Easy & Affordable

Form 990 Filings

Ensure your org stay fully compliant.

- No subscription fees or minimum balances.

- Trusted by 1,000+ nonprofits

- No subscription fees or minimum balances.

- Trusted by 800+ nonprofits

Stay tax-exempt with no stress

Maintain your nonprofit’s tax-exempt status for the long term with Crowded’s nonprofit bank accounts.

How does it work?

Open a Crowded account

Sign up for a free* nonprofit bank account with Crowded.

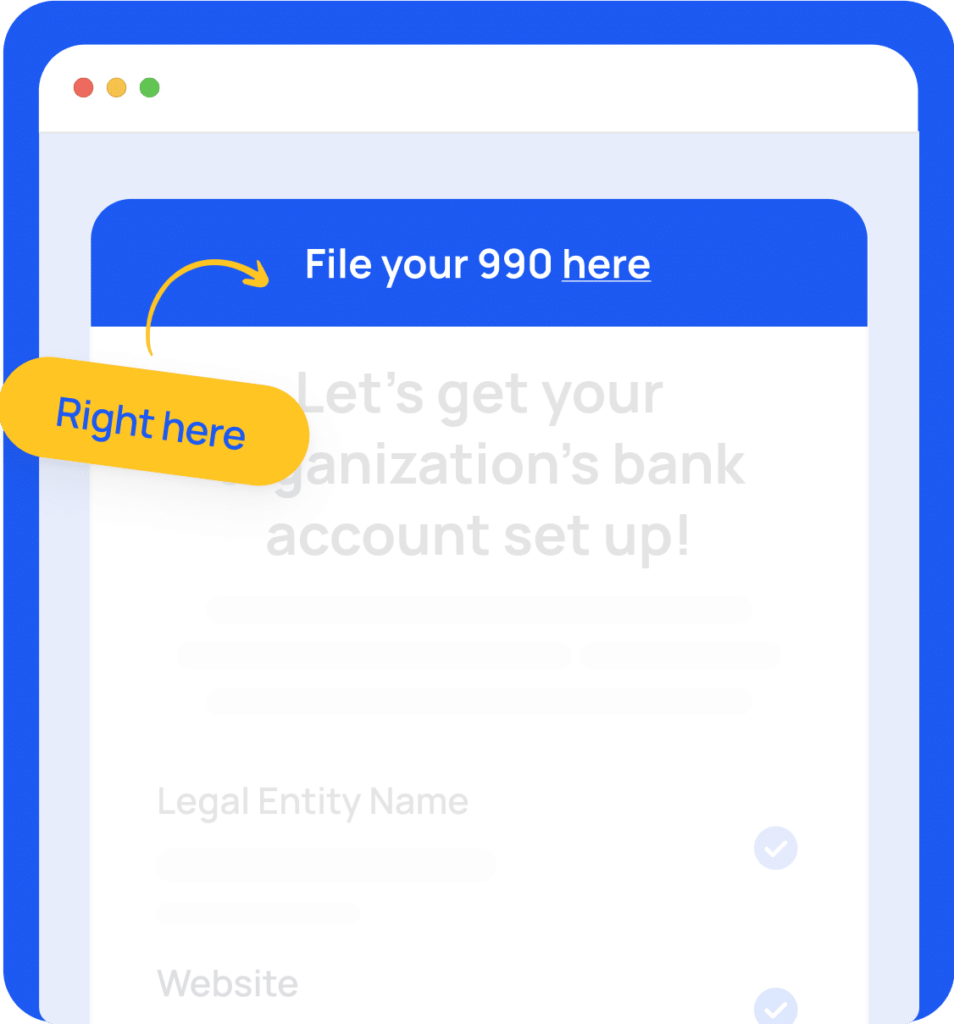

Submit your Form 990

Upload the necessary bank statements, and let Crowded handle the rest.

Retain your tax-exempt status

Use Crowded to store your nonprofit’s funds and stay compliant.

Which Form 990 should my nonprofit file?

Your nonprofit should file...

0

Sent!

We’ll reach out shortly about pricing and timelines, so keep an eye on your inbox.

In the meantime, take a look at our bank accounts that keep nonprofits tax compliant all year long.

Please leave your contact details and we will be in touch about managing your 990 filing.

Pricing*

$99

- Collected under $50k

- No bank statements required

$249

- Collected $50k-$200k

- Submit monthly bank statements

$499

- Collected $200k+

- Full detailed return

“ As a college fraternity, tax filing season always falls at the exact time of year that things start to get really busy at school. It was such a relief to have one less thing to worry about with the Form 990 filing done within our Crowded account. Completely worth it!”

One platform for all your nonprofit financial needs

Say hello to a bank account that merges online payment collection, expenses, tax compliance and fundraising.

answered.

Do I have to be a 501(c)(3) to use Crowded’s Form 990 service?

What if my nonprofit has not filed a Form 990 in previous years?

If your nonprofit has not filed aForm 990 for more than 3 consecutive years, your tax-exempt status may have been revoked. Check with the IRS if that is the case!

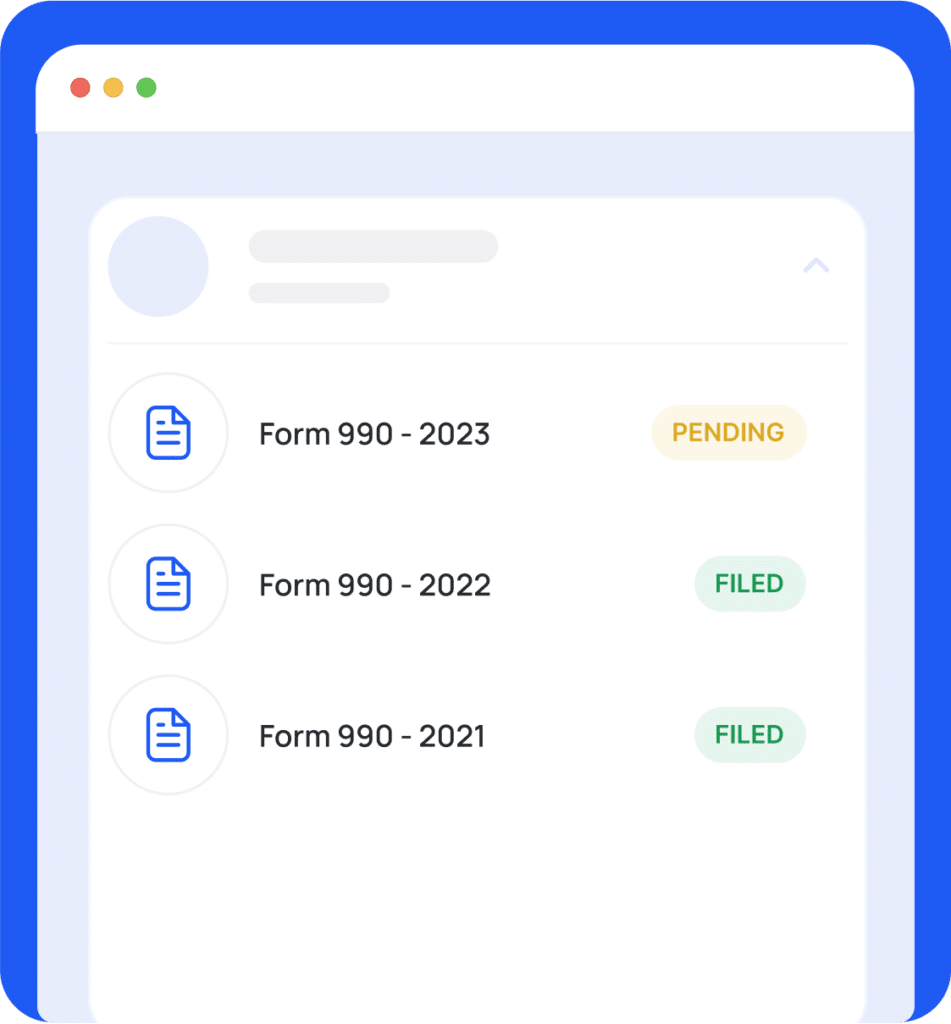

If your nonprofit has not filed a Form 990 in 2021 or 2022, Crowded can file them in addition.

What if my nonprofit has lost its tax-exempt status?

Unfortunately, Crowded can only file Form 990s for nonprofits that have their tax-exempt status intact. You must reapply to the IRS for your tax-exempt status first.

When is the Form 990 due?

It depends on when your nonprofit’s fiscal year ends. If your nonprofit’s fiscal year ends on December 31st, it is due May 15th.

What if my nonprofit’s fiscal year ends at a different point during the year so the 990 filing is due after May 15th?

Crowded files Form 990s year round, get your 990 filed on your nonprofit’s schedule. Pricing is calculated relative to the filing due date.

Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by Blue Ridge Bank, N.A. and TransPecos Banks, SSB; Members FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by Blue Ridge Bank, N.A. and TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

*There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Deposit Account Agreement for more details on account transaction fees. Please review the Terms and Conditions for more details about the promotion.

© Crowded Technologies, Inc. 2024. All rights reserved.