Our mission

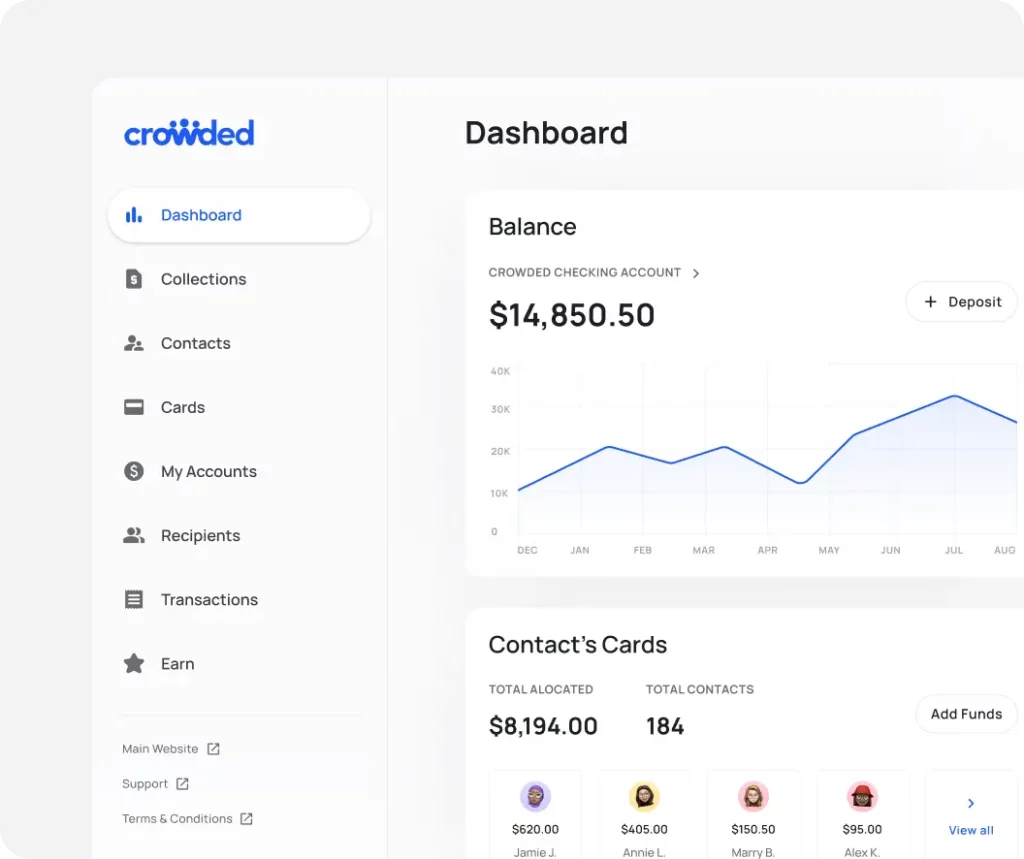

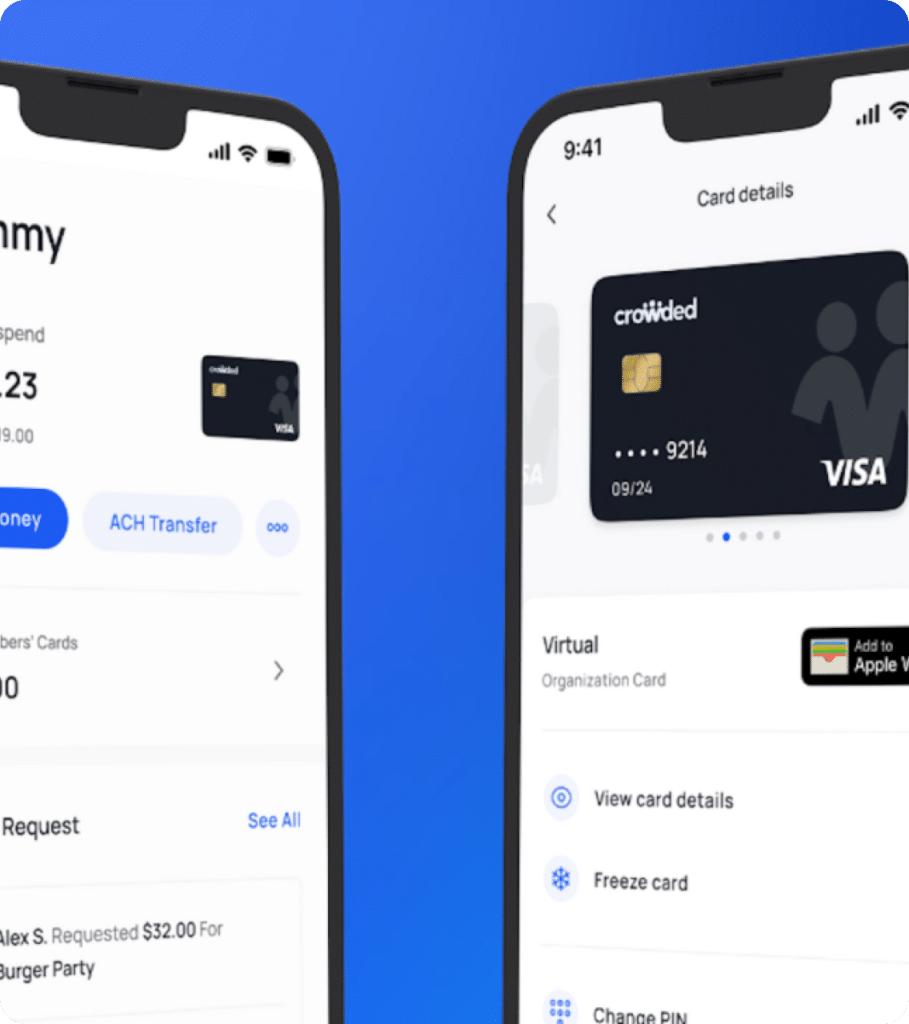

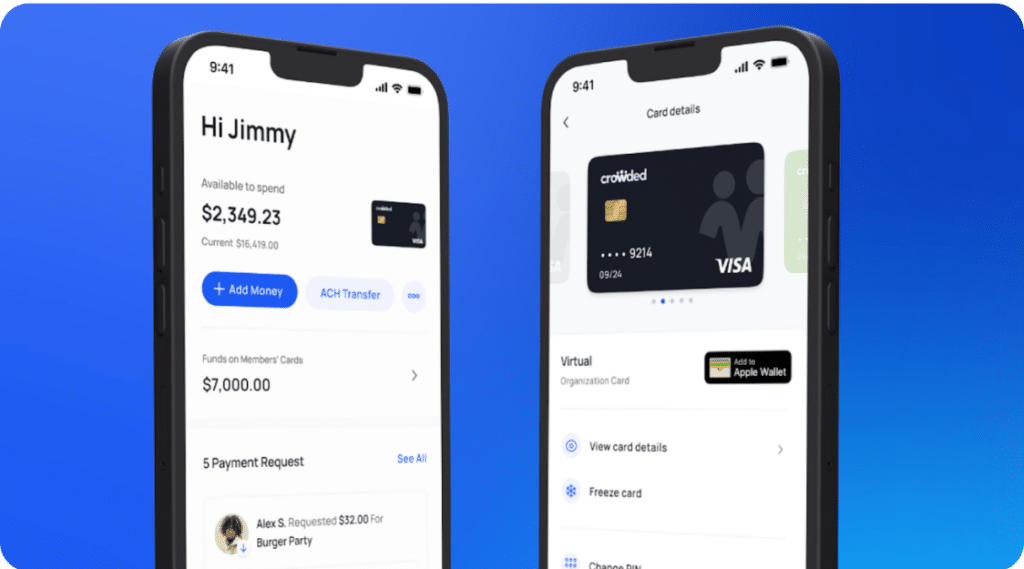

We believe that nonprofits deserve modern banking tools that meet their needs. That’s why we’re building a range of flexible and affordable banking* solutions designed specifically for nonprofits. We offer customizable account structures and online banking* services to make managing finances easy and stress-free for nonprofits.