how it works:

Pay salaries in a few clicks

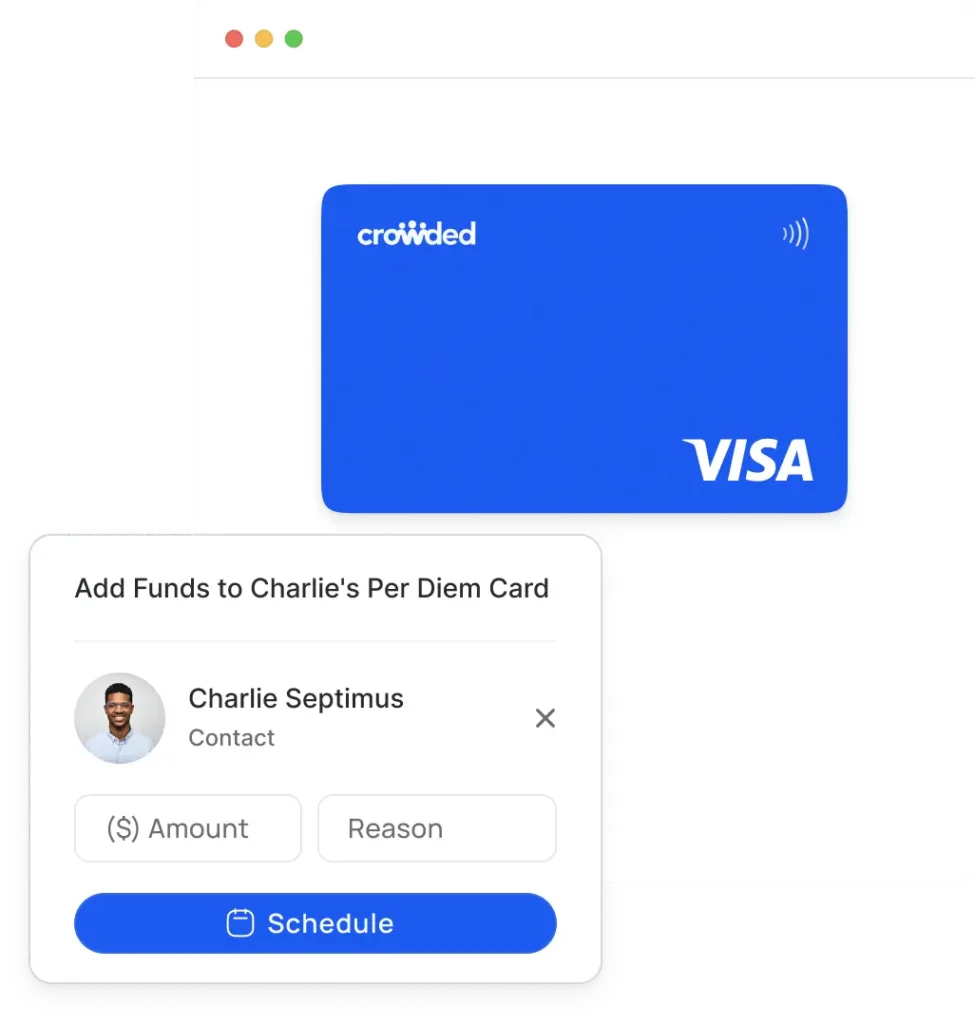

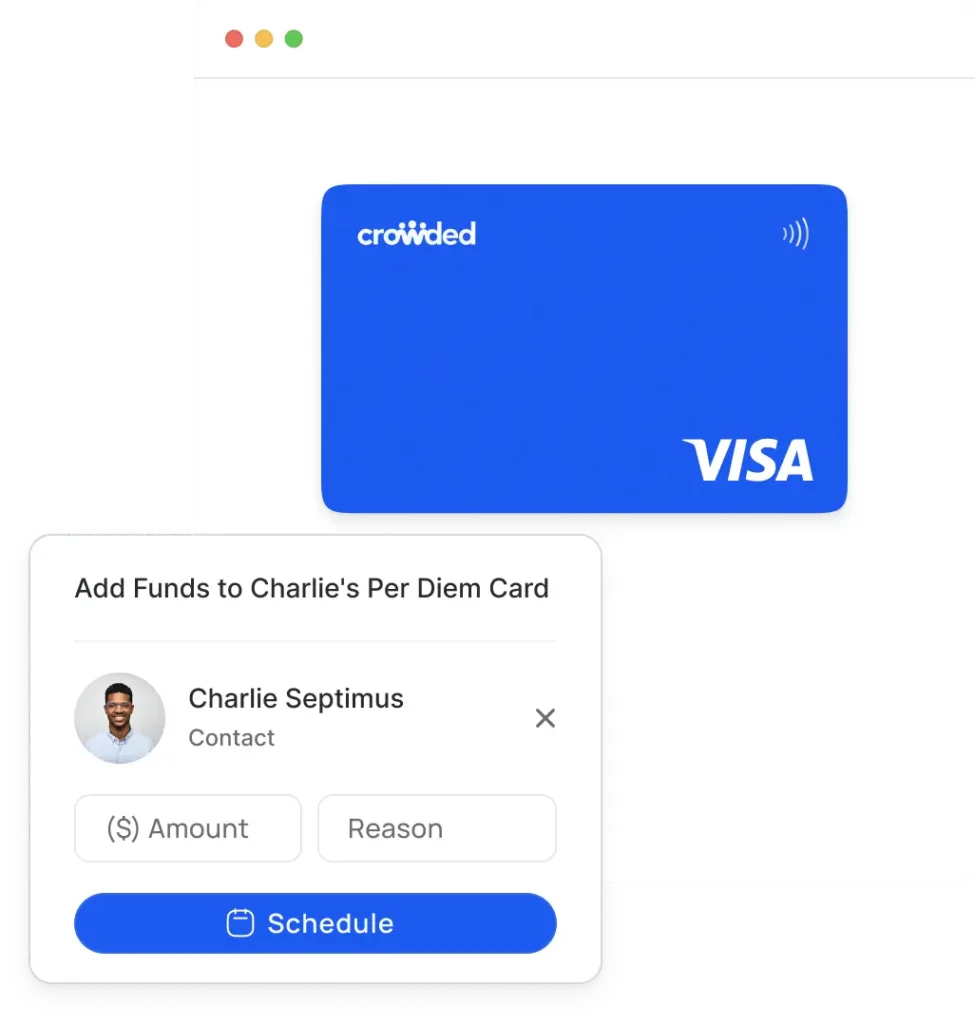

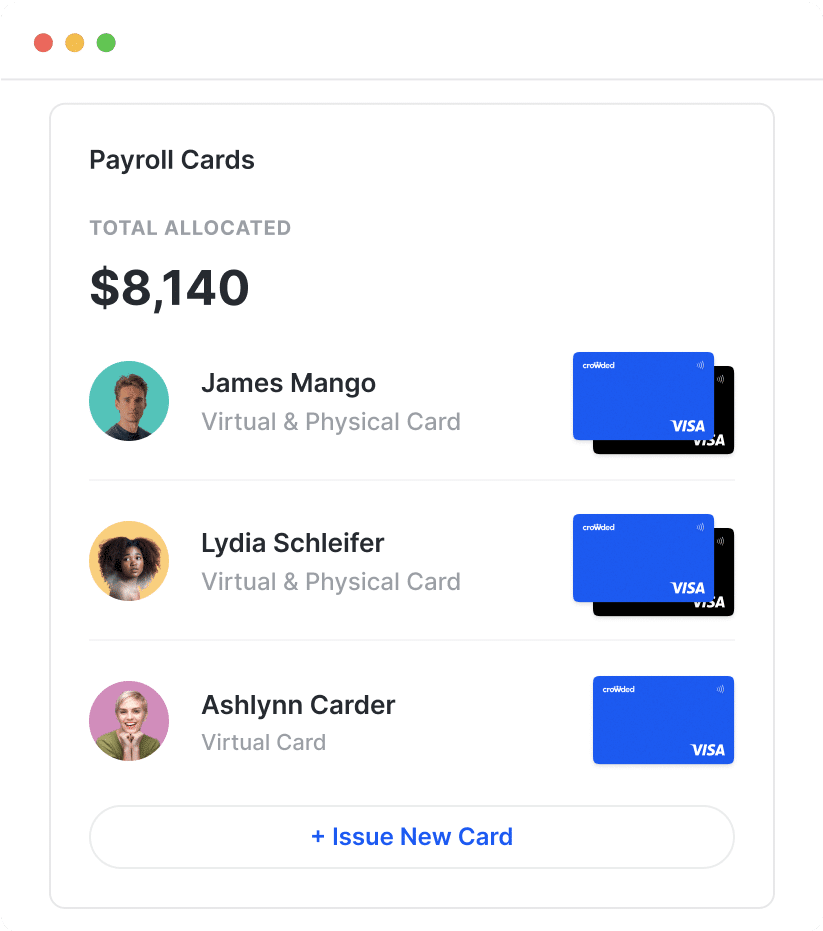

- Batch create and fund accounts for international counselors.

- Schedule payments to those accounts.

- Counselors receive their salaries in a dedicated account

Manage dues, donations,

events & more

Manage dues, donations,

events & more

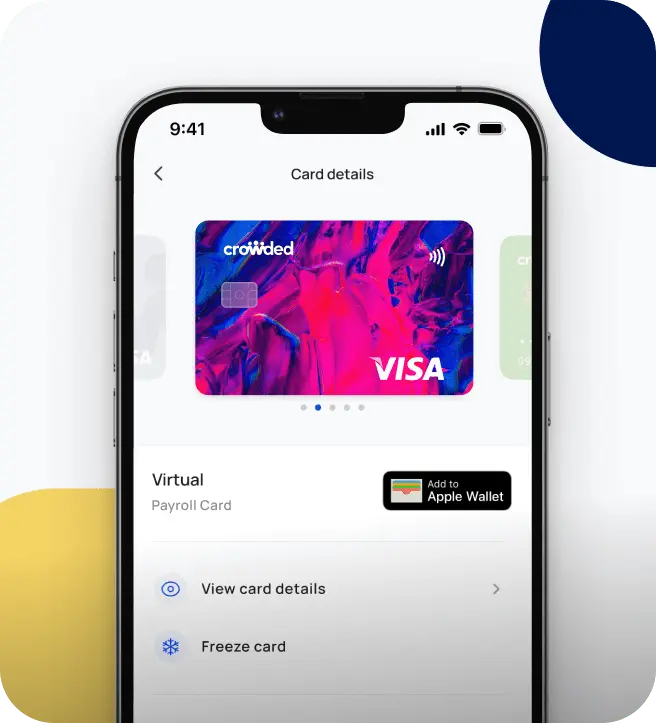

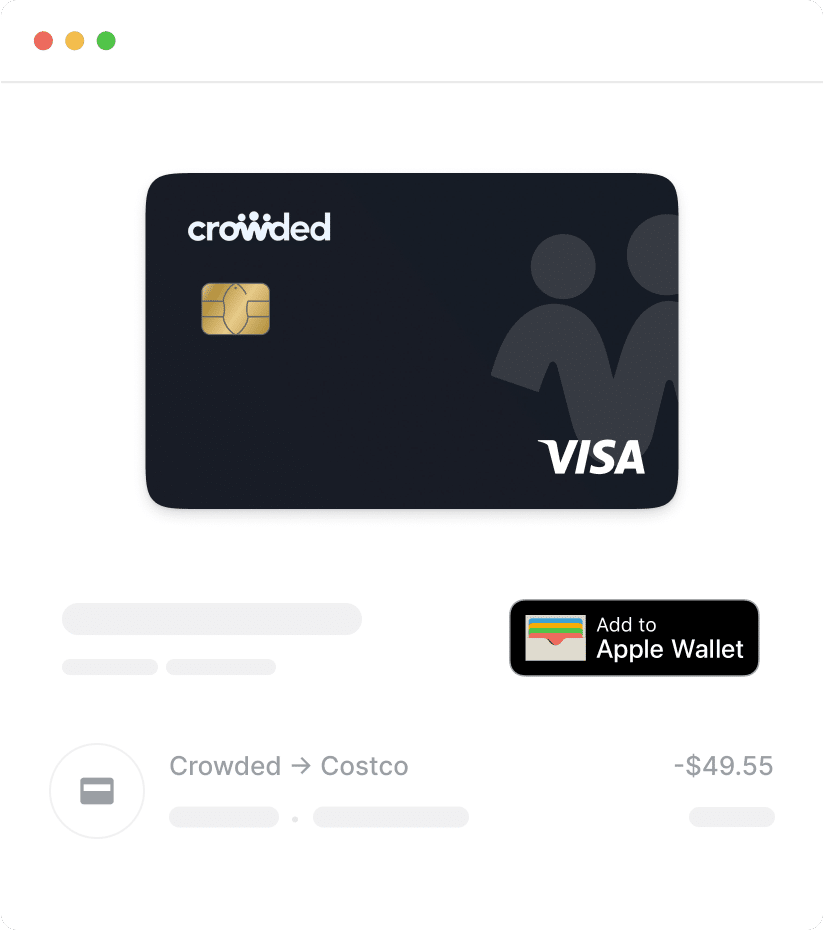

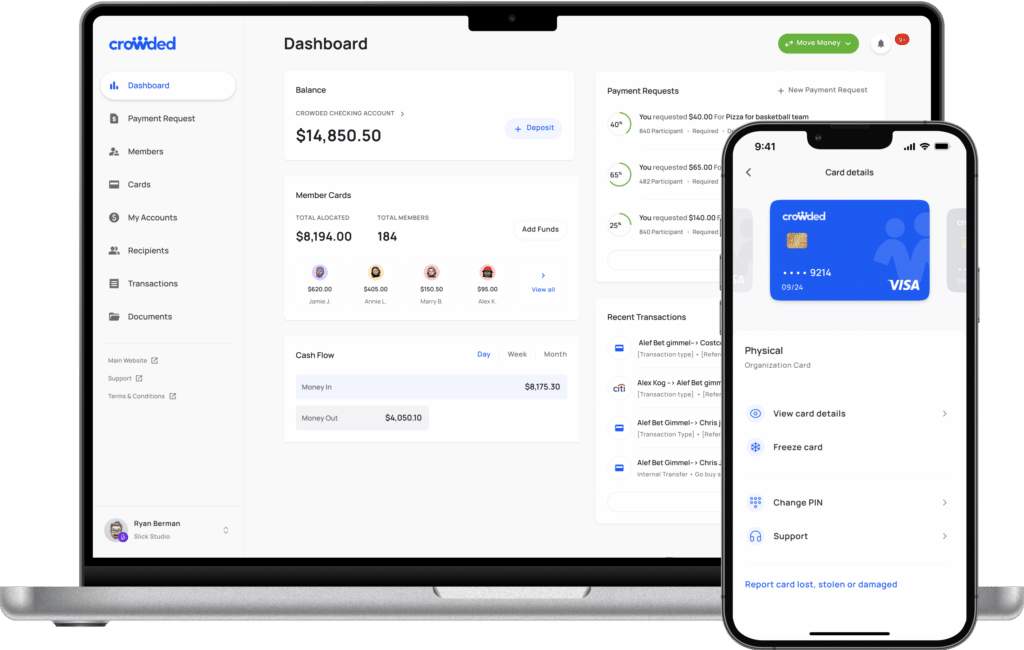

Manage spending with digital

debit cards

Set up a passive fundraising

program for consistent donations.

Stay compliant with tax regulations

Summer camp payments

Utilize Crowded’s Per Diem accounts to make paying international staff as easy as 1-2-3.

how it works:

usage options

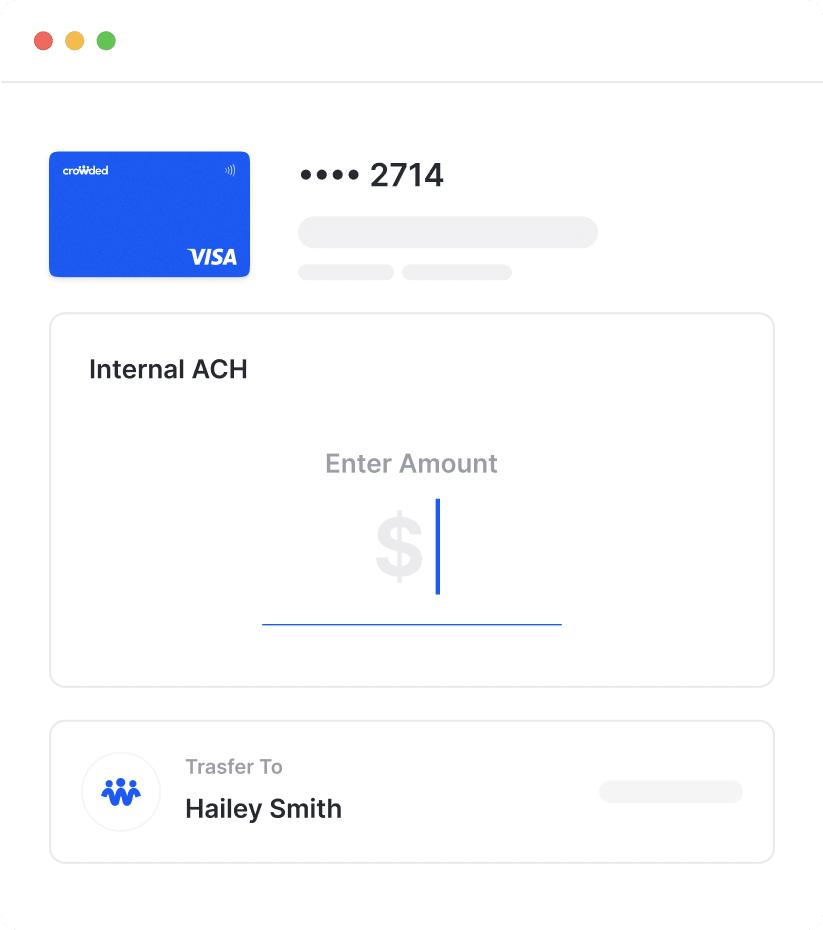

Send Money Abroad

pay out salaries

mobile payments

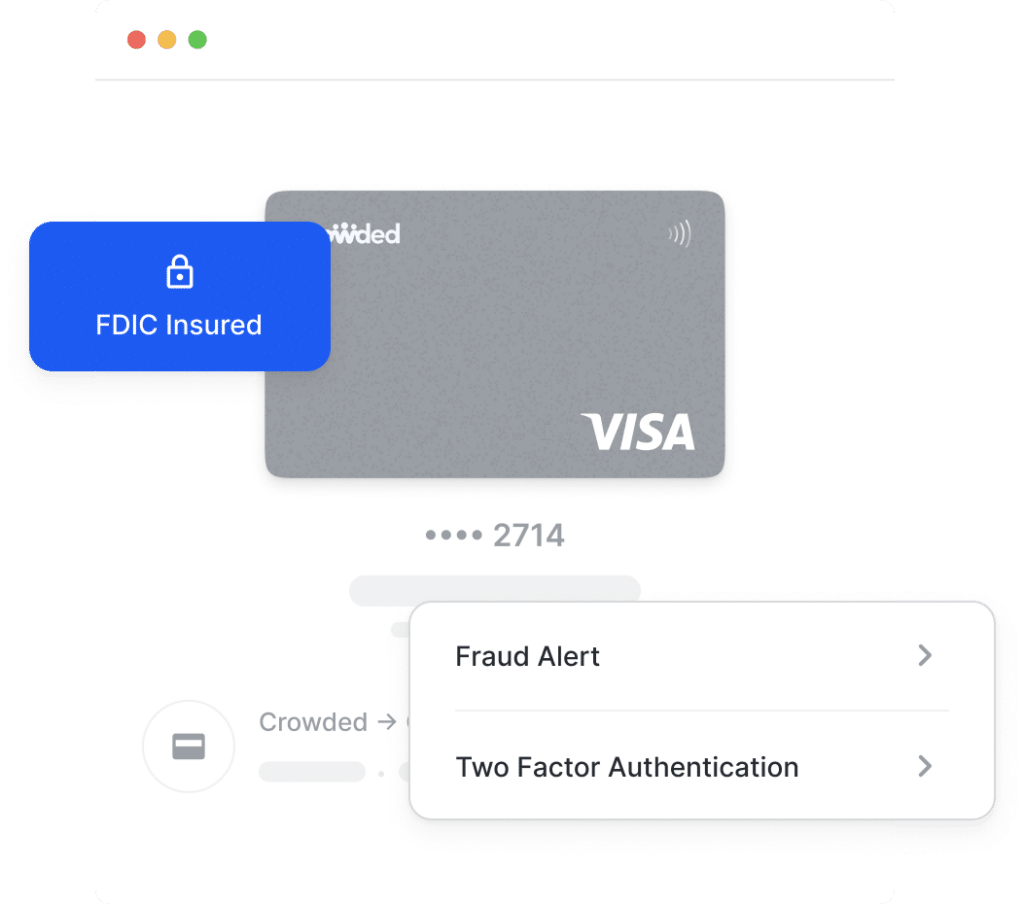

account security

Official banking partner

Denver, Colorado

Randolph, New Jersey

Waupaca, Wisconsin

Rhinebeck, New York

Official banking partner for camps across the south and southwest

Cascade, Maryland

Atlanta, Georgia

See how Camps Airy & Louise utilized our payroll cards to pay international staff and leveraged Crowded’s other banking and spending features.

Get all the features you need – all on one platform.

Traditional Banks | Cliq | |

|---|---|---|

Digital first, easy account opening | ||

No monthly fees or minimums | ||

QuickBooks compatible | ||

Free accounts for international staff | ||

Digital & physical cards for staff | ||

Passive fundraising tools for camps | ||

Camper spending accounts |

Digital first, easy account opening |

|---|

Traditional Banks |

Cliq |

No monthly fees or minimums |

|---|

Traditional Banks |

Cliq |

QuickBooks compatible |

|---|

Traditional Banks |

Cliq |

Free accounts for international staff |

|---|

Traditional Banks |

Cliq |

Digital & physical cards for staff |

|---|

Traditional Banks |

Cliq |

Passive fundraising tools for camps |

|---|

Traditional Banks |

Cliq |

Camper spending accounts |

|---|

Traditional Banks |

Cliq |

Want to chat? Contact us.

Crowded is a dedicated banking platform that offers for-profit and nonprofit camps easy ways to collect, spend and manage money online.

We’re popular for:

To set up a Crowded account for your camp in minutes, create a free account online or book a demo with one of our team members for any questions or additional support.

Crowded integrates with Quickbooks, Xero and other providers. For the full list, get in touch with us.

Creating a Crowded account for your camp is free, making it the most affordable option compared to traditional SaaS providers that charge subscription fees, or banks that impose monthly fees or minimum deposits.*

So, what do we charge for?

We charge standard banking fees for services such as ACH transfers, wire transfers, and mobile check deposits. View our fees page for more information.

Let’s chat!

Darryl Gecelter

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by Blue Ridge Bank, N.A. and TransPecos Banks, SSB; Members FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by Blue Ridge Bank, N.A. and TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by TransPecos Banks, SSB; Member FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

To provide the best experiences, we use technologies like cookies to store and/or access device information as specified in our Privacy Policy. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.