Ready to reclaim your nonprofit's finances?

- Fill out the quick online application

- We verify your identity & organizational info

- Manage your organization's finances stress-free

Connect all the platforms you use to Crowded.

“Last year, the team was run out of a personal checking account – which was a nightmare. When I took over as president, I knew there had to be a better businesses out there. Luckily we found Crowded, who we use for collecting dues & other payments, spending and banking! I’ve recommended Crowded to the other teams, because I see so much value in it.”

“After our previous experiences with other platforms, Crowded’s solution seemed too good to be true. The whole process of paying the staff was super easy, and our staff were happier. A definite win-win. Looking forward to next summer!”

“We only see benefits for our alumnae chapters who create a Crowded account. It gives the chapters freedom to manage their funds in a flexible way. That’s why we continue to say – Crowded is our financial management solution and we want more alumnae chapters to be utilizing it.”

“We were so glad to find a platform that allows us to support our chapters, and give them independence. There are complications managing an association partially comprised of volunteers who aren’t experienced with digital banking, but Crowded’s platform is so user-friendly that it was easily adopted across the organization.”

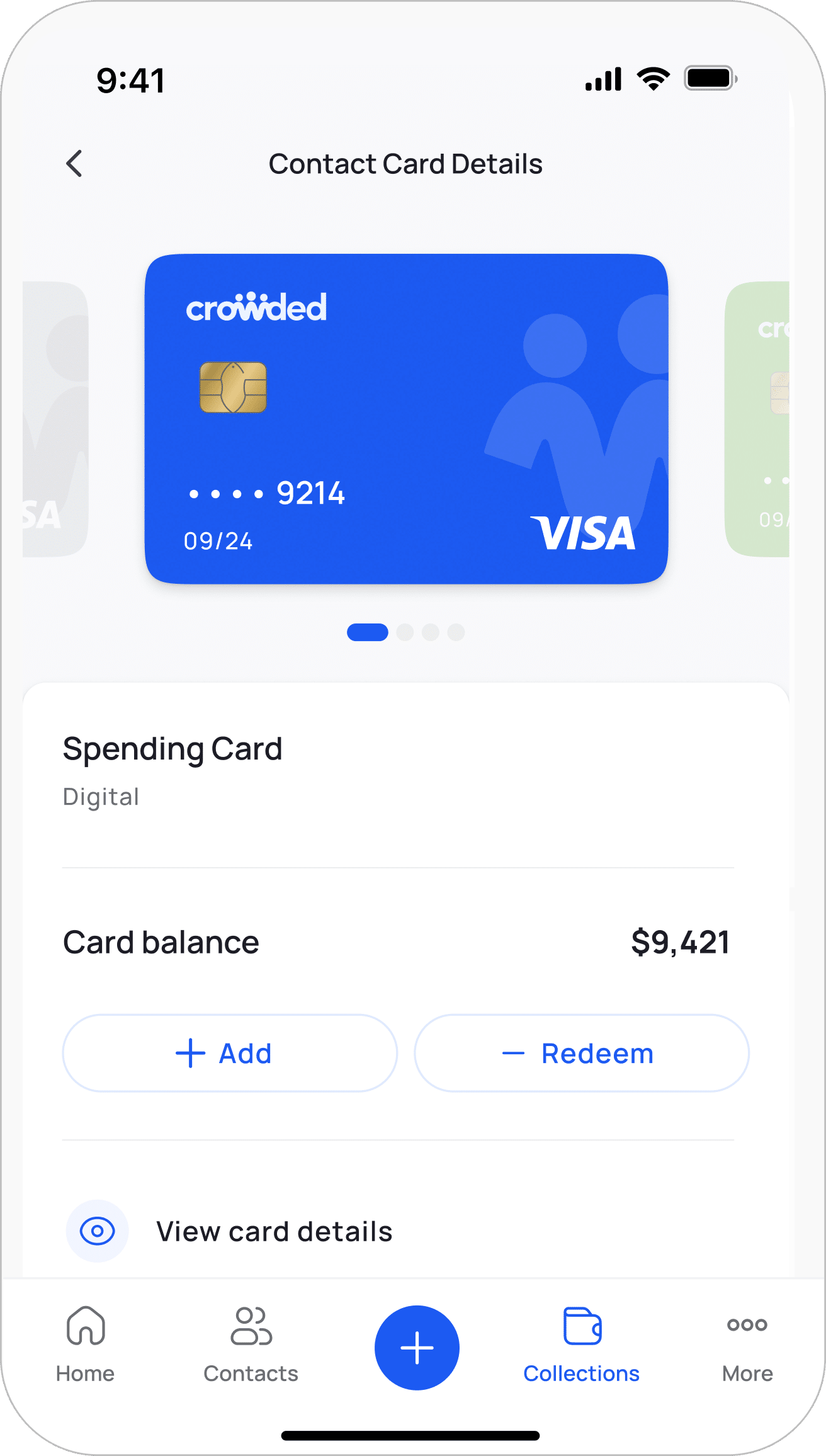

“Since our guys are young volunteers gaining experience, it’s awesome to partner with a company that has tools to fit their needs. Things like transition assistance between officers or digital cards (the physical frat card always goes missing!) keep our guys focused on their mission and not bogged down administratively”

Want to learn more? View All

Looking for creative raffle basket ideas to boost your next nonprofit fundraiser? From “Wine & Cheese Night” to “Tech Treats,” explore 25 themed baskets proven to attract donors and drive revenue. Plus, learn how Crowded’s digital tools simplify ticket sales, fund tracking, and reporting—so you can focus on fundraising, not spreadsheets.

Sponsorship packages are essential tools for attracting and retaining nonprofit partners. Learn how to craft compelling tiers that showcase value, align with your mission, and drive long-term support. Download our free, editable template to get started today.

Understanding your nonprofit’s classification is more than just paperwork—it’s a powerful tool for growth, compliance, and connection. NTEE codes, used by the IRS and the National Center for Charitable Statistics, help categorize nonprofits based on their primary mission. This guide explores what NTEE codes are, why they matter, and how the right classification can open doors to funding, increase donor visibility, and strengthen your organization’s impact. Whether you're starting out or reassessing your current code, this complete guide will help you navigate the NTEE system with confidence.

Have more questions? Contact us.

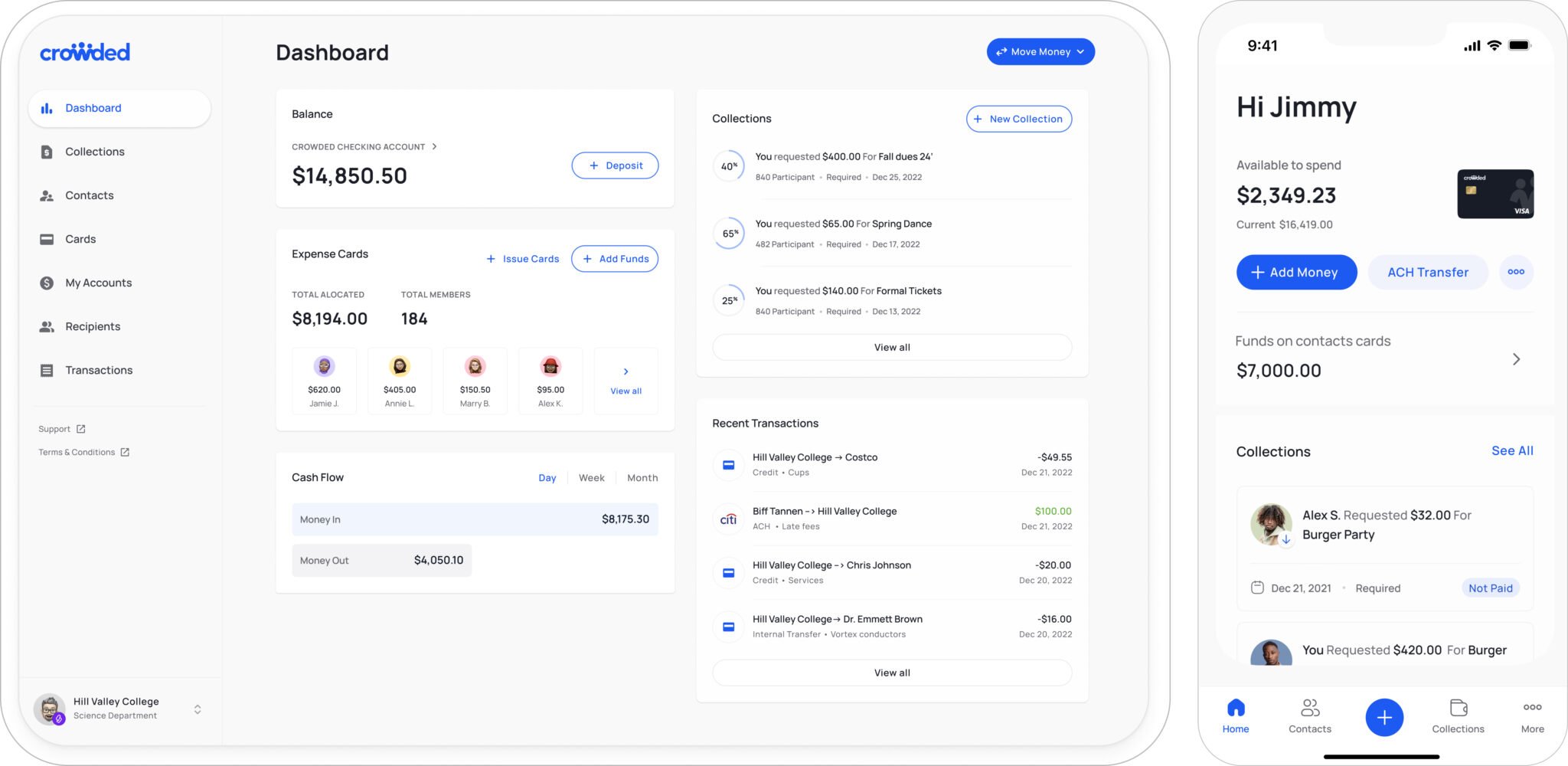

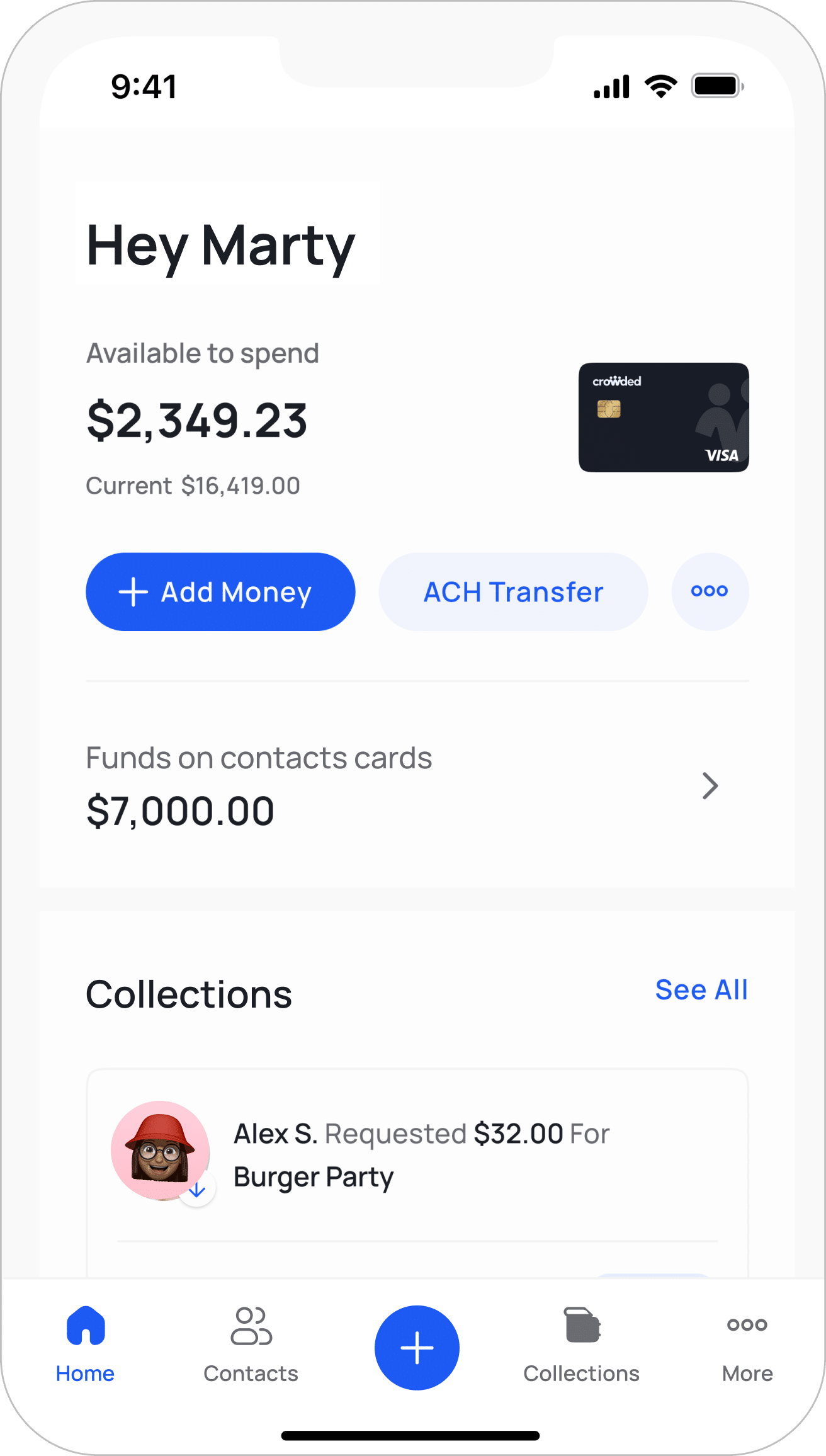

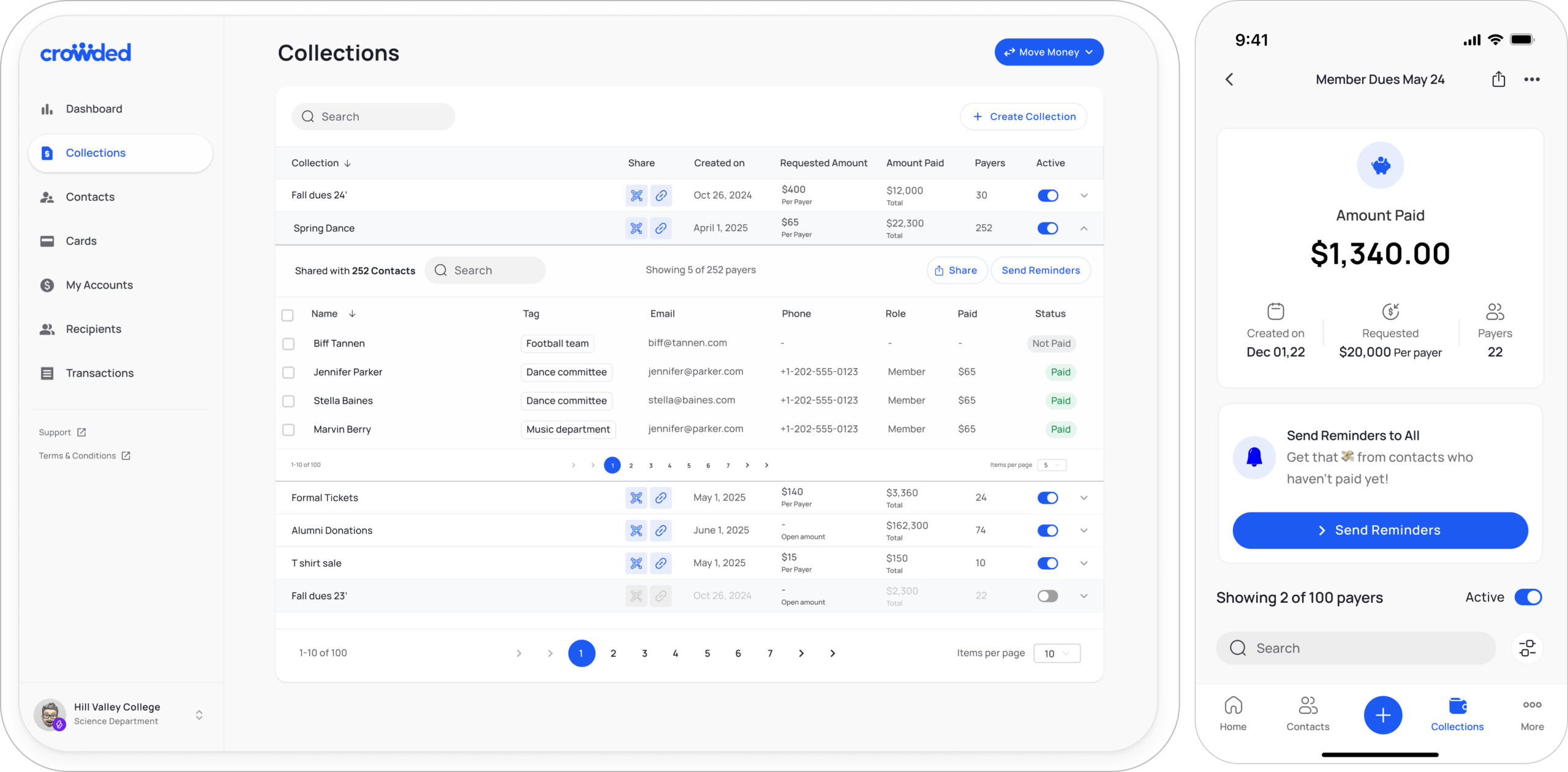

Crowded is a financial platform that offers nonprofit membership groups easy ways to collect, spend and manage money online.

Some of our standout features include:

FDIC pass-through, insurance-eligible accounts** with no fee to open and no minimum balances, and FDIC insurance available on deposits up to $250k through TransPecos Banks, SSB; Member FDIC.

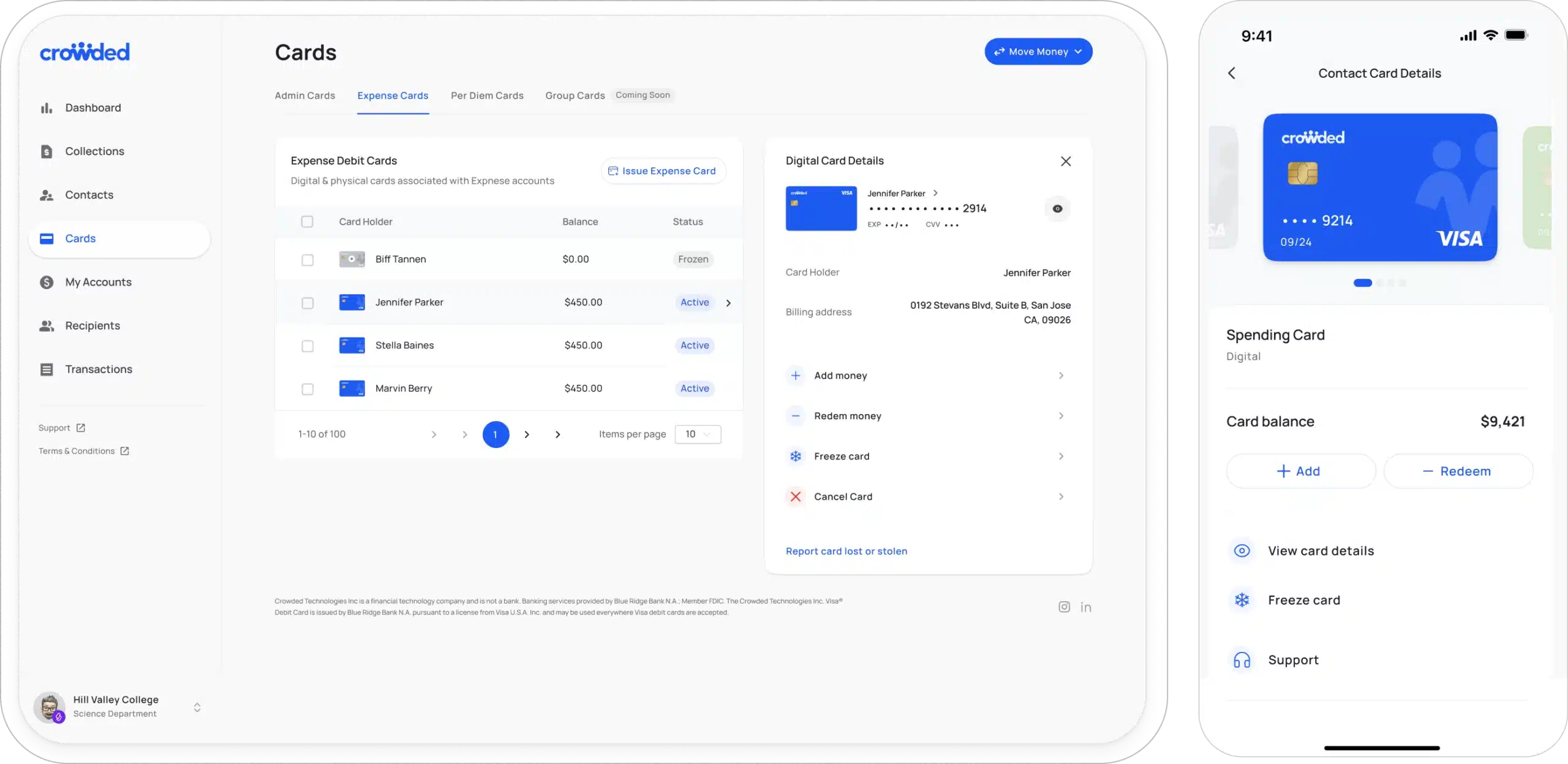

Easy digital officer handovers.

Digital & physical Visa® debit cards with budgeted amounts for group member expenses.

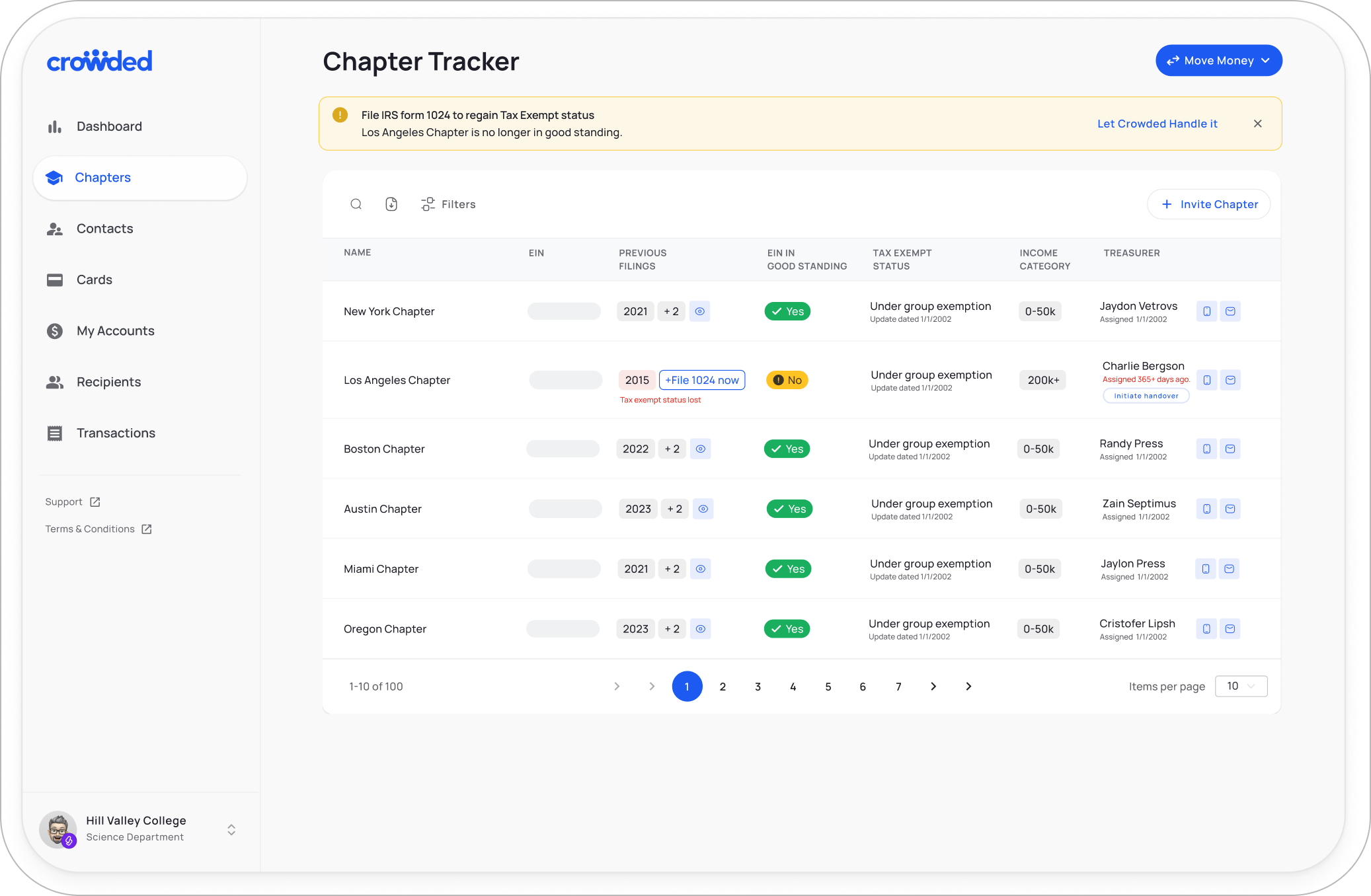

Unified banking for multi-chapter organizations.

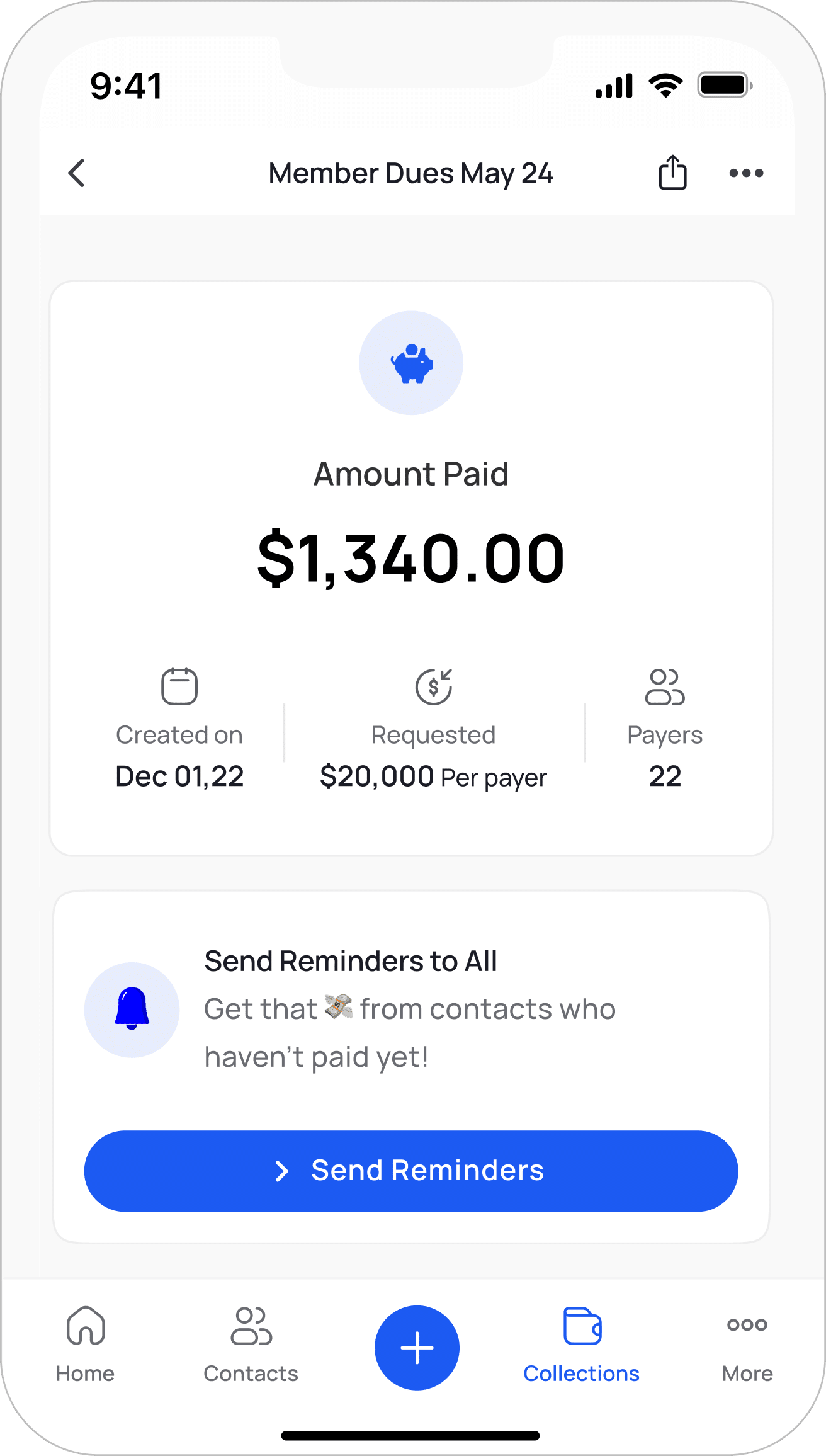

Payment processing for dues, member fees and donations.

To set up a Crowded account for your group in minutes, create a free account online or book a demo with one of our team members for any questions or additional support.

Venmo & Paypal? Great for friends, not for your organization. Here’s why Crowded is the better app for collecting dues & for events:

Crowded is available for use by any membership group or nonprofit organization.

We work with a wide range of nonprofits, from national fraternities and sororities to booster clubs, universities, associations, summer camps, sports teams, Girl Scouts and college clubs.

If you’re unsure whether Crowded would be the right fit for your organization, schedule a time to speak with one of our team members here.

Yes. If your organization would like to open a bank account** through Crowded (which is needed to access most of our specialized nonprofit features!) you will need an EIN.

If your organization currently does not have one or needs help locating or updating your EIN, we can help you from within our platform! See our helpful guides.

Crowded accounts are free to set up – we have no minimum balances or subscription fees.

What do we charge for?

When collecting payments, we charge 2.99% of the collection amount if paid by card and $5 for ACH payments.

You can always choose whether you want to cover these fees or ask your payers to handle them.

View our pricing page here.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by TransPecos Banks, SSB; Member FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by TransPecos Banks, SSB; Member FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

To provide the best experiences, we use technologies like cookies to store and/or access device information as specified in our Privacy Policy. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.