501(c)(6) banking

Streamlined finances

for trade associations

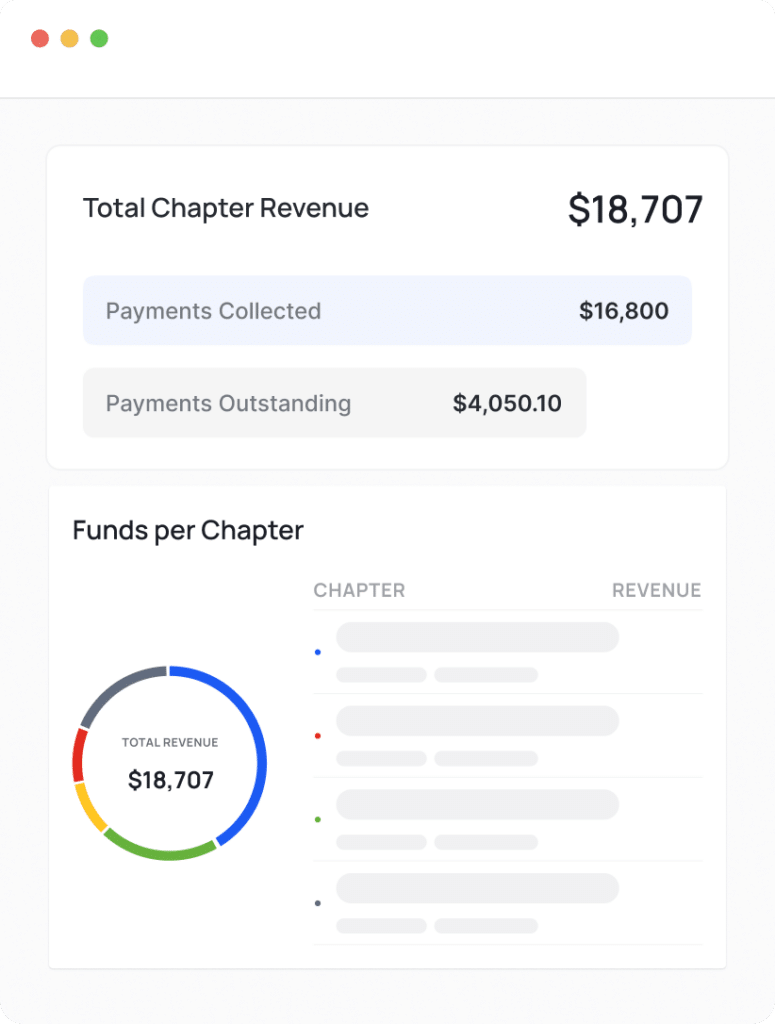

Crowded consolidates finances for multi-chapter professional trade associations, providing insights at the HQ level while maintaining chapter independence.

- Unified banking* & compliance across chapters.

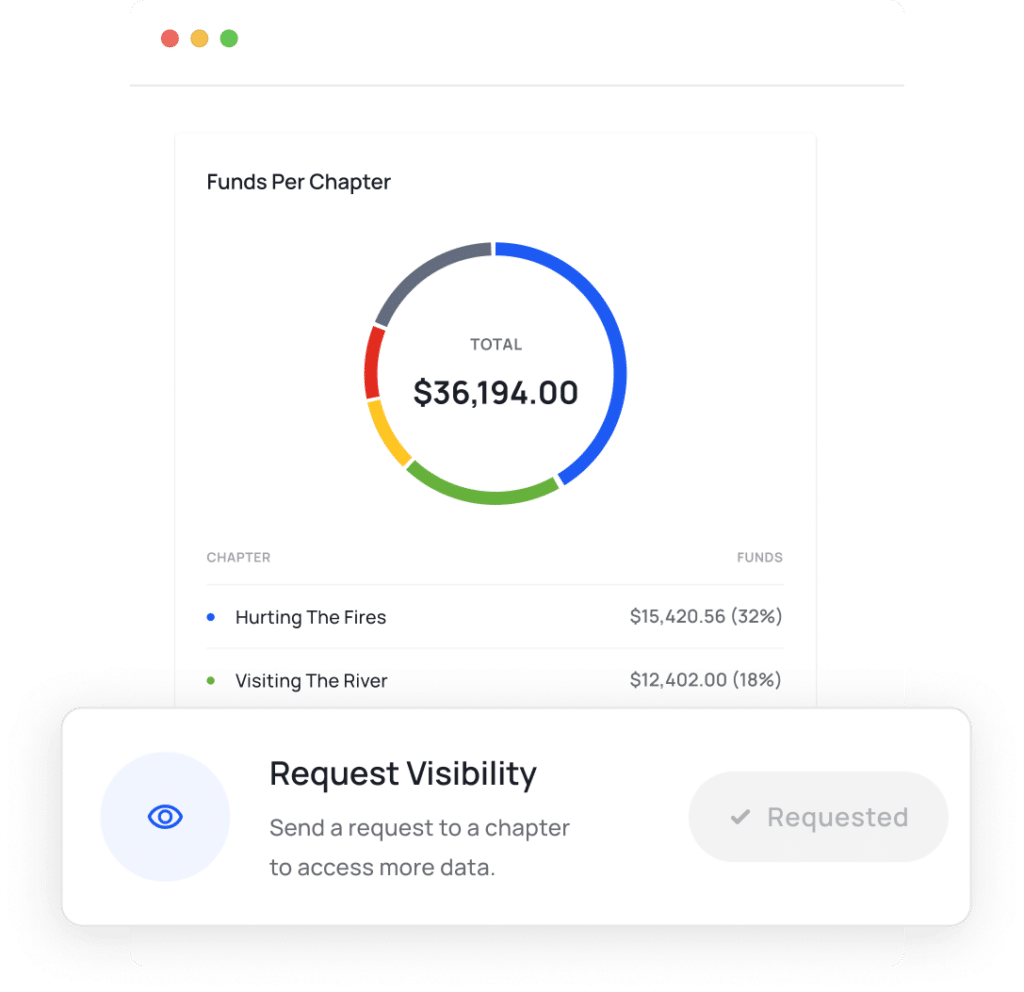

- Valuable chapter insights with customizable transparency.

- Free & instant fund transfers between HQ & chapters.

insights

Get full visibility into all your chapters in one place

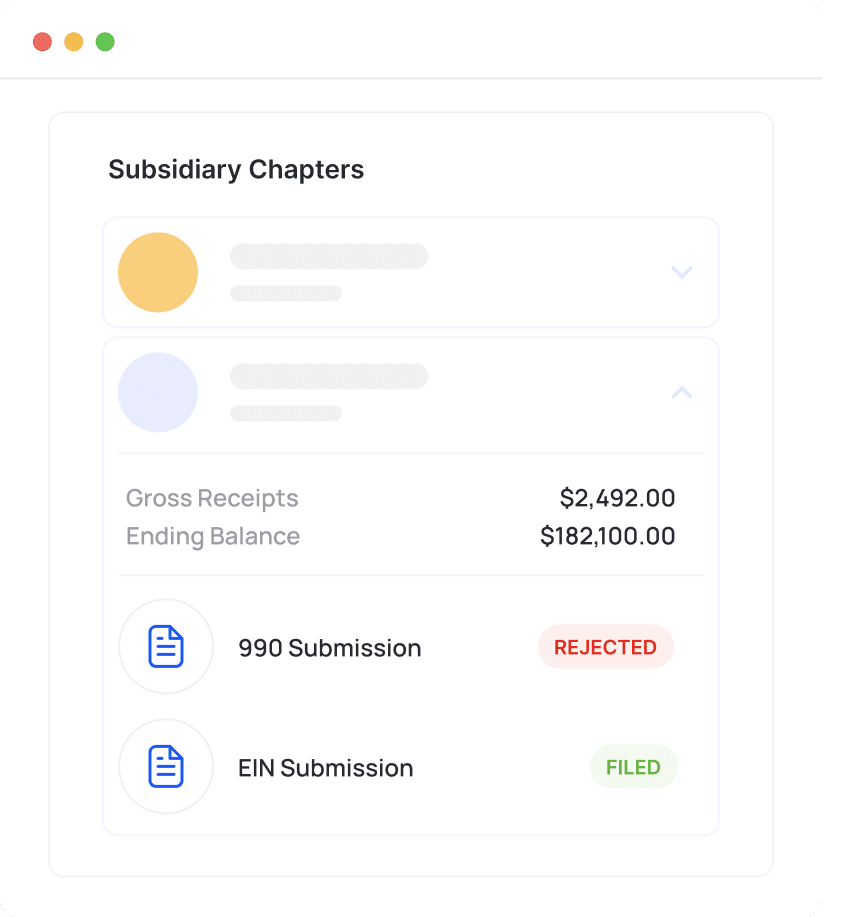

- Easily track crucial information on your subsidiary chapters.

- Oversee each chapter's tax filing status.

- Track which chapters are in good standing.

- Get notified about overdue chapter officer handovers.

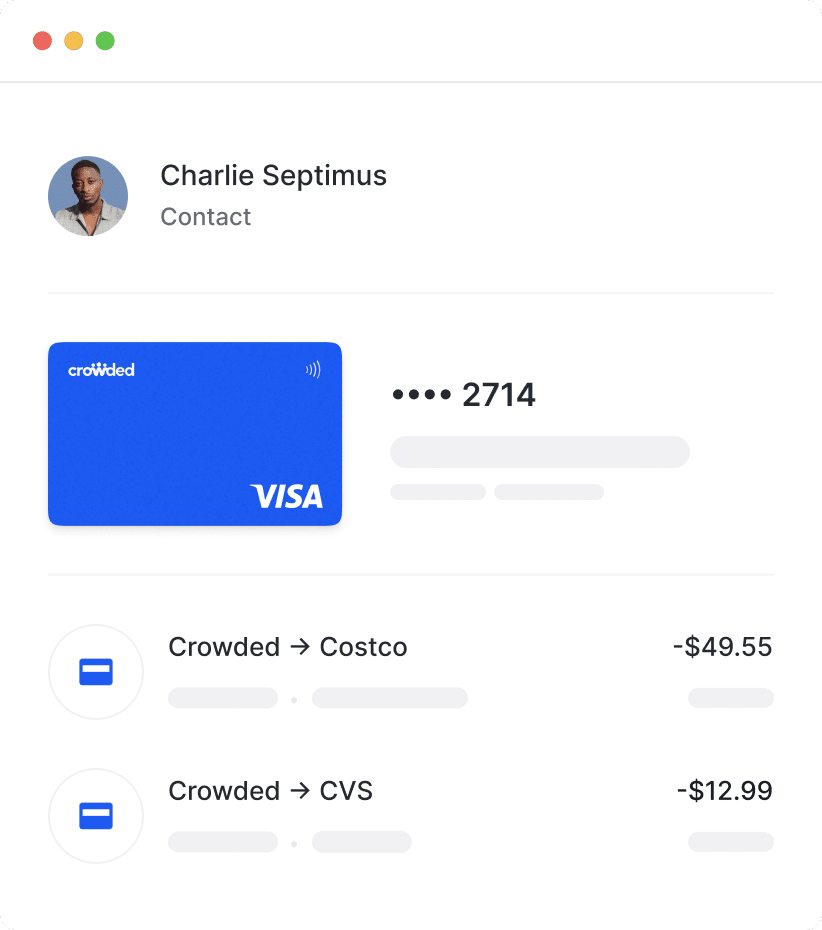

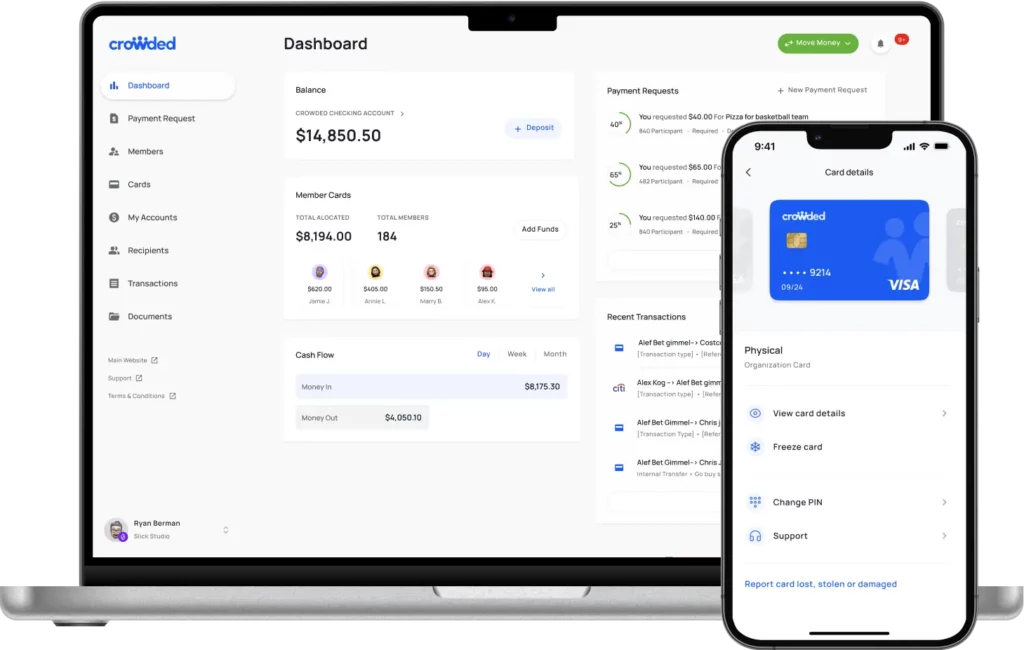

Issue spending Cards

Make spending easy with budgeted debit cards

- Issue digital & physical Visa® debit cards to your contacts.

- Delegate expenses while keeping total visibility & control.

- Set budget limits, redeem funds, and freeze cards at any time.

Why groups love using Crowded

“We only see benefits for our alumnae chapters who create a Crowded account. It gives the chapters freedom to manage their funds in a flexible way. That’s why we continue to say – Crowded is our financial management solution and we want more alumnae chapters to be utilizing it.”

Laura, Assistant Director of Lifetime Engagement, Alpha Chi Omega

“We were so glad to find a platform that allows us to support our chapters, and give them independence. There are complications managing an association partially comprised of volunteers who aren’t experienced with digital banking, but Crowded’s platform is so user-friendly that it was easily adopted across the organization.”

Abigail, Director of Chapters & Leadership, ANFP

“Since our guys are young volunteers gaining experience, it’s awesome to partner with a company that has tools to fit their needs. Things like transition assistance between officers or digital cards (the physical frat card always goes missing!) keep our guys focused on their mission and not bogged down administratively”

Turner, Director Of Administrative Services, Delta Kappa Epsilon

“It was great to have one place to pay international staff as well as reimburse other staff members when needed. We were able to drastically reduce the amount of petty cash we kept on site because we were able easily transfer money to staff when needed.”

Scott, Director of Operations, Camps Airy and Louise

“Crowded has given our fraternity the ability to develop financial strategies from the local to the national level. By partnering with Crowded on both the national and chapter level, we have not only achieved annual savings of approximately $10k but also experienced a reduction in reporting time by over 40 hours annually.”

Anthony, International Grand Treasurer, Iota Phi Theta

“As PIKE transitioned from a ‘bank-less’ member billing solution to one that required a bank, Crowded was the missing piece to the puzzle. With seamless officer transitions, digital debit cards, and fantastic customer support, it was a no-brainer!”

Blaine, Director of Finance & Insurance, Pi Kappa Alpha Fraternity

“We needed a mainstream way to collect dues, as Venmo stopped supporting group accounts. We also liked the feature of allocating funds to team members’ virtual cards.”

Kaegon, President, Carolina Health Samaritan Society

Trusted by 1,000+ groups nationwide

The Association of Nutrition & Foodservice Professionals

National banking partner

Clemson University

Banking partner to student clubs

University of Arizona

Banking partner to student clubs

Omega Delta Phi

Official banking partner across 40+ chapters

Lambda Sigma Gamma

Official banking partner serving all active chapters

Lambda Alpha Upsilon

Official banking partner serving undergrad and alumnae chapters

Camp La Llanda

Official banking partner for camps across the south and southwest

Alpha Chi National College Honor Society

Official banking partner serving 400 chapters

Alpha Chi Omega

Official banking partner serving alumnae chapters

Iota Phi Theta

Official banking partner serving 300+ chapters.

Pi Kappa Alpha

Official banking partner serving 500 chapters.

Phi Kappa Sigma

Official banking partner serving 50 chapters.

Delta Kappa Epsilon

Official banking partner serving 56 chapters.

answered.

Want to chat? Contact us.

Crowded is a financial platform that offers membership groups easy ways to collect, spend and manage money online.

Some of our standout features include:

- Accounts that are free to open with no minimum balances & funds that are FDIC-insured up to $250,000.

- One-click online officer handovers.

- Digital Visa® debit cards with budget limits for group member expenses.

- Unified banking for multi-chapter organizations.

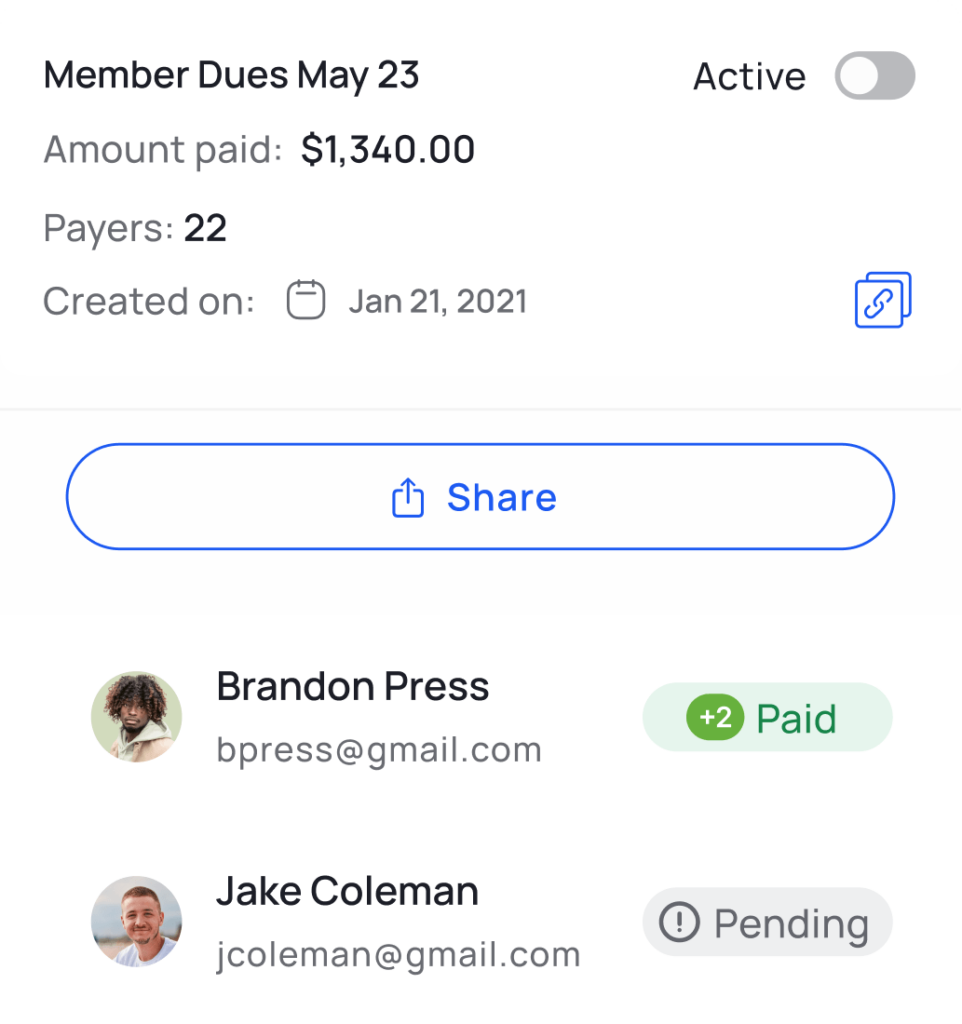

- Payment collection links for dues, member fees and donations.

To set up a Crowded account for your group in minutes, create a free account online or book a demo with one of our team members for any questions or additional support.

Our platform truly covers it all.

With Crowded, you can avoid constantly transferring funds between payment apps and banks to access your group’s money. Utilizing embedded finances, Crowded enables your group to bank, collect, and spend with just one platform.

We charge little to no fees.

When collecting funds through Crowded, you’ll have the flexibility to decide whether to cover processing fees or let your payers handle them. When we do charge fees, they are fair and competitive with industry standards.

Crowded is a financial platform that offers multi-chapter 501(c)(6) easy ways to collect, spend and manage money online.

Specifically for multi chapter organizations, Crowded’s banking dashboard allows the national/regional level to maintain oversight over their subsidiary chapters’ finances.

Instead of each of their subsidiaries maintaining separate bank accounts that the national level has no access to, with Crowded each chapter is organized under the main organization. This is better for 2 reasons:

- In the case of a defunct chapter or botched officer handover, the national level can step in easily through the Crowded platform.

- Maintaining chapters under a single address makes compliance with IRS group exemption guidelines much easier.

- Comprehensive support for group exemptions

- Recovery of off-course chapter accounts

- Tailored tax exemption application assistance for each chapter

- Annual Form 990 filings

- EIN setup and ongoing management for individual chapters

- Expertise in nonprofit incorporation.

- Create your account.

- Onboard your chapters.

- Consolidate your financial management!

Let’s chat!

Darryl Gecelter