Membership fees are crucial for the financial stability and continued functioning of any member-based group. This steady income stream provides the necessary funds for planning and executing activities, purchasing resources, and investing in the tools needed to function efficiently.

Each member’s payment of these fees forms the bedrock of your membership group’s financial health, ensuring that your group can continue to serve its members and its cause.

Whether you are starting a new membership group, starting to charge fees, or looking to optimize your current membership payment system, considering an online payment processor for collecting membership fees is the move in 2024.

How to collect membership fees online

In our digital era, online payment collection has become the most effective method of collecting membership fees and dues. Gone are the days of chasing members for checks or cash. With digital payment systems, you can track payments, minimize delays, and ensure a smooth process for all involved.

Collecting membership fees online is easy, if your nonprofit has the right tools. Meaning, you’ll need to set up an account with an online payment processor, and a nonprofit bank account to store the money collected. Then, create a payment collection link with the amount for membership fees, and share it with your group. The money your members pay will flow right into your dedicated bank account.

This is a high-level summary of how to collect membership fees online, keep reading for features to look out for, and what to avoid.

Many companies offer online payment collection services, where you can create payment collections that your members can pay. Crowded offers a secure, no download required, easy way to collect membership fees online with collection links with a dedicated bank account attached to it.

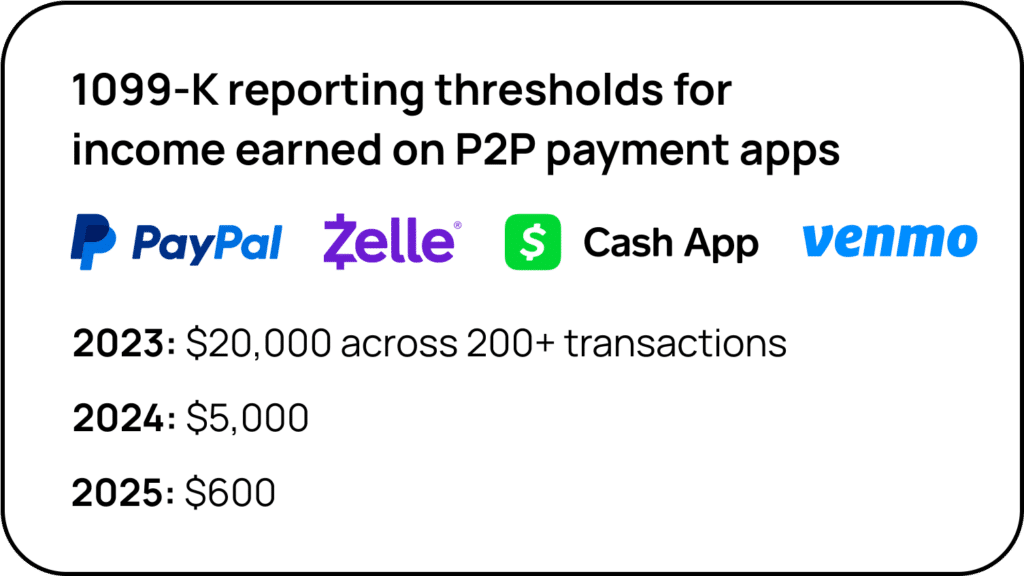

It’s important to pick a provider though, rather than turning to a seemingly innocent popular payment app like Venmo, PayPal, Cash App or Zelle to collect dues.

Why you shouldn’t trust Venmo to collect membership fees

You might be thinking, let’s just use Venmo, Zelle etc.; everyone already has an account; it’s so easy to use, no big deal. But, there are several issues with using these peer-to-peer (P2P) apps to collect dues:

- Collected funds are not FDIC-insured

- Money goes straight into a personal bank account with no visibility or accountability

- No tracking ability to see who has and hasn’t paid

- No way to see which payments are meant for what purpose

- IRS reporting requirement on amounts higher than $600 in 2025

As you can see, there are many reasons why collecting with these P2P apps is not worth the perceived ‘convenience’. A dedicated payment collection service that’s geared toward nonprofit groups will provide services more aligned with your group’s needs.

How to pick an online membership fee collection provider

For the reasons above, your group should not rely on Venmo to collect dues. Instead, consider a dedicated online payment collection provider. Look for a provider that offers specific features for membership groups and dues collection.

Here are a few to look out for:

Easy to use

You want to make the payment process for your members as easy as possible, both for their convenience and so you won’t have to dedicate time to responding to calls like, “I can’t figure out how to pay” and “ It’s not working!”

Payment tracking

When you’re collecting dues from a group of people, it’s crucial to be able to track who has paid and who hasn’t. That way, you can track your active membership base, remind those who haven’t paid, and see the progress of your dues collection initiative.

Sending reminders

Once you see who hasn’t paid their membership fees online, no need to manually reach out to them, send reminders in one click within the online payment collection platform.

Create specific collections

Some organizations only collect dues once a year, but there are many more cases where a group needs to collect money from their members (for a trip, event, etc.). Use an online payment collection service where you can create payment collections as your group needs them. Each payment collection would have a unique name, for easy organization.

Reasonable transaction fees

When collecting membership dues and fees online, the convenience comes with a cost. But be sure to not overpay. Each provider has a list of fees, and charges a certain credit card charge. For example, Crowded charges an extra 2.99% while Cheddar Up charges 3.95% + $0.95. Do thorough research to ensure that your group does not lose too much of your money to fees!

Excellent Customer Support

Make sure the payment collection tool you choose offers exceptional customer support to members who may encounter issues during the online payment process. Make sure there are clear channels of communication, such as email or live chat, to address any inquiries or concerns promptly.

Security measures

Ensure that your chosen payment processor adheres to industry-standard security practices, such as encryption and tokenization, to protect members’ sensitive information. Regularly monitor your systems for any potential vulnerabilities and promptly address any security concerns.

For new clubs:

If you are beginning the process of creating a club, group or team, collecting membership fees is only one of the things to think about. Check out our helpful blog and checklist of how to start a club to help you get started.

In many cases, you’ll want to incorporate with your state as an official entity and apply for nonprofit status. If you obtain nonprofit status, your group will not need to pay any federal income tax on the money you collect, and in some states, you may be exempt from sales tax too. See our articles on how to apply for nonprofit status for guidance!

Once your club is incorporated, you’ll need to decide how to collect membership fees and how much to charge.

How to decide on how much to charge for club membership fees

Deciding on the structure and amount of club membership fees is a balancing act that requires both art and science. It involves a careful analysis of your group’s financial needs and an understanding of what is affordable for members.

The calculation typically begins with estimating the total expected costs of running the organization for the upcoming year. This should include operational costs, expenses for special events, overheads, and a buffer for unforeseen expenses. This total amount is then divided by the number of members to derive the fee per member. The goal is to strike a balance that ensures financial sustainability without creating a financial burden for members.

A bank account for collected membership dues

You might be tempted to collect all of the dues into a personal bank account, but do not. It will be impossible to keep personal funds separate from the group’s funds, it leaves room for mismanagement or embezzlement of funds, the account cannot be handed over to the next treasurer, and it leaves you in a tricky situation with the IRS.

It is best practice to set up a dedicated bank account for your group. Your group should have a business or nonprofit bank account for all of the collected dues and for making purchases with the group’s money.

Choosing a bank for your group

Having a bank account for your group is a crucial aspect of collecting membership fees online because you need somewhere to put the collected dues and fees. Choosing where you are going to bank is an important decision, so take a look at a few bank account providers to see which one best fits your needs. Check out our article on best banks for nonprofits for a detailed look into the topic.

Introducing Crowded – an easy way to collect group membership fees online

Crowded is a financial management app designed specifically to meet the needs of clubs and groups. While other payment apps may cover basic online collection needs, Crowded offers a financial platform that allows you to collect and spend funds from one place.

This eliminates the need to constantly withdraw funds and move money between apps. With Crowded, you can send a collection link to your members for dues, issue them a digital Visa® debit card with a specific amount of group funds for expenses, and track all of your group’s financial movements online. With all the tools to manage group finances at your disposal, you can rest assured that your group will stay on budget and compliant with any tax-exempt regulations.

Unlike other apps that focus solely on payment collection, Crowded offers a holistic solution to manage, collect, spend, and track group finances. Additionally, Crowded provides FDIC insurance-eligible pass-through accounts** ensuring that your money is always protected.

Managing and collecting club membership dues and fees online no longer has to be a daunting task. With Crowded, you can enjoy an efficient, secure, and user-friendly platform that caters to the unique financial needs of your membership group. Embrace the future of online finances with Crowded, and give your members an experience they’ll thank you for.