bank

Tailored online banking for PTAs

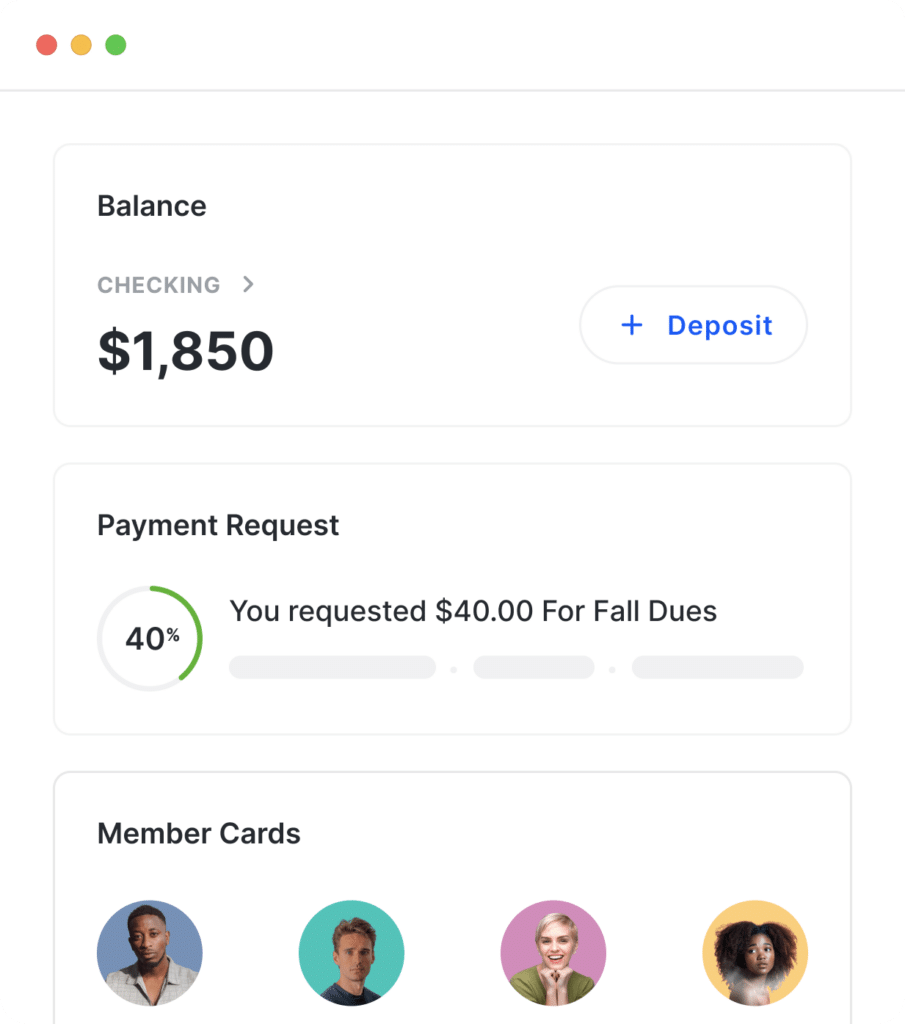

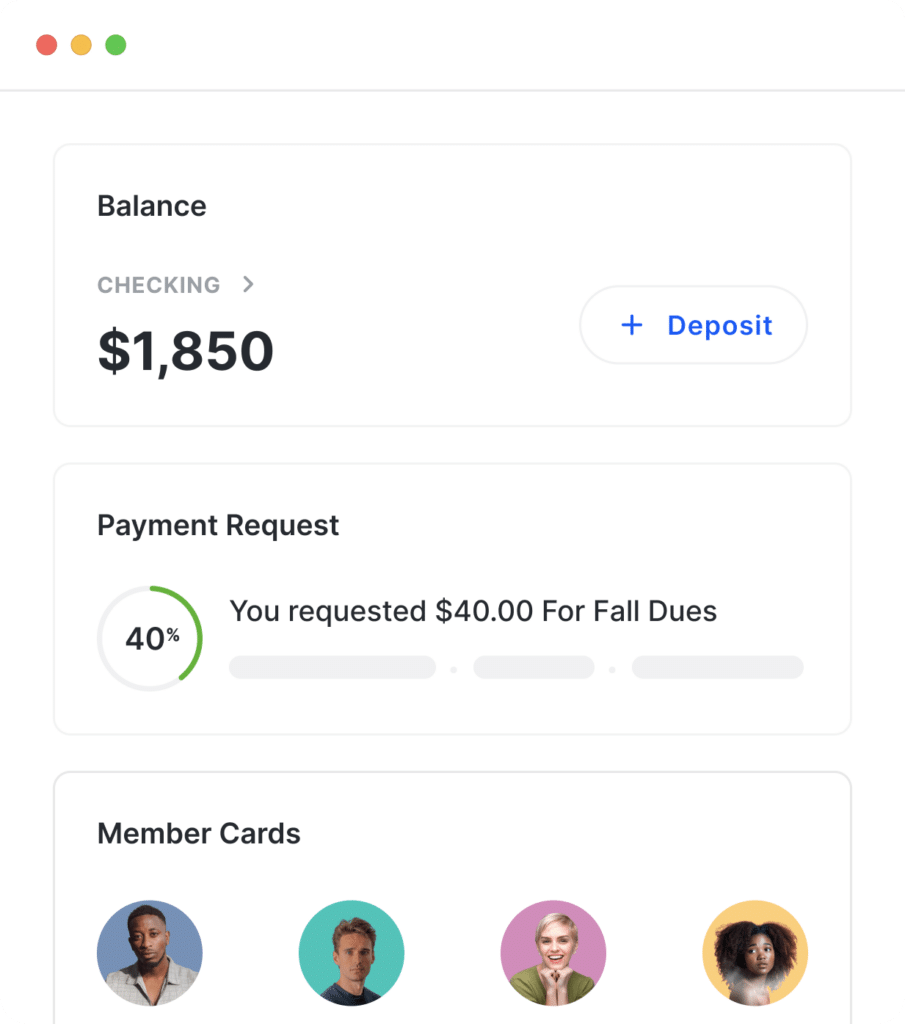

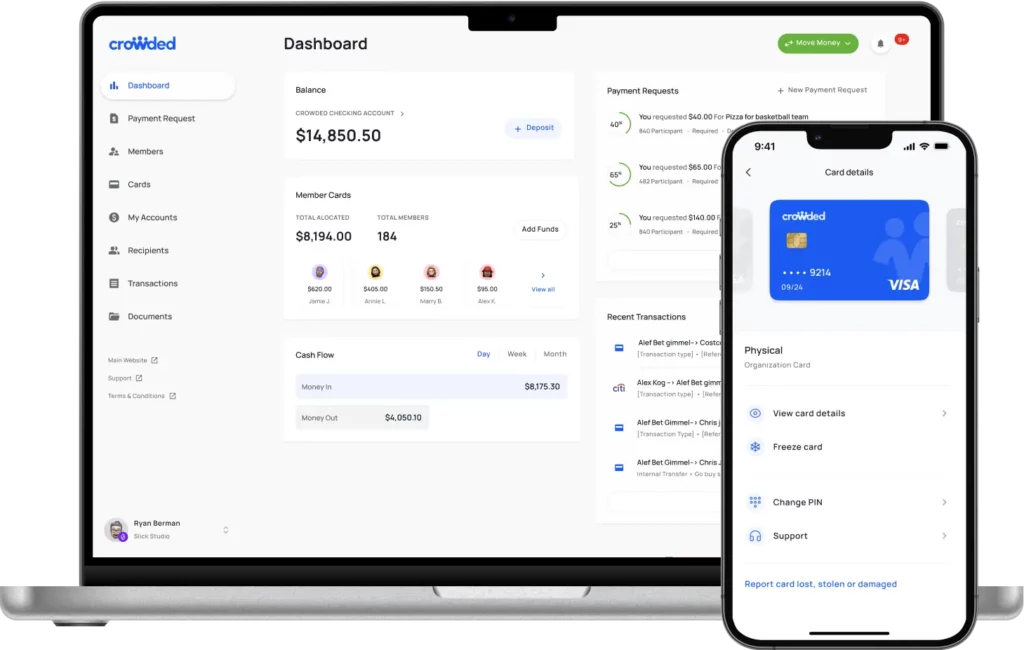

- Manage all of your PTA's banking digitally – even setup.

- Easy officer account handovers and account management

- User-friendly banking dashboard.

Parent teacher associations

Manage your PTA’s finances with modern banking tools for easy payment collection, expenses, budgeting and financial reporting with ease.

bank

Collect

Spend

Earn

Want to learn more? View All

Get all the features you need – all on one platform.

Traditional Banks | Cheddar Up | |

|---|---|---|

Digital first, easy account opening | ||

No monthly fees or minimums | ||

QuickBooks compatible | ||

FDIC Fund Insurance** | ||

Digital & physical debit cards | ||

Free fundraising tools | ||

POS Solutions |

Digital first, easy account opening |

|---|

Traditional Banks |

Cheddar Up |

No monthly fees or minimums |

|---|

Traditional Banks |

Cheddar Up |

Payment collection links |

|---|

Traditional Banks |

Cheddar Up |

Digital & physical cards for spending |

|---|

Traditional Banks |

Cheddar Up |

Free PTA fundraising tools |

|---|

Traditional Banks |

Cheddar Up |

Want to chat? Contact us.

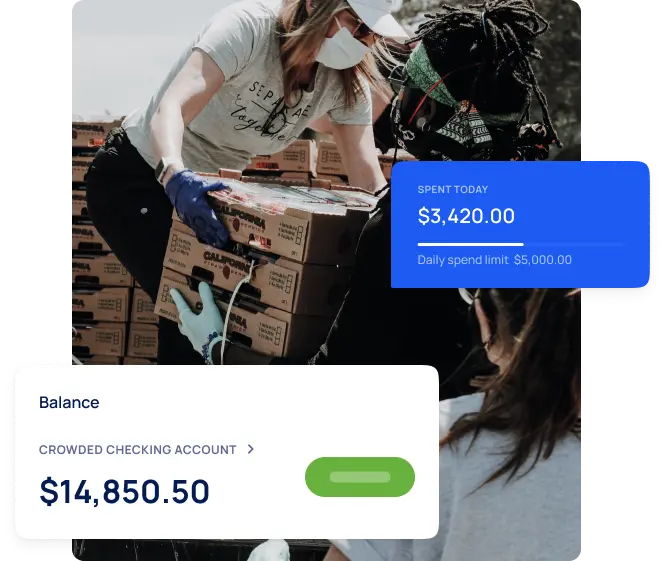

Crowded is a financial platform that offers PTAs an easy way to collect, spend and manage money online.

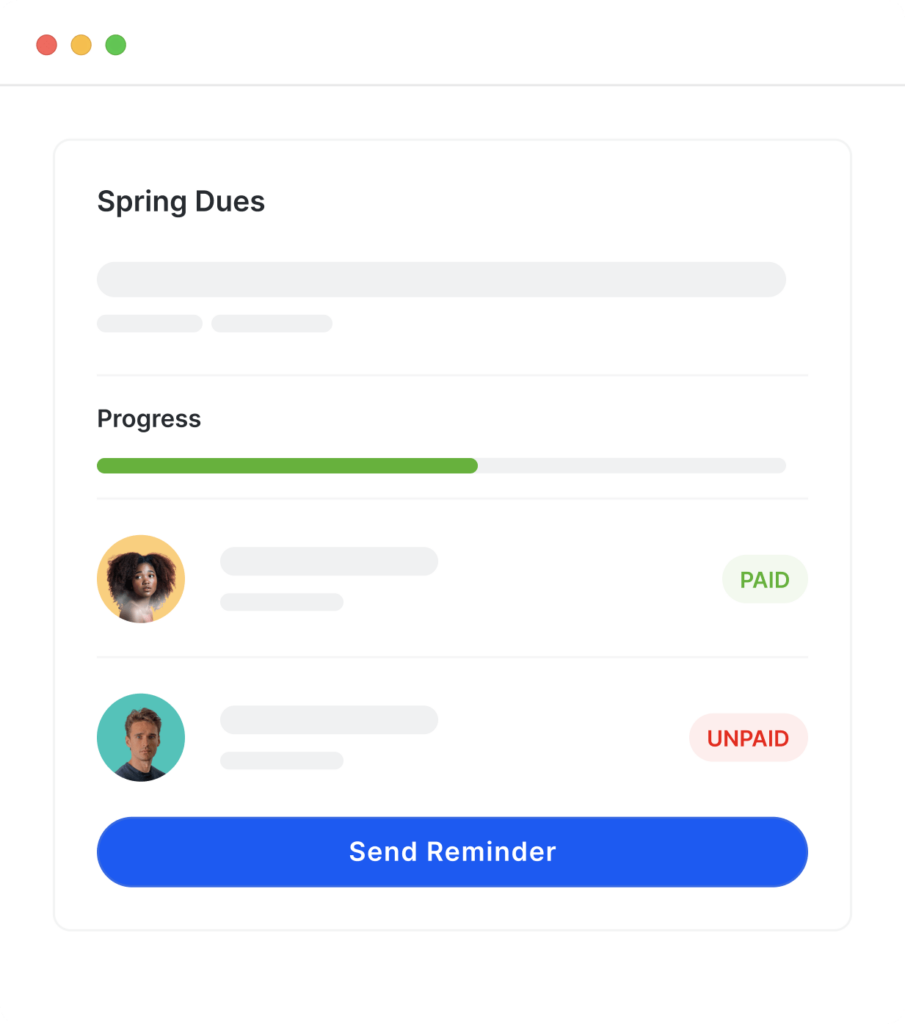

PTAs are constantly collecting money – bake sales, teacher gifts, donation drives, membership fees, and etc. Using Crowded to collect these funds is safe, easy and trackable.

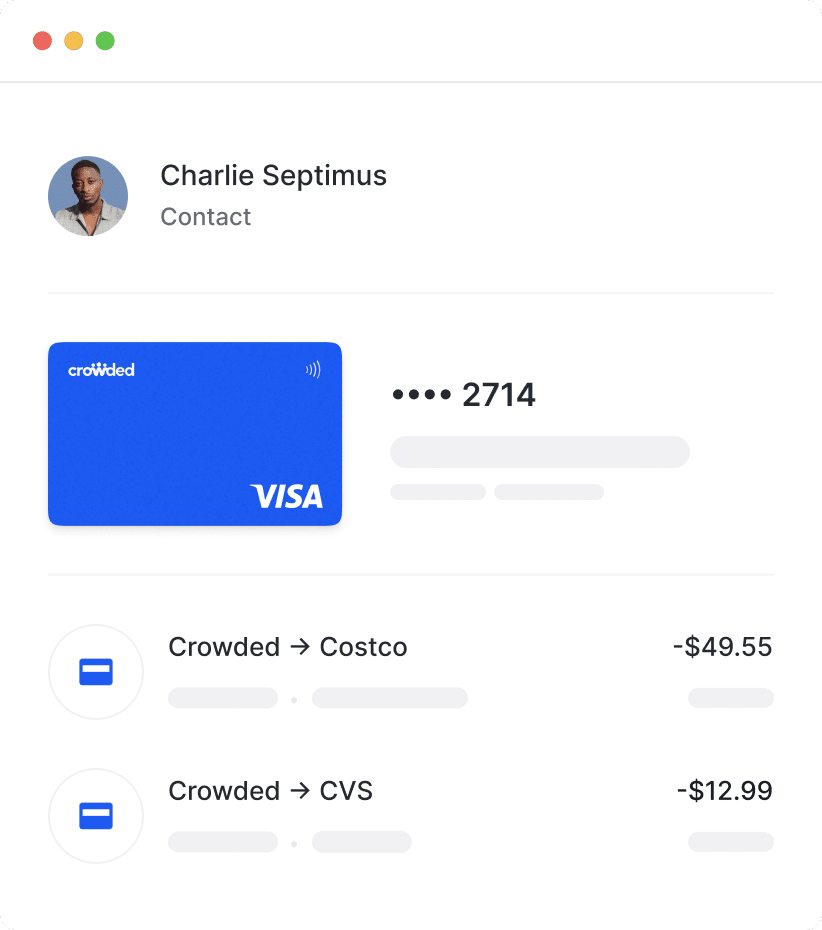

When the PTA needs to spend, they can spend from the same place where they collect. The PTA treasurer can issue digital debit cards as needed to members to spend with budgeted amounts.

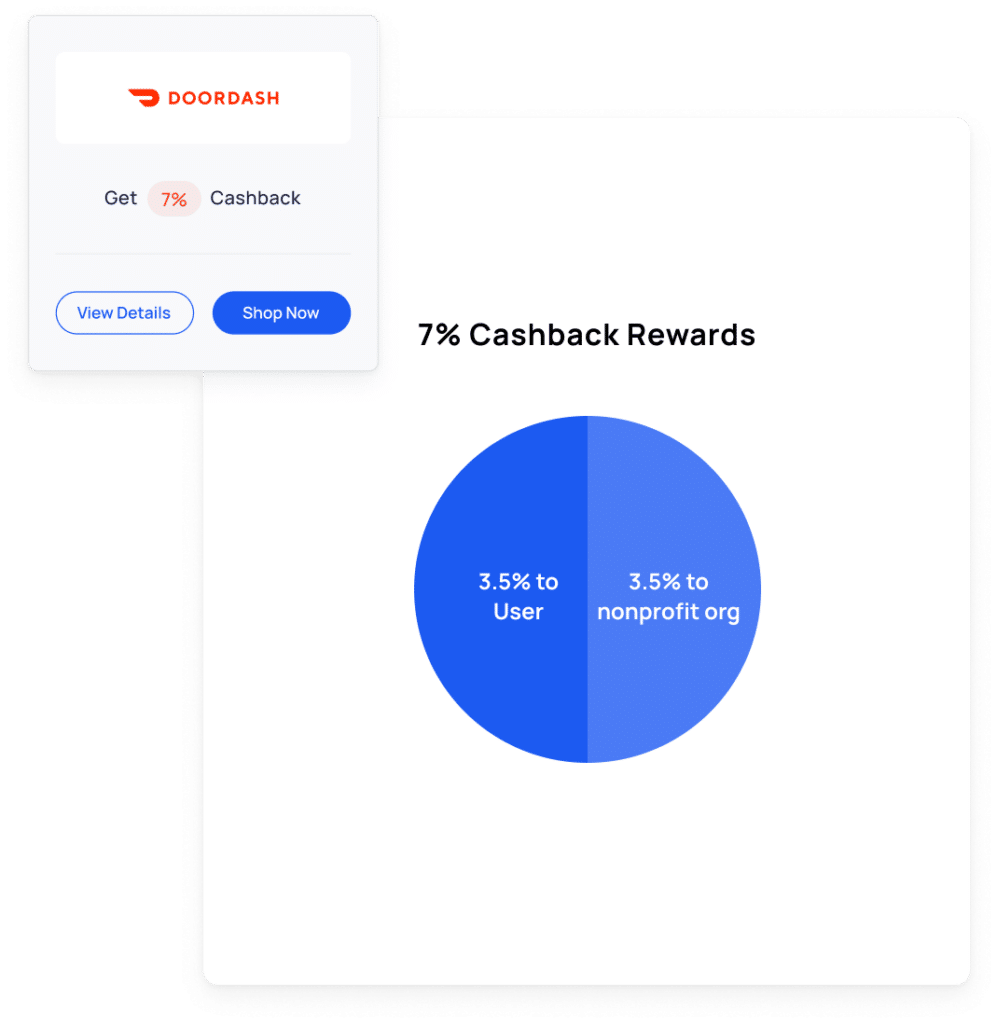

Also, use Crowded Rewards to generate extra income for your booster club!

Cheddar Up provides a great way to collect payments online, but that’s where it ends. Once you collect funds through Cheddar Up, you have to withdraw it to a bank account to use the funds.

Crowded offers online payment collection, like Cheddar Up, but also provides modern banking services within the app. You can spend the collected funds, track payments, and use Crowded Rewards to raise extra funds for your group!

Crowded is also cheaper. Cheddar Up charges a 3.59% + $0.59 credit card fee while Crowded charges only 2.99%.

Venmo & Paypal? Great for friends, not for your PTA. Here’s why Crowded is the better app for collecting dues & for events:

Crowded accounts are free to set up – we have no minimum balances or subscription fees.*

What do we charge for?

When collecting payments, we charge 2.99% of the collection amount if paid by card and the lesser of 2.99% or $5 for ACH payments.

You can always choose whether you want to cover these fees or ask your payers to handle them.

View our full fee schedule here.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by TransPecos Banks, SSB; Member FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by TransPecos Banks, SSB; Member FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

To provide the best experiences, we use technologies like cookies to store and/or access device information as specified in our Privacy Policy. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.