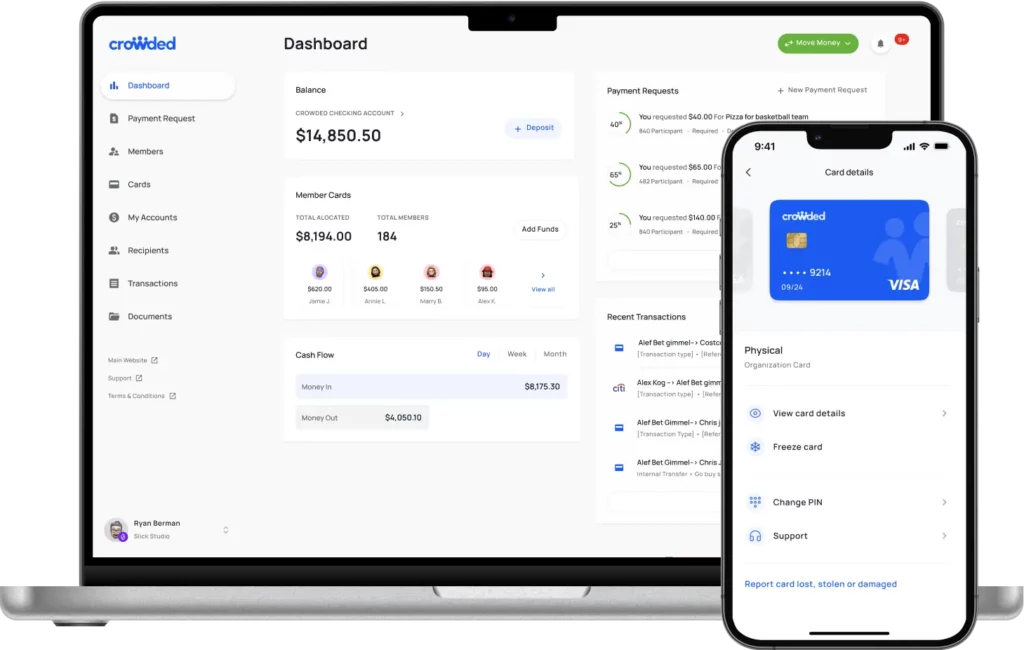

online banking

Enjoy tailored greek life banking

- Fully digital account setup, no paperwork required

- Customizations for multi-chapter Greek life organizations

- Digital officer handovers - no more trips to the bank!

Manage dues, donations,

events & more

Manage dues, donations,

events & more

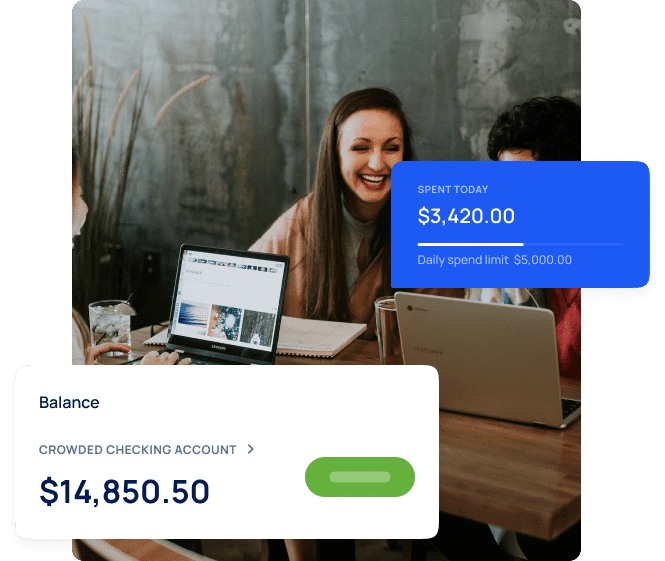

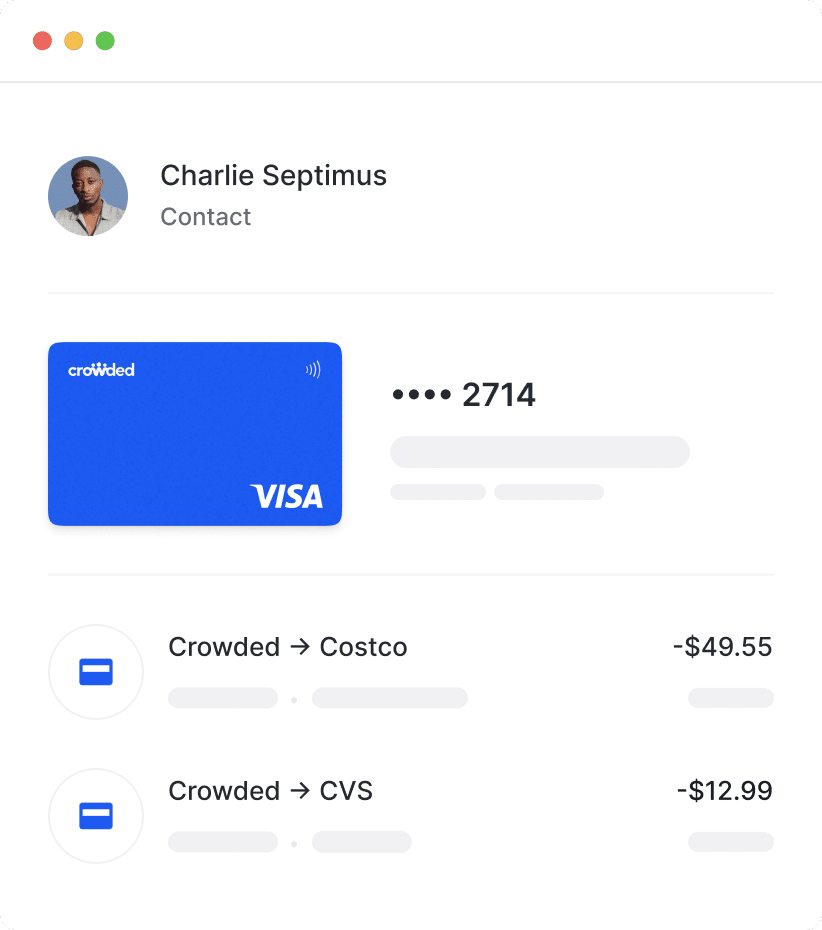

Manage spending with digital

debit cards

Set up a passive fundraising

program for consistent donations.

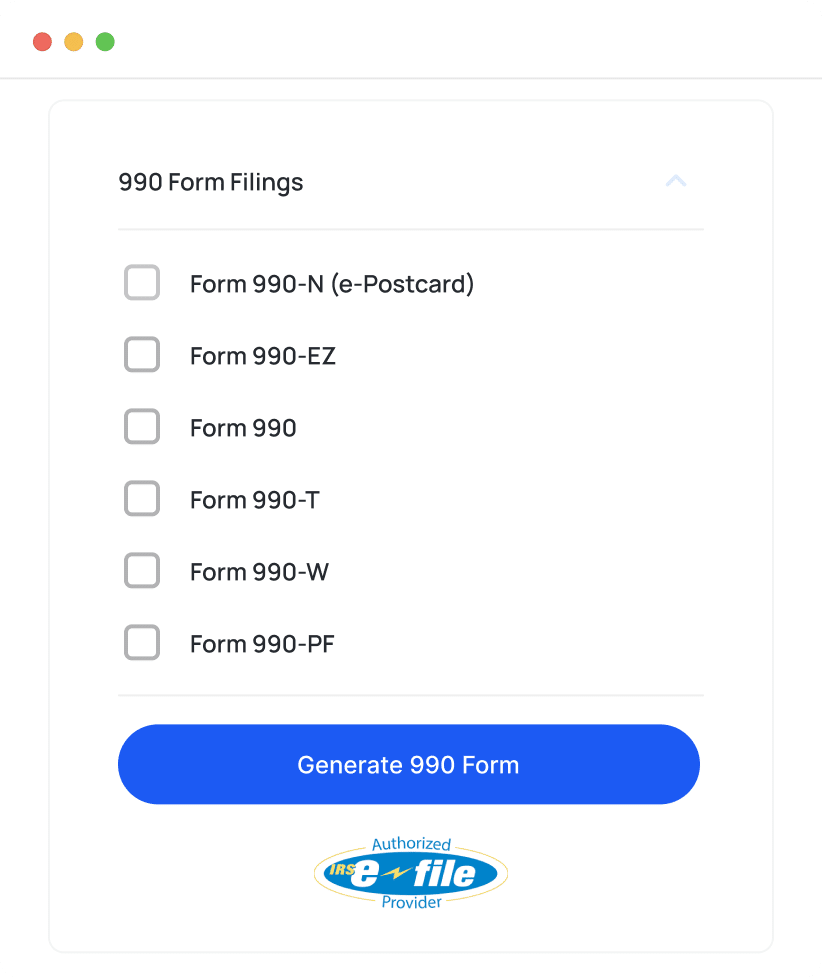

Stay compliant with tax regulations

Greek life organizations

Say hello to effortless dues collection, online officer handovers and easy 990 Form filing.

online banking

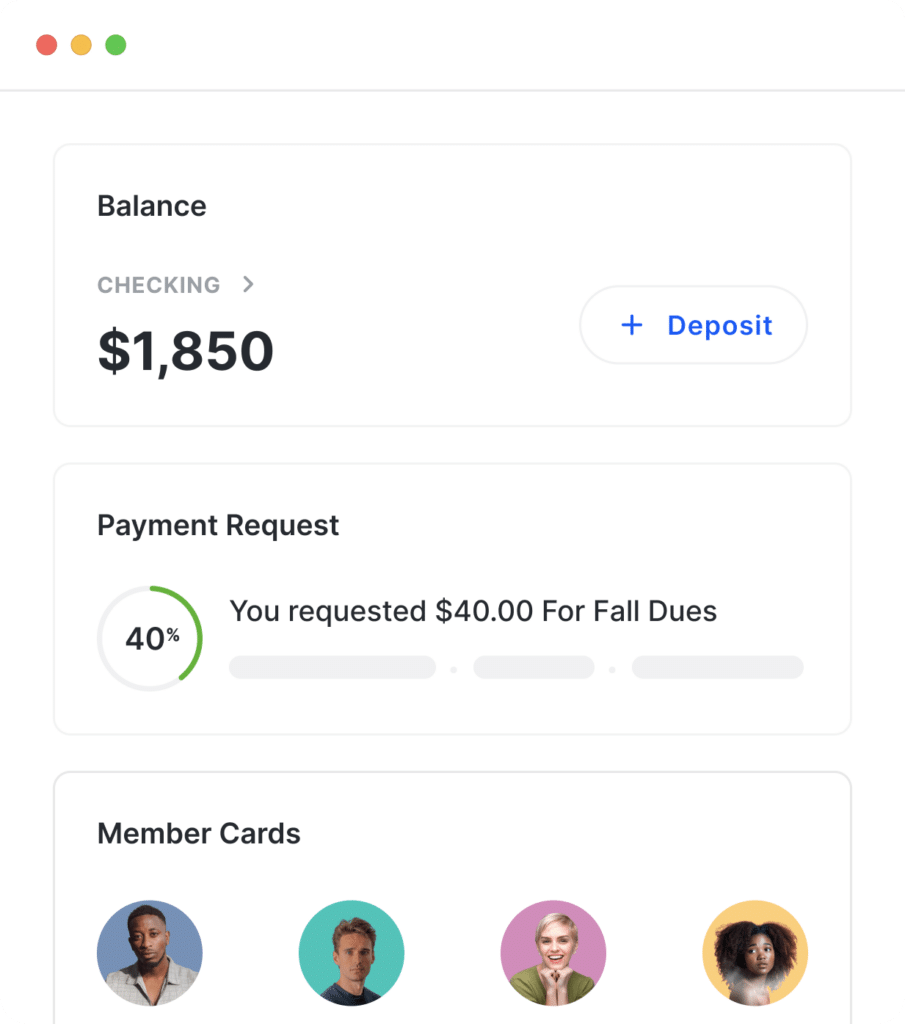

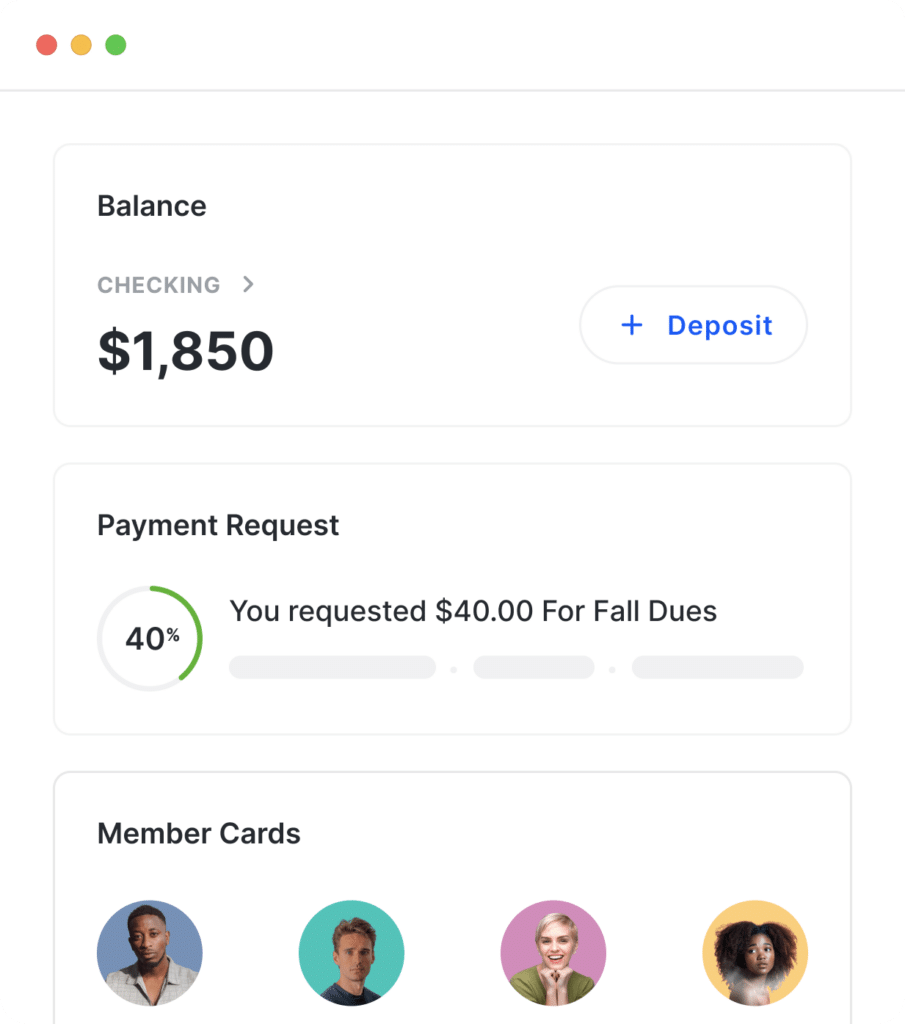

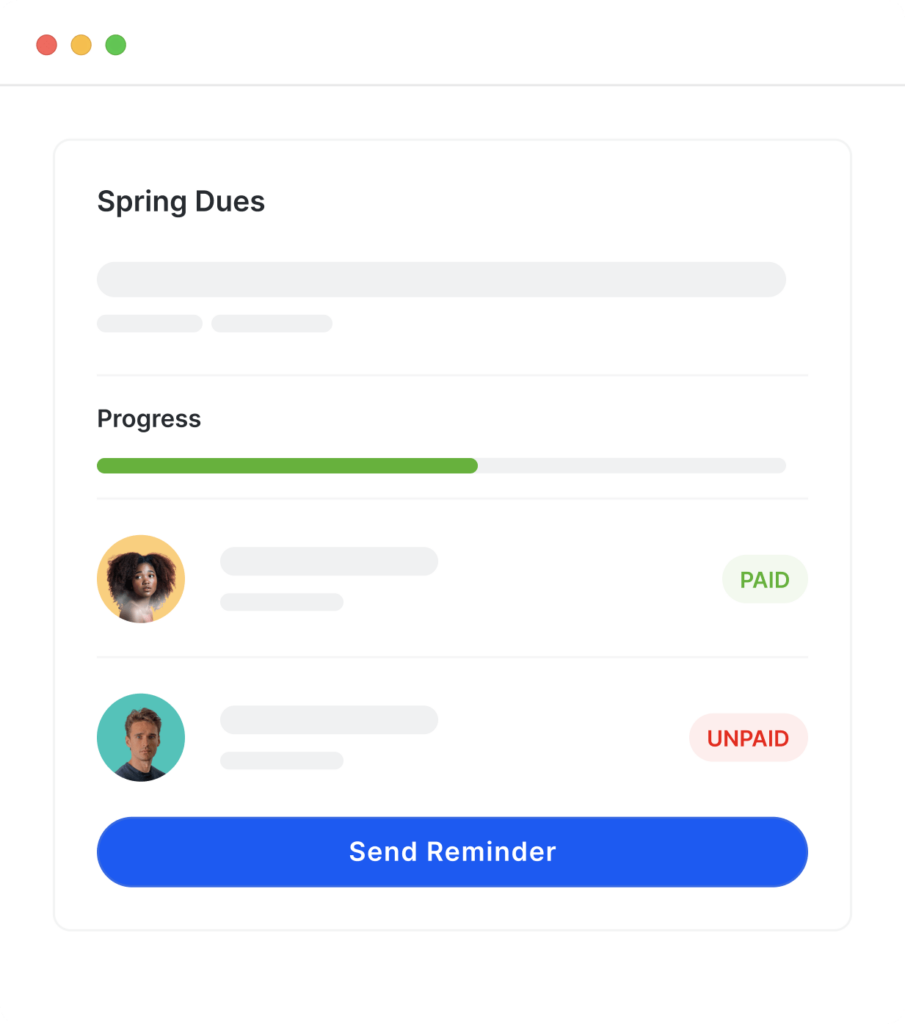

Collect dues

Spend

annual tax compliance

“We only see benefits for our alumnae chapters who create a Crowded account. It gives the chapters freedom to manage their funds in a flexible way. That’s why we continue to say – Crowded is our financial management solution and we want more alumnae chapters to be utilizing it.”

“We were so glad to find a platform that allows us to support our chapters, and give them independence. There are complications managing an association partially comprised of volunteers who aren’t experienced with digital banking, but Crowded’s platform is so user-friendly that it was easily adopted across the organization.”

“Since our guys are young volunteers gaining experience, it’s awesome to partner with a company that has tools to fit their needs. Things like transition assistance between officers or digital cards (the physical frat card always goes missing!) keep our guys focused on their mission and not bogged down administratively”

“It was great to have one place to pay international staff as well as reimburse other staff members when needed. We were able to drastically reduce the amount of petty cash we kept on site because we were able easily transfer money to staff when needed.”

“Crowded has given our fraternity the ability to develop financial strategies from the local to the national level. By partnering with Crowded on both the national and chapter level, we have not only achieved annual savings of approximately $10k but also experienced a reduction in reporting time by over 40 hours annually.”

“As PIKE transitioned from a ‘bank-less’ member billing solution to one that required a bank, Crowded was the missing piece to the puzzle. With seamless officer transitions, digital debit cards, and fantastic customer support, it was a no-brainer!”

“We needed a mainstream way to collect dues, as Venmo stopped supporting group accounts. We also liked the feature of allocating funds to team members’ virtual cards.”

Conveniently access all of your financial management tools in one place and avoid using scattered apps.

Traditional Banks | Paypal | Venmo | |

|---|---|---|---|

Digital first, easy account opening | |||

No monthly fees or minimums | |||

QuickBooks compatible | |||

Physical & digital cards | |||

Digital cards for members | |||

Free fundraising tools | |||

Trackable dues collection |

Digital first, easy account opening |

|---|

Traditional Banks |

Paypal |

Venmo |

No monthly fees or minimums |

|---|

Traditional Banks |

Paypal |

Venmo |

QuickBooks compatible |

|---|

Traditional Banks |

Paypal |

Venmo |

Free FBO Accounts |

|---|

Traditional Banks |

Paypal |

Venmo |

Digital Cards for Staff |

|---|

Traditional Banks |

Paypal |

Venmo |

Financing solutions for camps |

|---|

Traditional Banks |

Paypal |

Venmo |

Free Fundraising Tools |

|---|

Traditional Banks |

Paypal |

Venmo |

Official banking partner across 40+ chapters

Official banking partner serving all active chapters

Official banking partner serving undergrad and alumnae chapters

Official banking partner serving 400 chapters

Official banking partner serving alumnae chapters

Official banking partner serving 300+ chapters.

Official banking partner serving 500 chapters.

Tulane University & University of Chicago

Serving 13 Chapters Nationwide

Official banking partner serving 50 chapters.

Official banking partner serving 56 chapters.

Want to chat? Contact us.

With collecting with Crowded, you can avoid constantly transferring funds between payment apps and banks to access your group’s money. Utilizing embedded finances, Crowded enables your group to bank, collect, and spend with just one platform.

Crowded accounts are free to set up – we have no minimum balances or subscription fees.

What do we charge for?

When collecting payments, we charge 2.99% of the collection amount if paid by card and the the lesser of 2.99% or $5 for ACH payments.

You can always choose whether you want to cover these fees or ask your payers to handle them.

View our full fee schedule here.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by Blue Ridge Bank, N.A. and TransPecos Banks, SSB; Members FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by Blue Ridge Bank, N.A. and TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by TransPecos Banks, SSB; Member FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

To provide the best experiences, we use technologies like cookies to store and/or access device information as specified in our Privacy Policy. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.