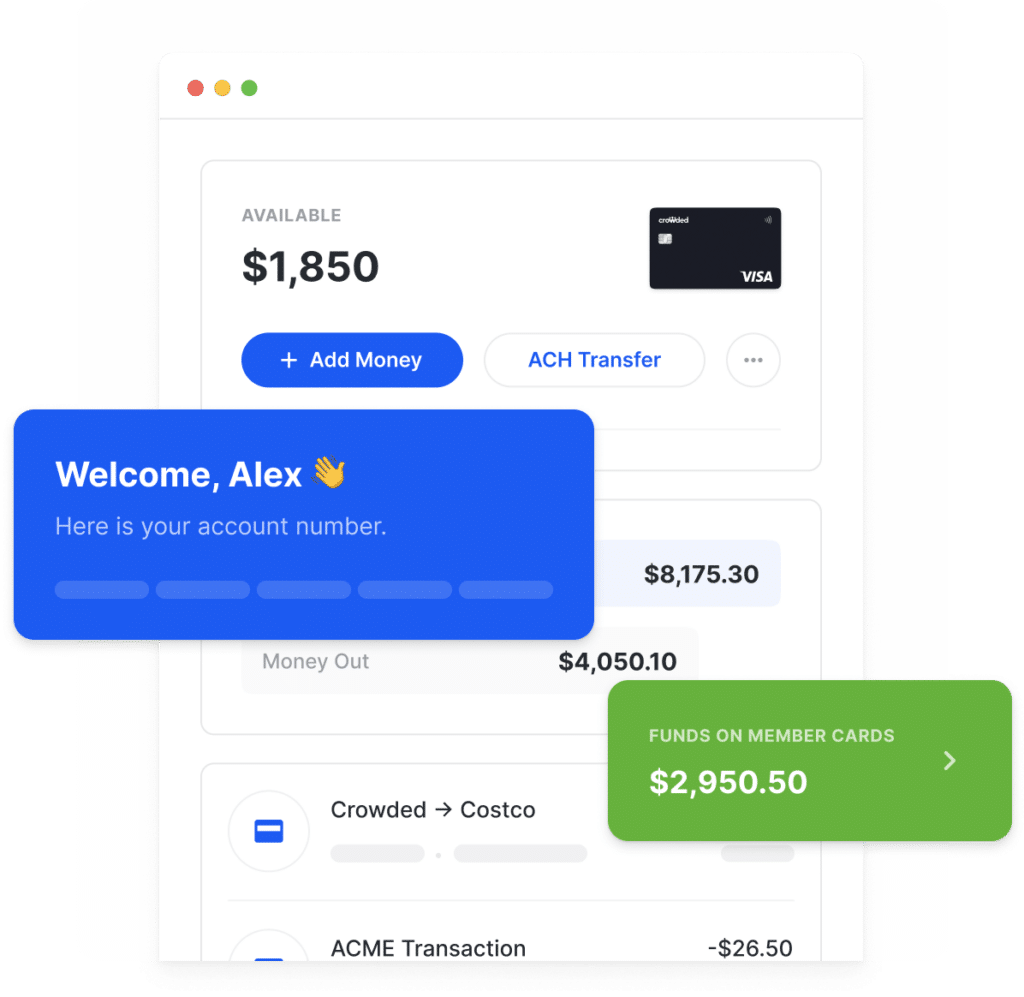

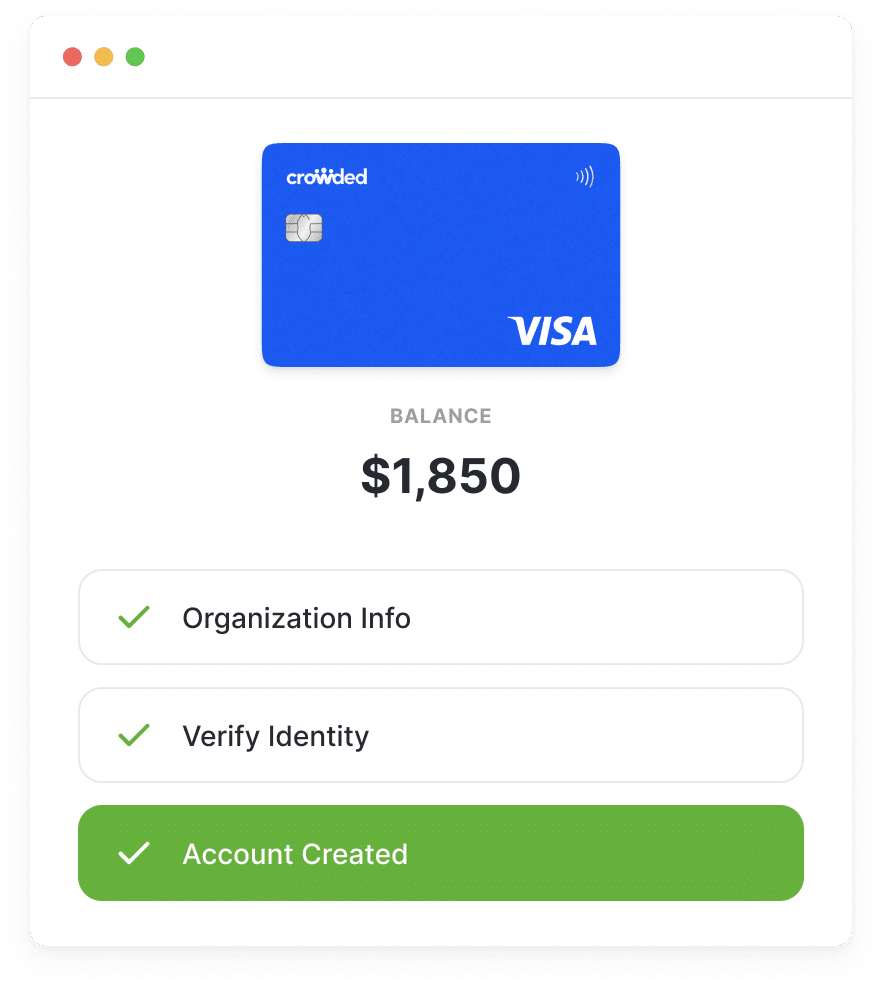

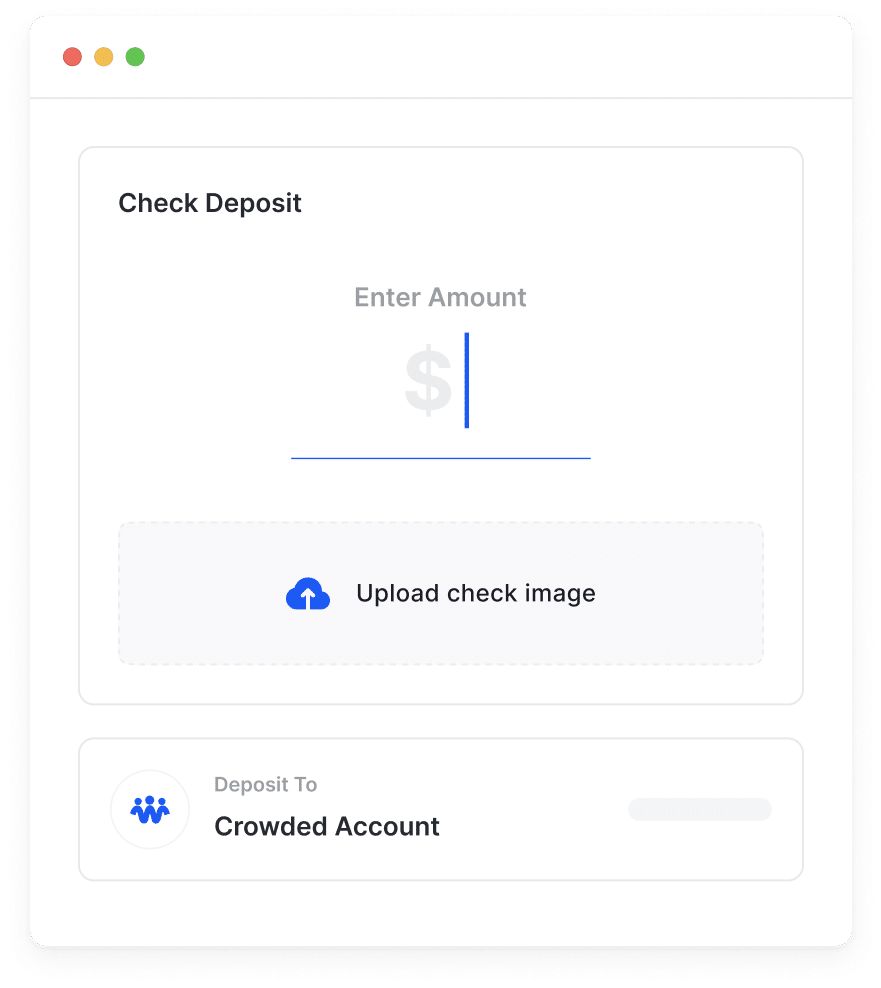

Bank

Manage dues, donations,

events & more

Bank

Manage dues, donations,

events & more

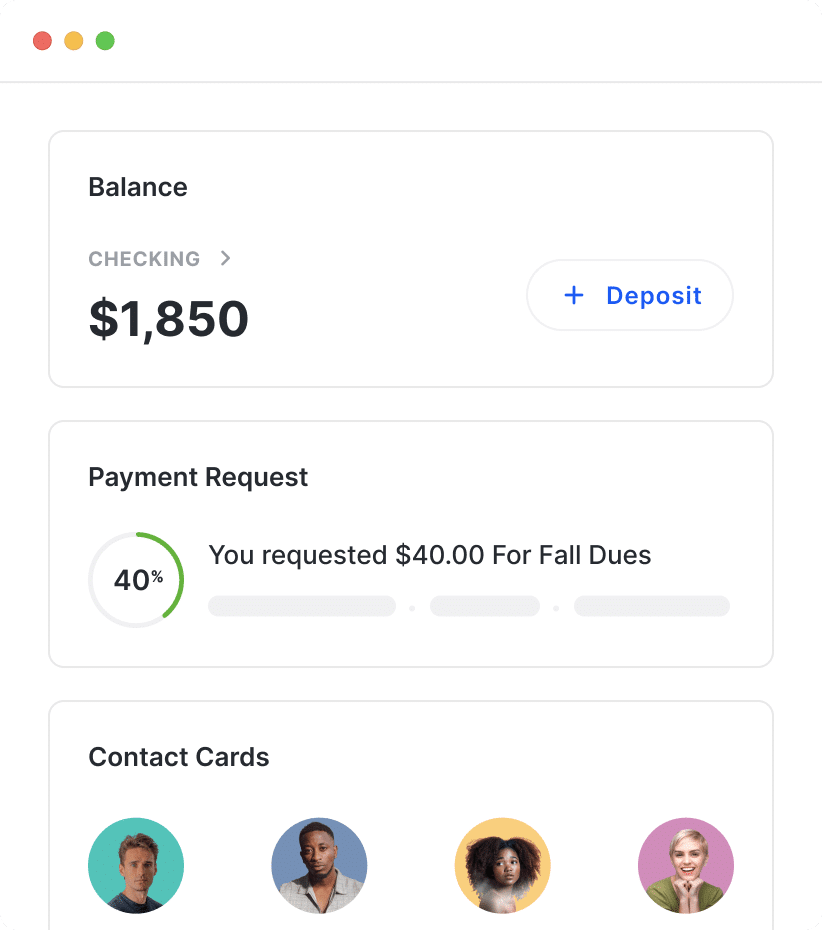

Collect

Manage dues, donations,

events & more

Collect

Manage dues, donations,

events & more

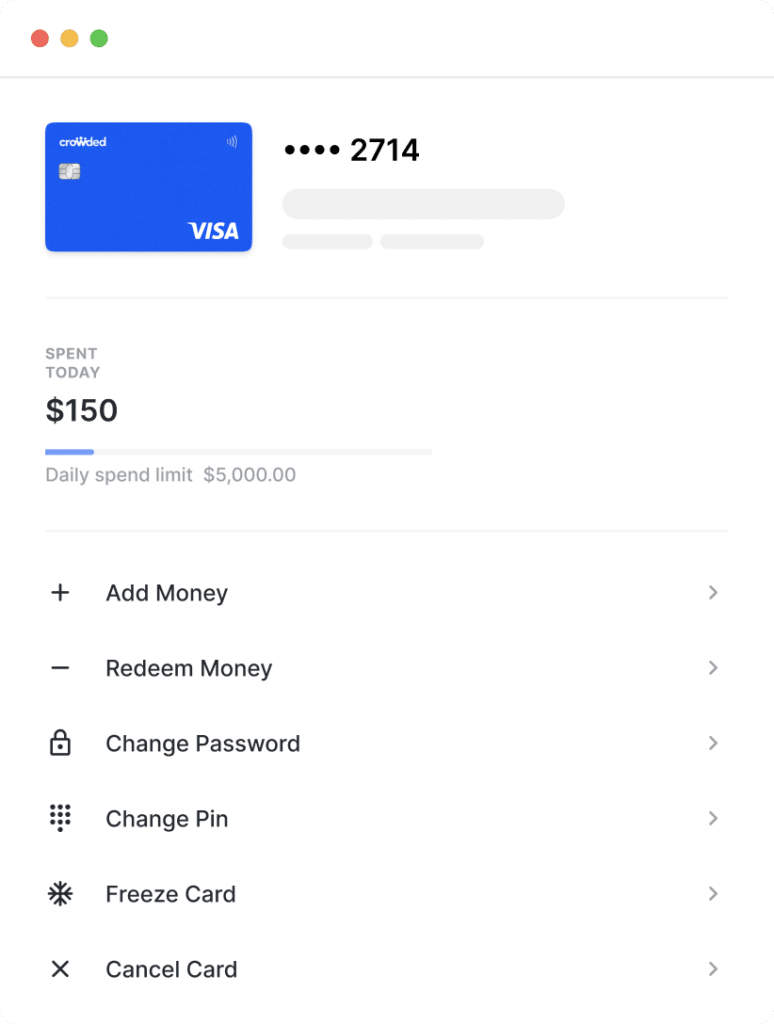

Spend

Manage spending with digital

debit cards

Spend

Manage spending with digital

debit cards

Earn

Set up a passive fundraising

program for consistent donations.

Earn

Set up a passive fundraising

program for consistent donations.

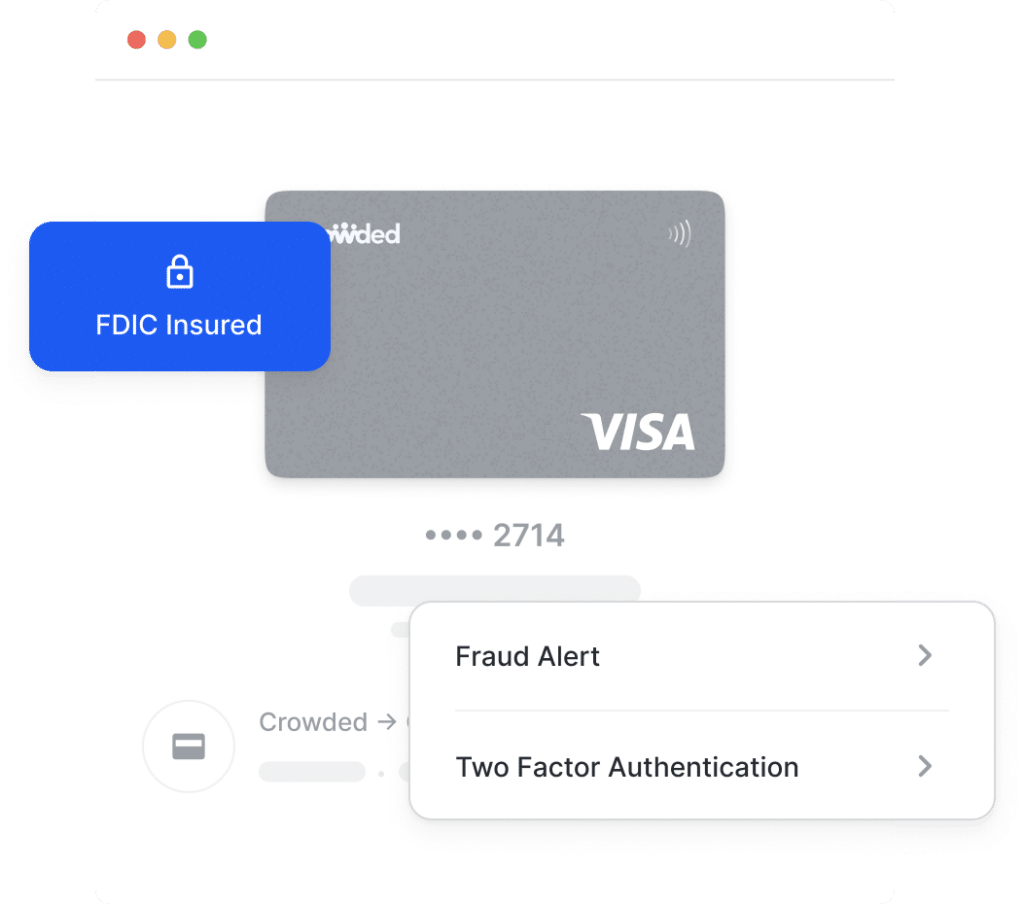

Comply

Stay compliant with tax regulations

Comply

Stay compliant with tax regulations