In the world of nonprofits, knowing how tax exemptions work can make or break your organization. No matter if you’re an experienced leader or just starting out, this blog will help you understand the impact of tax exemption, how to apply for it, and how to maintain your nonprofit’s compliance.

It’s not just about tax codes; it’s about keeping your organization active and impactful.

What is nonprofit tax exemption?

A tax exemption for nonprofits refers to a special status granted by the Internal Revenue Service (IRS) at the federal level. This status relieves qualifying nonprofit organizations from paying certain taxes that are normally applicable to for-profit entities. Most notably, nonprofits are generally exempt from paying federal income tax. State-level exemptions exist on a state-by-state basis. Not all nonprofits are the same, however. Different designations of nonprofits are eligible for different treatment by the IRS.

What type of nonprofits qualify for tax exemption?

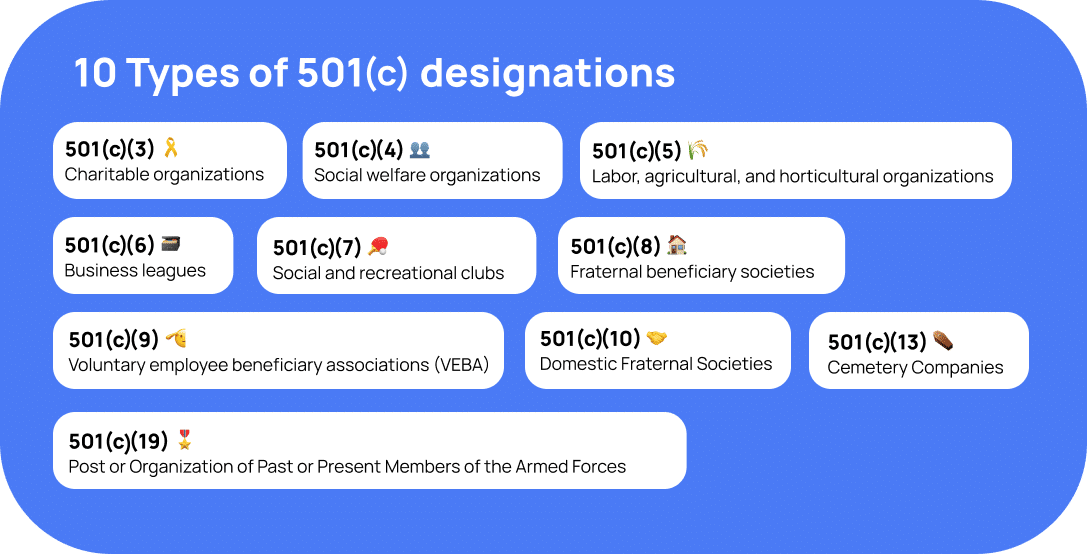

The IRS has created many different 501(c) categories that nonprofits can fall into. There are 25 categories total, ranging from cemetery companies to agricultural organizations. The two most relevant to us at Crowded are 501(c)(3) and 501(c)(7).

What is a 501(c)(3) organization?

501(c)(3) organizations are commonly known as charitable organizations. They are organized and operated exclusively for charitable, religious, educational, scientific, or literary purposes. These organizations must serve the public interest and provide a benefit to the community or a significant segment of it. Their main source of funding is through donations and fundraising.

What is a 501(c)(7) organization?

501(c)(7) organizations are social and recreational clubs that are organized for pleasure, recreation, and other similar non-profitable purposes. They are typically membership-based organizations that exist for the enjoyment and social interaction of their members, like sororities or a gardening club. These groups are funded via membership dues or fees.

The benefits of tax exemption for nonprofit organizations

Exemption from federal income tax

Nonprofit organizations will generally be exempt from paying federal income tax. This is not to say that you are exempt from taxes. Each 501(c) designation has specific tax exemptions, but the overarching rule is that you are exempt from paying federal income tax.

Exemption from certain state taxes

Depending on the state, nonprofits may also be exempt from paying state sales taxes on goods and services related to their charitable activities. You may also qualify for property tax exemptions on real estate and personal property used for your mission. Check your state regulations to determine the tax benefits available to your nonprofit.

Tax deductible donations

Charitable nonprofit organizations, (501(c)(3)s and select 501(c)(4)s, can offer their donors the opportunity to deduct their donations from their annual tax return. This incentivizes donations from the public, and helps significantly with nonprofit fundraising goals!

Increased credibility

Earning tax-exempt status is like a rite of passage for nonprofit organizations. Once you’ve obtained tax-exempt status, you can approach potential donors, partners, volunteers, etc. with real credibility.

Access to grants and funding opportunities

Many government agencies and private foundations only provide grants to organizations with tax-exempt status. This opens up additional funding opportunities for your nonprofit to pursue your charitable objectives.

How to apply for nonprofit tax exemption

Thinking about founding a nonprofit or starting a new chapter? If so, follow these steps on how to obtain tax-exempt status.

Before applying for tax-exempt status

Before you go running to the IRS, there are a few crucial steps to take ahead of time to get accepted as a tax-exempt nonprofit.

1. Check if you are eligible for coverage under a group exemption

If you are a subordinate organization of an existing nonprofit, you will want to check to see if your umbrella nonprofit has a group exemption. A nonprofit group exemption is a provision by the IRS that allows a central or parent organization to obtain and maintain tax-exempt status on behalf of its subordinate organizations or chapters, eliminating the need for each subordinate to apply separately. This is particularly beneficial for larger nonprofits with multiple chapters or affiliates under a central umbrella, ensuring consistent tax-exempt status across the entire organization.

If your umbrella nonprofit has a group exemption, they will need to add you to their list of subordinate chapters and you will not need to apply for separate tax exempt status for your organization.

2. Incorporate your nonprofit

Create a name, purpose, and bylaws for your new nonprofit. You can apply to your state yourself as a nonprofit or check out Crowded’s incorporation services to make incorporating stress-free.

Either way, at the end of the process you will have a Certificate of Incorporation. This document includes the basic information of your new nonprofit such as address and name, and will allow you to apply for tax-exempt status later.

This process officially establishes your nonprofit as a corporation, and you are ready to move forward with applying for the tax exemption at the IRS.

To read more about this topic, check out our blog on how to incorporate your nonprofit membership club.

Get a Free Nonprofit

Bylaws Template

When creating a nonprofit, creating a set of bylaws is one of the requirements for incorporating. Luckily for you, if you submit your email, we’ll send you a free nonprofit bylaws template.

Applying to the IRS for a nonprofit tax exemption

Have an EIN

If your nonprofit does not have an EIN (Employer Identification Number), it’s an important first step! You can apply to the IRS for an EIN yourself, or take advantage of Crowded’s $20 EIN service. This unique identifier is similar to a social security number for your nonprofit and is necessary for tax reporting and financial transactions.

Read our article on What is an EIN and how to get one for more information.

Compliance with IRS requirements

Now that you are getting your application ready for the tax exemption, be sure to follow the IRS guidelines as closely as possible to ensure your approval.

- Your nonprofit’s charitable purpose should be clearly articulated in your mission statement.

- Ensure that your purpose aligns with the specific 501(c) category you are applying for

- Demonstrate how your activities will advance these charitable goals and benefit the public and community.

Which application form to file

To attain federal tax-exempt status, you’ll typically need to submit one of three forms to the IRS: Form 1023, Form 1023-EZ, or Form 1024.

If you’re a 501(c)(3) charitable organization, you’ll likely choose between Form 1023 and Form 1023-EZ based on your size and other criteria. If you’re another type of 501(c) nonprofit, Form 1024 will be the way to go. Feel free to reach out to us if you have any questions about which form is the best fit for your nonprofit.

Final step: The IRS determination letter

Issued by the IRS, the determination letter confirms your organization’s tax-exempt status and outlines the specific 501(c) category under which it has been recognized. It serves as proof of your nonprofit’s eligibility for tax benefits and of your organization’s legitimacy.

Tip: Store the IRS determination letter in a safe, accessible place, as it may be required for financial transactions, grants, and compliance reporting.

Nonprofit state tax exemptions

Each state has its own set of criteria and procedures for tax exemption, covering areas like sales tax, property tax, and income tax. Search up the rules in your state to see which tax exemptions your nonprofit may be eligible for.

Tip: Keep meticulous records, engage with state tax authorities for guidance, and stay updated on changing regulations.

How to maintain your nonprofit’s tax exempt status

Now that you have been granted tax exempt status, it is crucial to maintain it!

Recordkeeping and transparency

Diligent recordkeeping and a commitment to transparency is crucial for tax-exempt nonprofits. Keep detailed and accurate records of financial transactions, donations, and activities. It will be a huge help in filling out your Form 990 – your annual report to the IRS.

Share your financial information and annual reports with stakeholders, donors, and the public to foster trust and credibility. By keeping a clear and transparent financial trail, nonprofits can safeguard their tax-exempt status and maintain confidence in their operations.

Keeping up with annual filing requirements by the IRS

Most tax-exempt organizations are required to file Form 990 annually. Smaller organizations may be eligible for the streamlined Form 990-EZ. Even those who are under a group exemption are still required to file a 990 form. Read more about filing requirements for group exempt chapters.

It’s crucial to set up internal processes that ensure compliance with filing deadlines and to provide accurate financial information, program descriptions, and governance details on these forms.

Tip: Keep a calendar of due dates, seek professional assistance when needed, and maintain meticulous records. It will help you meet your annual IRS filing requirements and safeguard your tax-exempt status.

Which Form 990 should my nonprofit file?

Your nonprofit should file...

0

Sent!

We’ll reach out shortly about pricing and timelines, so keep an eye on your inbox.

In the meantime, take a look at our bank accounts that keep nonprofits tax compliant all year long.

Please leave your contact details and we will be in touch about managing your 990 filing.

Tax-exempt revocation and how to avoid it

Consequences for not meeting the annual IRS filing requirements

One significant reason for tax-exempt revocation is failing to meet the annual IRS filing requirements, especially the Form 990. If this obligation is neglected for three consecutive years, the IRS can automatically revoke the organization’s tax-exempt status.

Revocation of tax-exempt status not only jeopardizes your organization’s ability to receive tax-deductible donations but also results in the loss of various state-level grants. It can also harm the organization’s reputation and credibility.

Conducting activities outside of tax-exempt purposes

Engaging in activities that fall outside the scope of your organization’s tax-exempt purposes can put its tax-exempt status at risk. You should continually make sure that your activities align with your stated mission and charitable goals (if applicable). Deviating from these purposes could lead to tax-exemption revocation.

Unrelated business income

Unrelated Business Income (UBI) arises from activities conducted by your organization with a profit motive that are not substantially related to its exempt purpose. Organizations with UBI are required to report this income on Form 990-T and pay taxes at corporate or trust rates on the net income generated from these activities.

Tip: Carefully assess your nonprofit’s activities to ensure they don’t inadvertently generate UBI, which could have tax implications and affect your organization’s tax-exempt status.

Remedial measures

If your nonprofit organization has done something to jeopardize your nonprofit’s tax exemption status, there are steps you can take to remedy the situation.

- If you miss IRS filing deadlines, quickly file the necessary forms retroactively and address any issues that led to the lapse in compliance.

- To avoid conducting activities outside your tax-exempt purposes, periodically review your organization’s mission statement and programs to ensure alignment.

- If unrelated business income (UBI) is generated, consider restructuring or mitigating those activities to minimize tax consequences.

- Consider seeking legal or financial guidance when navigating tax-exemption revocation

To avoid losing your tax exempt status, check out our comprehensive compliance checklist for help.