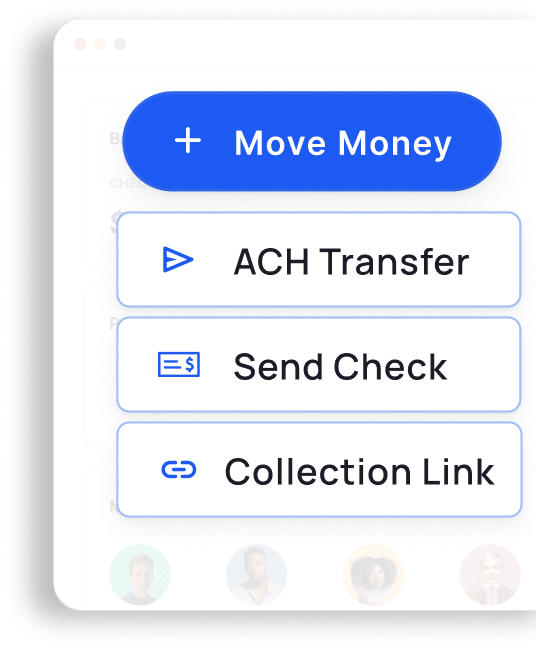

Collect Payments

Easily collect payments for dues, donations, events with no app or subscription required by your members.

Manage Your Finances

Fundraise Passively

Set up a shop-to-give cashback program, earn a share of the savings your members receive on their everyday shopping, no subscription fees.

Manage Your Finances

Fundraise Passively

Set up a shop-to-give cashback program, earn a share of the savings your members receive on their everyday shopping, no subscription fees.

Darryl Gecelter

Co-Founder @ Crowded

Hey 😊 Let’s see if Crowded

is a good fit for your organization 👀

Thank you ! Your demo is booked!

While waiting on your demo, check out how Crowded helps

non-profit groups like yours.

Built for any nonprofit group

Trusted by 700+ nonprofits including

4.2 stars from our users

Treasurers like you already love us

Better than Venmo

We needed a mainstream way to collect dues, as Venmo stopped supporting group accounts. We also liked the feature of allocating funds to team members’ virtual cards.

Kaegon,

President, Carolina Health Samaritan Society

A Treasurer’s lifesaver

This has made my life so much easier! Its saved so many back and forth Venmo requests and now I don’t have to keep receipts. I don’t usually review apps but this has been just great!

The best app for collecting dues

This thing is a treasurer’s lifesaver. Best thing our chapter has bought.

Incredible

An absolute incredible app really helps a ton!

So helpful!!

Crowded made collecting dues so much easier!! The digital debit card is my favorite aspect of the app as it makes work as a treasurer much easier!!

Would Highly Recommend

Switching my fraternity’s financial system from Venmo to Crowded Banking is the best decision I’ve made as treasurer. Collecting dues and handling reimbursements became hassle free, people no longer have to wait for me to manually reimburse them. I would recommend this system to any fraternity, sorority , or club of any kind.

Love the Digital Cards

As a social chair for my professional frat on campus, Croweded makes life so much easier with its officer debit cards! I can spend out social budget without worrying about losing the physical card or annoying reimbursements 🙂

Saves Time & Money

Crowded has given our fraternity the ability to develop financial strategies from the local to the national level. By partnering with Crowded on both the national and chapter level, we have not only achieved annual savings of approximately $10k but also experienced a reduction in reporting time by over 40 hours annually.

Anthony,

Iota Pi Theta, International Grand Treasurer

No-brainer!

I heard about Crowded through another chapter that recently switched over and said that collecting dues with Crowded is super easy. Can definitely say that it’s so much easier after using Crowded for a few months. Saves a lot of time and everything is way more organized.

Blaine,

International Director of Finance and Insurance, Pi Kappa Alpha

Collecting Dues

I heard about Crowded through another chapter that recently switched over and said that collecting dues with Crowded is super easy. Can definitely say that it’s so much easier after using Crowded for a few months. Saves a lot of time and everything is way more organized.

Ben,

Zeta Beta Tau

Huge time save

I’m the treasurer of my frat and we started using Crowded a few months ago. I was spending so much time tracking down members and messaging everyone, and now I can do everything on Crowded in minutes.

Sam,

Zeta Psi

Free, Helpful, and Easy-to-use

Crowded ended up being a really useful application for my fraternity, and definitely helped me out as Treasurer. I was able to organize all the payments and reimbursements on one platform and view the required actions for all members.

answered.

Have other questions? Contact Us

What is Crowded?

Crowded is a financial platform that offers nonprofit membership groups easy ways to collect, spend and manage money online.

Some of our standout features include:

Accounts that are free to open with no minimum balances & funds that are FDIC-insured up to $250,000 through Blue Ridge Bank.

Easy digital officer handovers.

Digital & physical Visa® debit cards with budgeted amounts for group member expenses.

Unified banking for multi-chapter organizations.

Payment collection links for dues, member fees and donations.

To set up a Crowded account for your nonprofit, create a free account online or book a demo with one of our team members for any questions or additional support.

How is Crowded different from Venmo or PayPal?

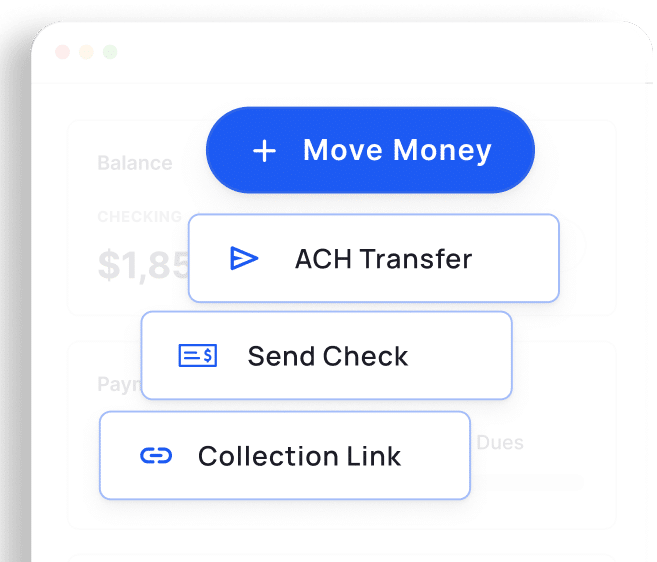

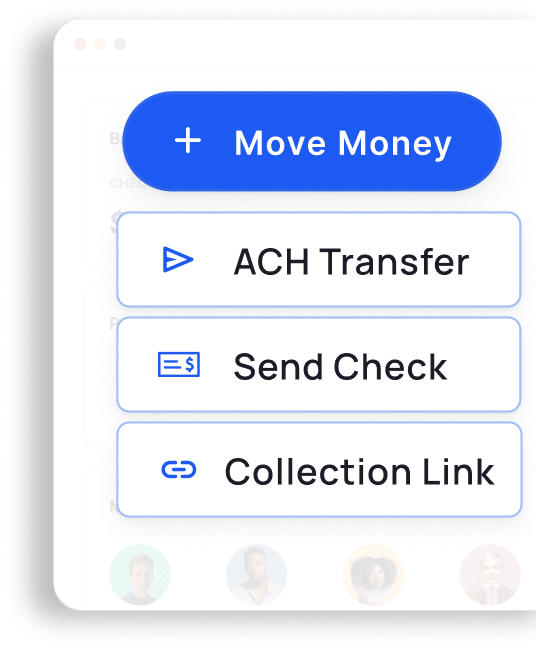

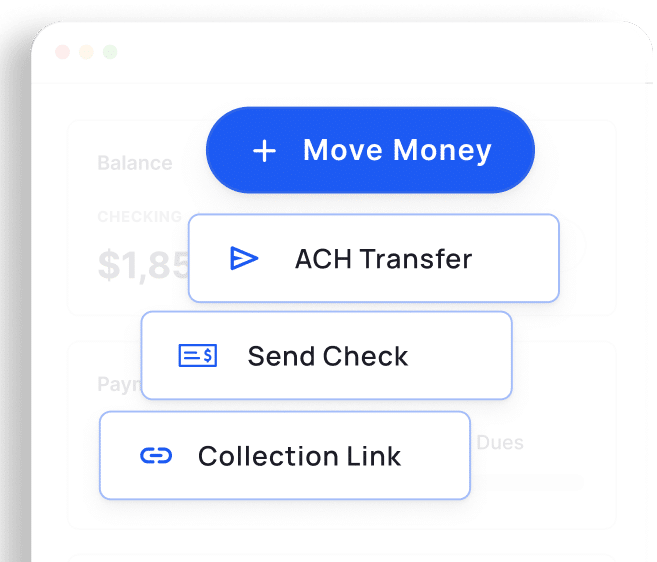

With Crowded, you can avoid constantly transferring funds between payment apps and banks to access your group’s money. Utilizing embedded finances, Crowded enables your group to bank, collect, and spend with just one platform.

We charge little to no fees.

When collecting funds through Crowded, you’ll have the flexibility to decide whether to cover processing fees or let your payers handle them. When we do charge fees, they are fair and competitive with industry standards.

We provide extra fund protection.

Unlike payment collection apps, funds you keep on Crowded are protected with FDIC insurance for up to $250K, and our banking accounts are completely free to set up – we don’t have any minimum balances or subscription fees.

What kinds of groups can use Crowded?

Crowded is available for use by any membership group or nonprofit organization.

We work with a wide range of nonprofit groups, from national fraternities and sororities to individual booster clubs, PTAs, summer camps, sports teams, girls and boy scouts, and college clubs.

If you’re unsure whether Crowded would be the right fit for your group, schedule a time to speak with one of our team members here.

Do I need an EIN to use Crowded?

No. To sign up for Crowded’s platform and use our passive fundraising feature, you do not need an EIN.

If you would like to open a Crowded banking account, you will need an EIN. If your group currently does not have one or needs help locating or updating your EIN, Crowded’s team can help.

Is Crowded free?

Crowded accounts are free to set up – we have no minimum balances or subscription fees.

What do we charge for?

When collecting payments, we charge 2.99% of the collection amount if paid by card and the lesser of 2.99% or $5 for ACH payments.

You can always choose whether you want to cover these fees or ask your payers to handle them.

View our full fee schedule here.

- Book a 15 min demo

- Onboard in minutes

- Manage your group’s finances stress-free

Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by Blue Ridge Bank N.A.; Member FDIC. The Crowded Technologies Inc.Visa® Debit Card is issued by Blue Ridge Bank N.A. pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. *There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Deposit Account Agreement for more details on account transaction fees.

© Crowded Technologies, Inc. 2024. All rights reserved.