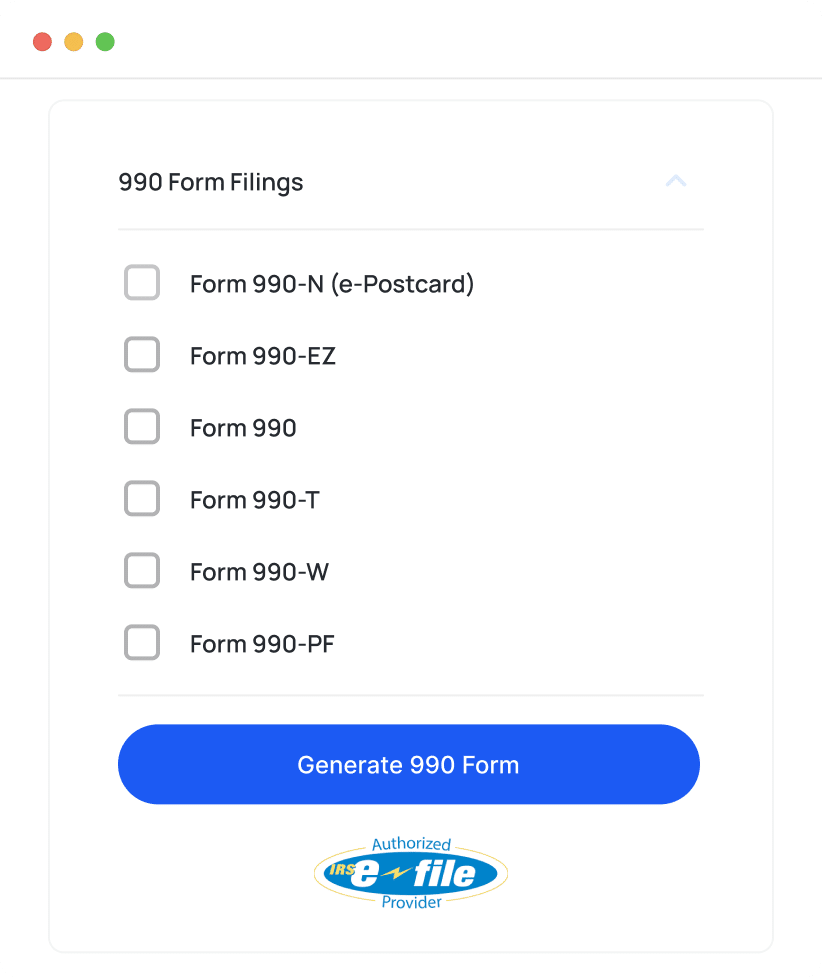

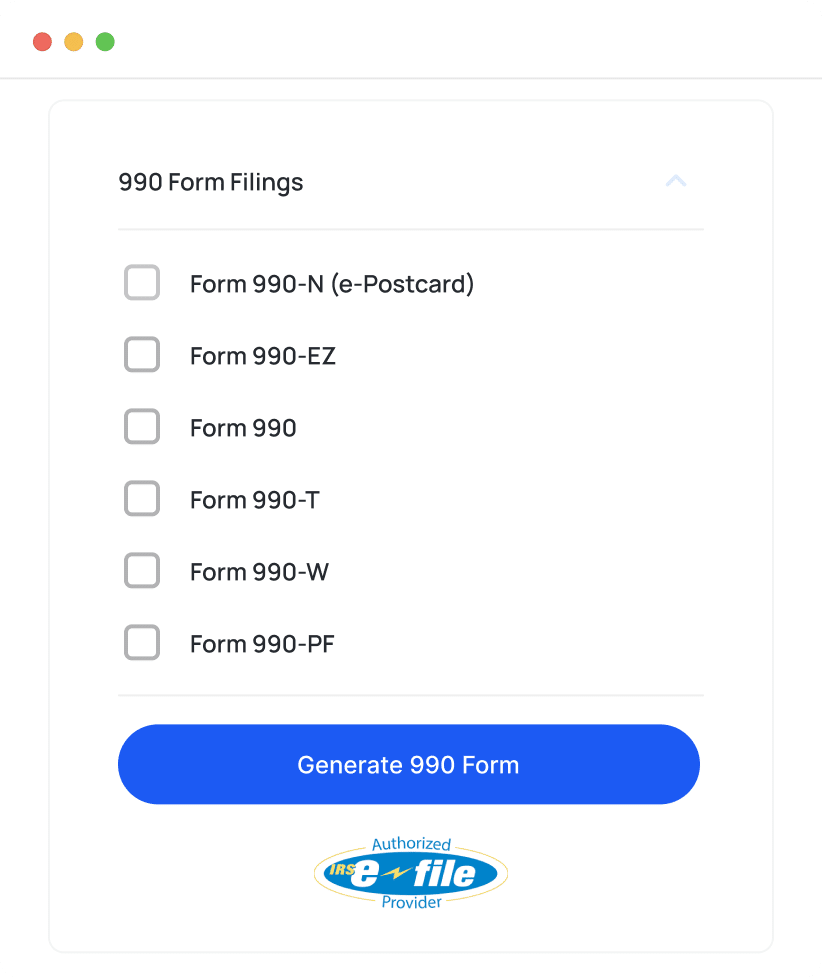

Form 990

AI-generated Form 990 filing services

- No need to download monthly statements

- Effortless and cheap filing process

- E-filing certified with the IRS

Manage dues, donations,

events & more

Manage dues, donations,

events & more

Manage spending with digital

debit cards

Set up a passive fundraising

program for consistent donations.

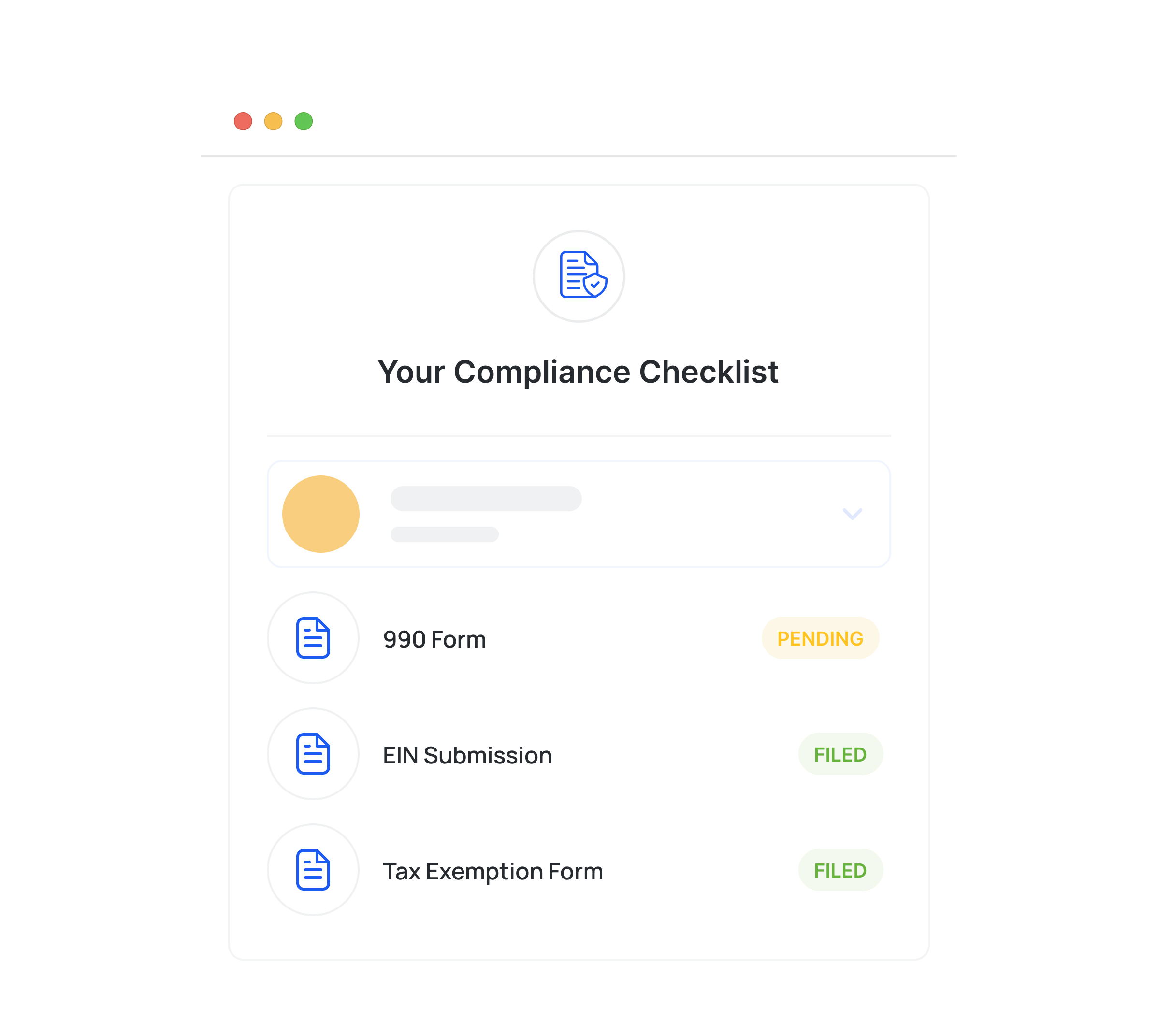

Stay compliant with tax regulations

Comply with Crowded

No need to download reports and waste time on bureaucracy, use Crowded Compliance AI ✨ to file your Form 990s year after year.

Form 990

We’ll reach out shortly about pricing and timelines, so keep an eye on your inbox.

In the meantime, take a look at our bank accounts that keep nonprofits tax compliant all year long.

Please leave your contact details and we will be in touch about managing your 990 filing.

chapter Tracker

Group exemption Maintenance

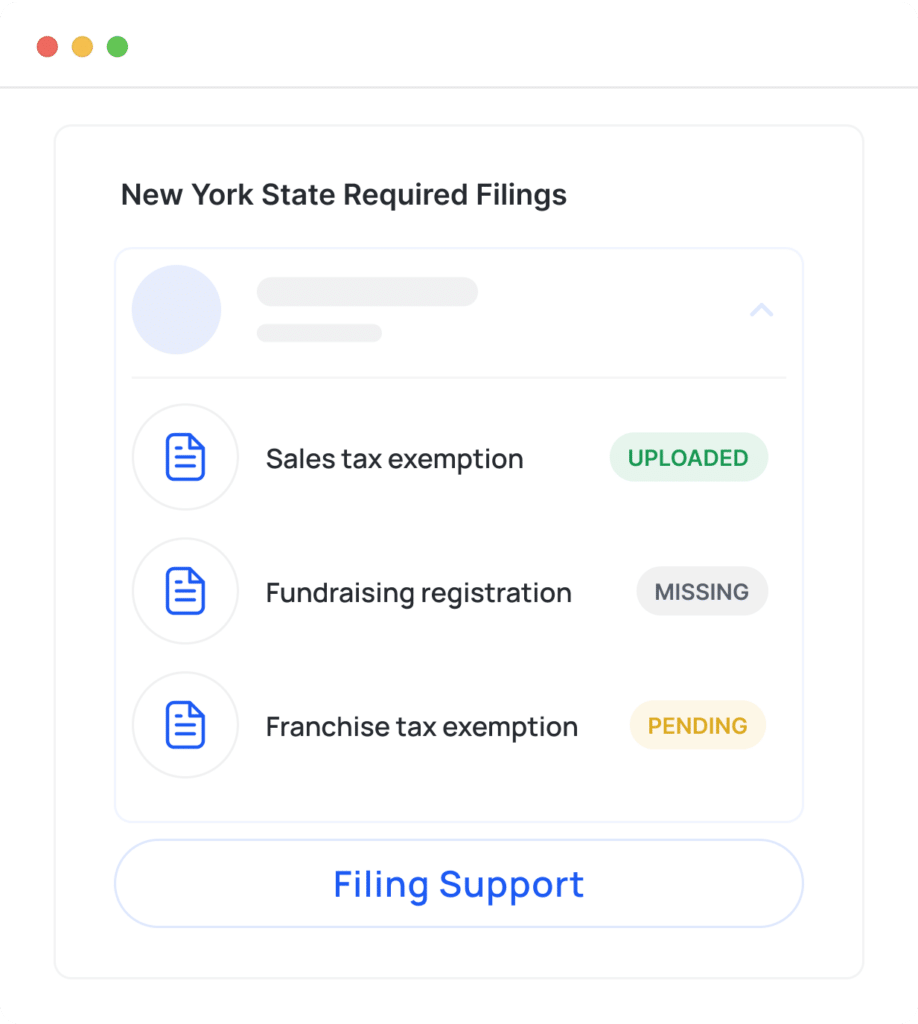

state level compliance

Want to learn more? View All

Enter the world of nonprofit tax exemption and understand who qualifies, the benefits it offers, and the application process.

Explore the ins and outs of group exemptions and determine if it's the optimal path for your nonprofit's tax status.

Our compliance checklist is your roadmap to preserving your nonprofit's tax-exempt status and fulfilling all legal requirements.

Want to chat? Contact us.

Get in touch with us, and Crowded can help file to the IRS to reinstate tax-exempt status!

The magic of Crowded’s Form 990 filing, is when a nonprofit banks* with Crowded, and when it comes time for the annual tax filing, the nonprofit does not need to go searching for any monthly reports.

The financial data required for the IRS Form 990 is auto-filled using AI from Crowded data for the nonprofit, making annual tax filing easier and cheaper than ever.

Crowded accounts are free to set up – we have no minimum balances or subscription fees.

Our compliance services incur a small fee. See our full fee schedule here.

Open a Crowded account today to benefit from compliant nonprofit banking* today!

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by Blue Ridge Bank, N.A. and TransPecos Banks, SSB; Members FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by Blue Ridge Bank, N.A. and TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by TransPecos Banks, SSB; Member FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

To provide the best experiences, we use technologies like cookies to store and/or access device information as specified in our Privacy Policy. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.