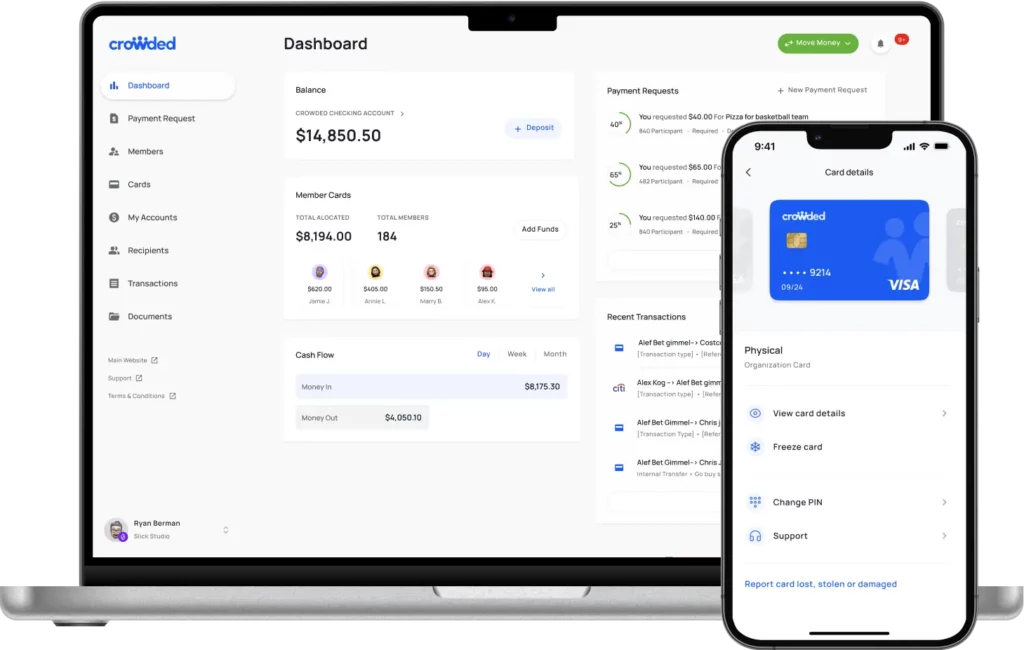

Discover 22 creative fundraising ideas to help your club maximize impact and engage the community. From unique events like pet parades to innovative services like pet sitting, these ideas will inspire excitement and support. Plus, learn how to streamline fundraising with tools like the Crowded app to make managing funds easier than ever.

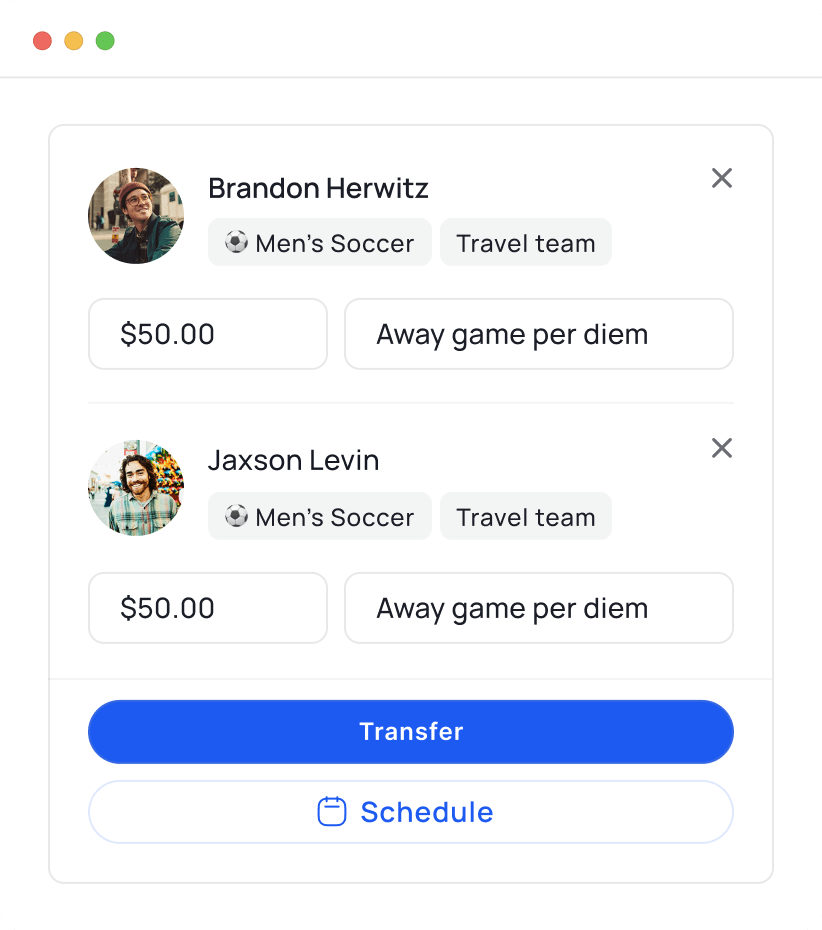

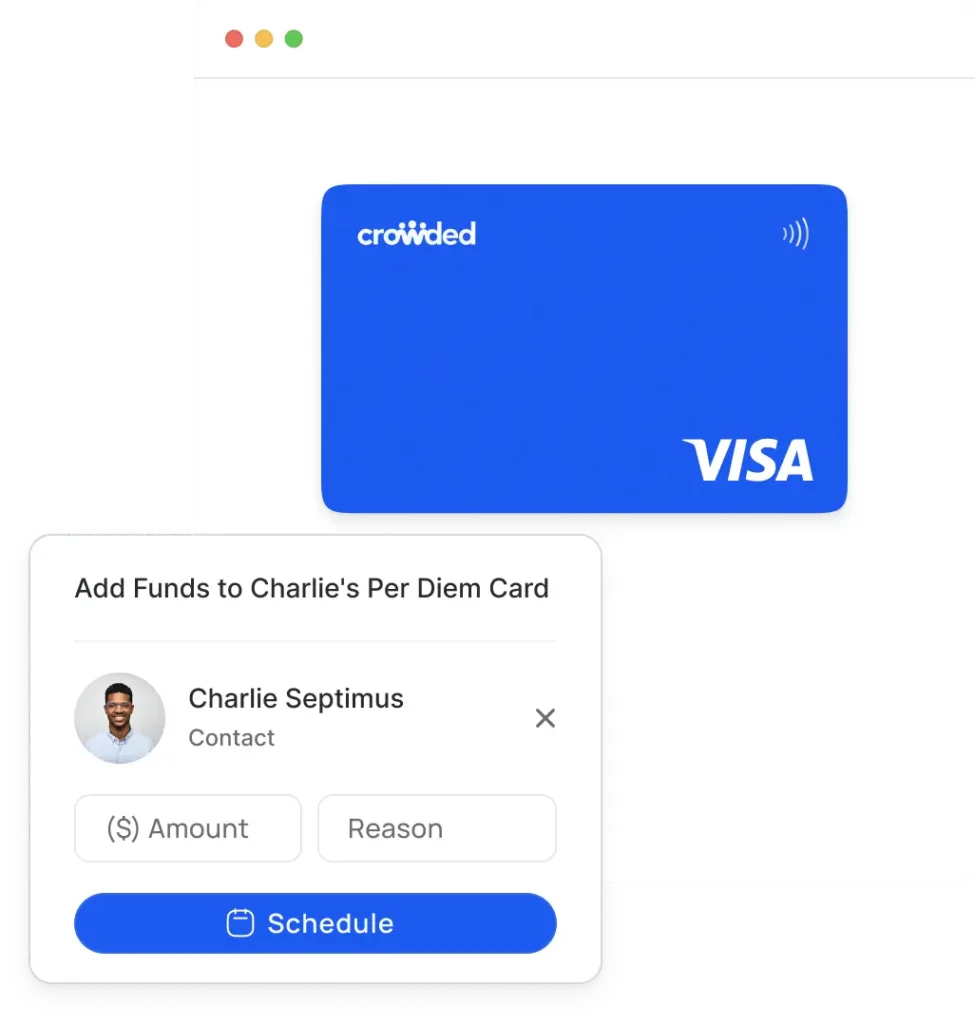

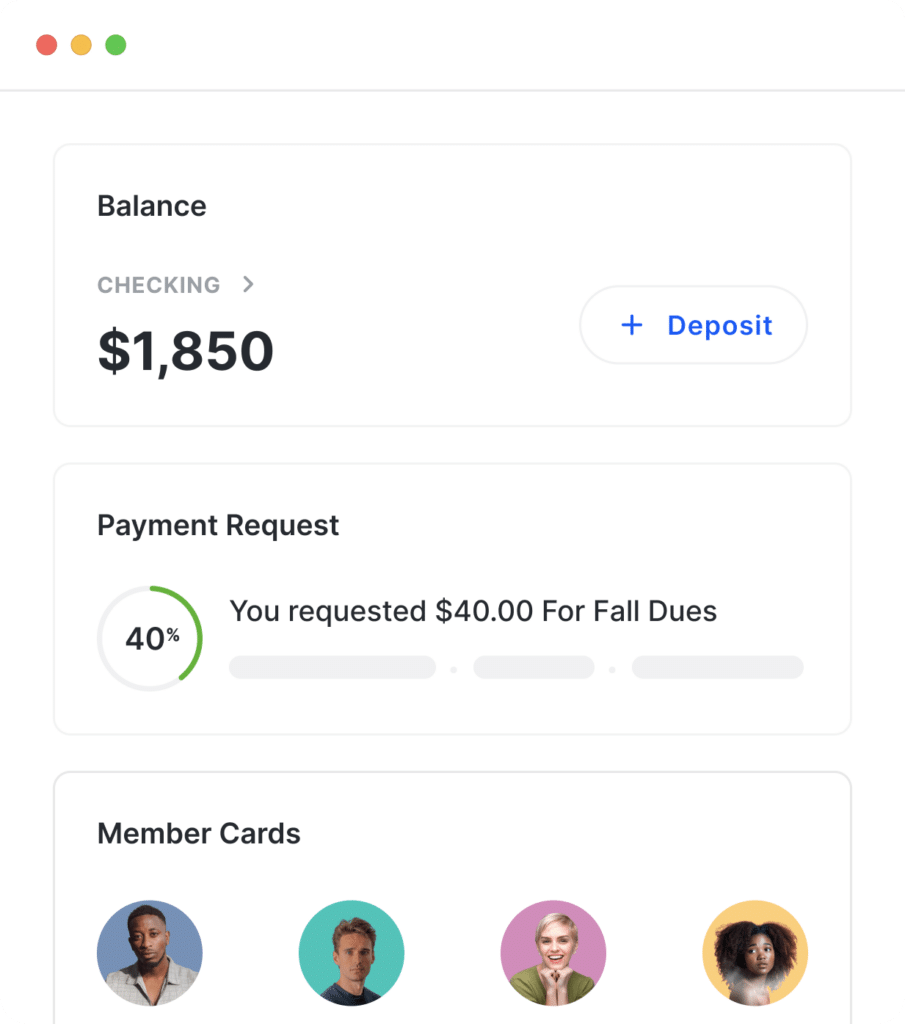

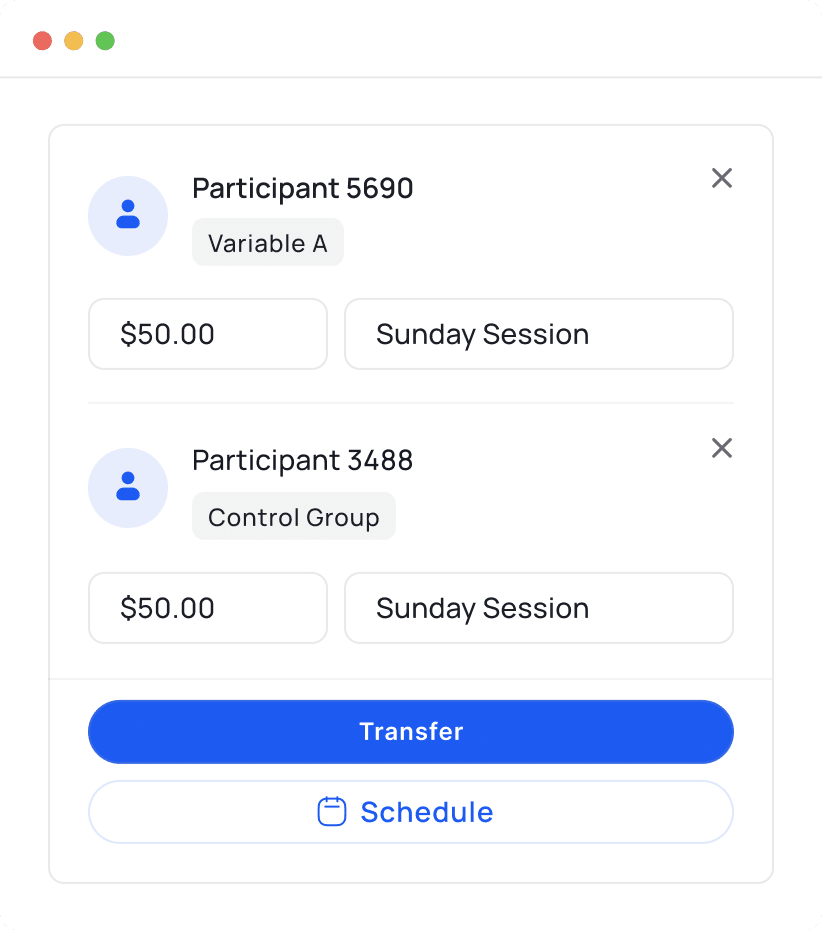

per diems for athletes

Athletic per diems without the headache

- Schedule per diem payments to team accounts in bulk.

- Easily track the cash flow from department to recipient.

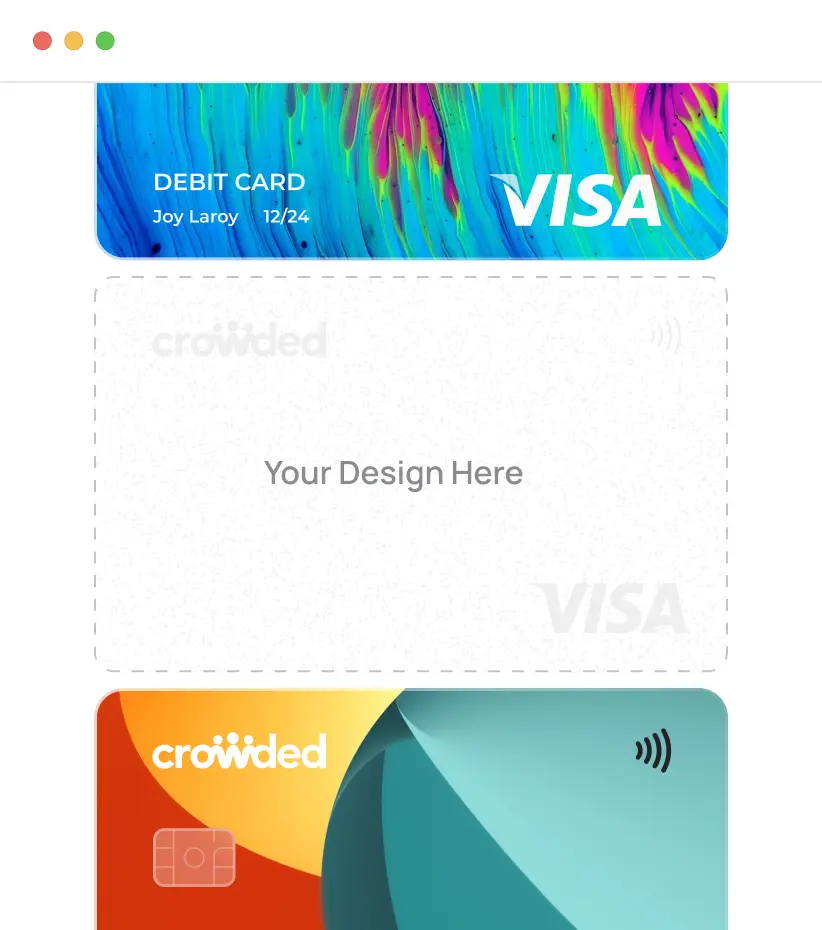

- Athletes can spend their per diems freely with debit cards.

- Learn more →