fundraisers

Say hello to built-in financial management for fundraising, from easy donation collection to a dedicated charity bank account* to spend and store donated funds.

fundraising page

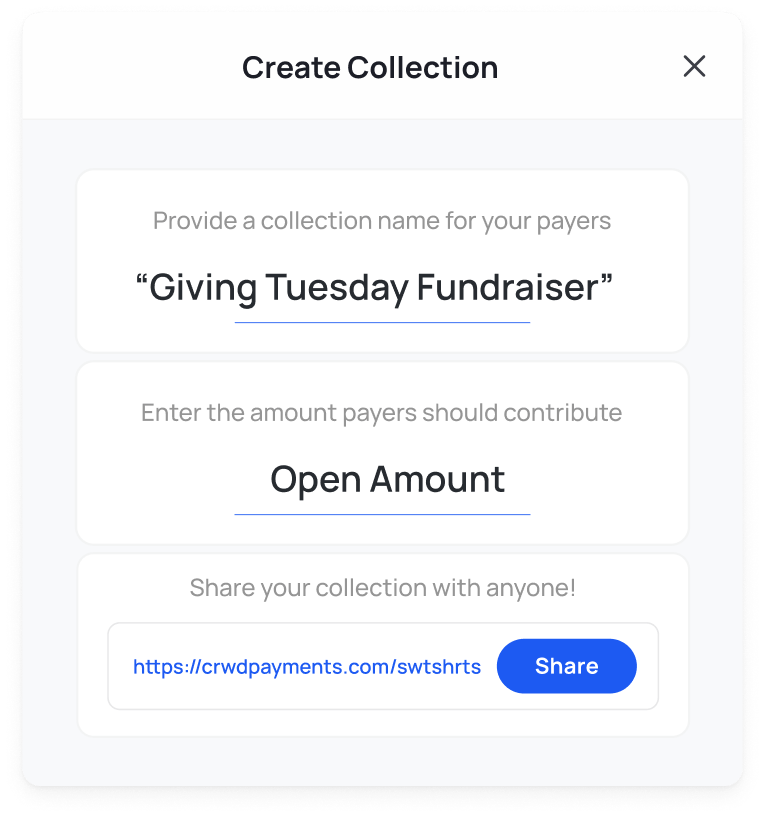

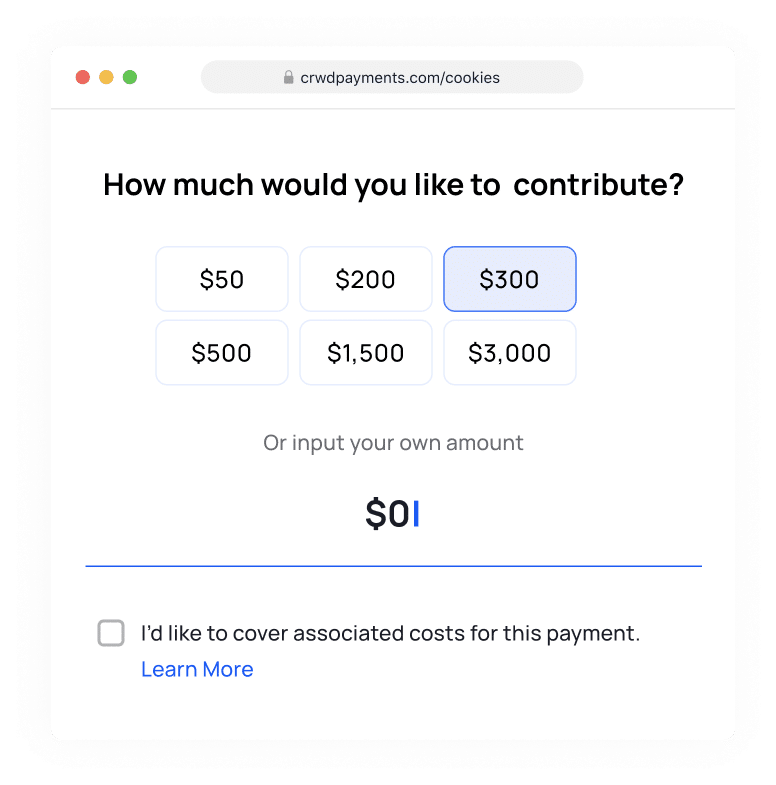

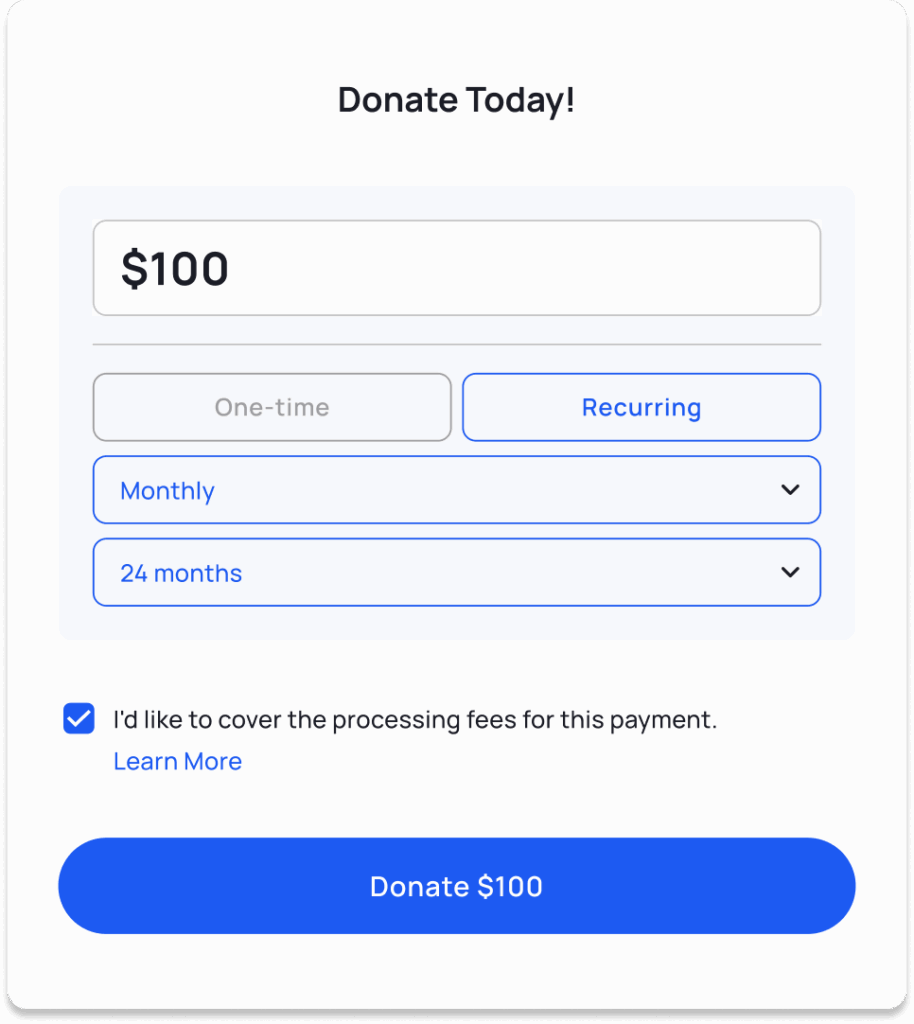

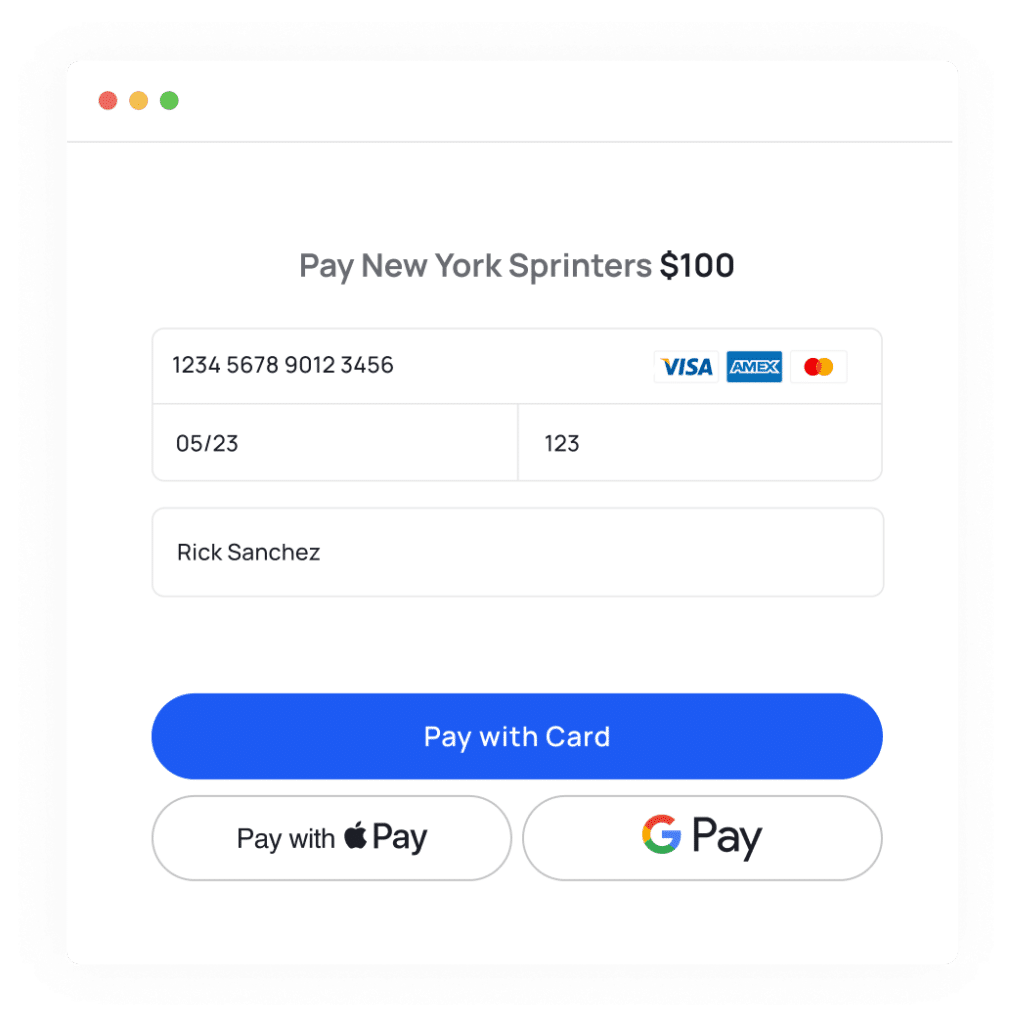

collect donations

Recurring Donations

share with your community

Embed a Collection with a Widget

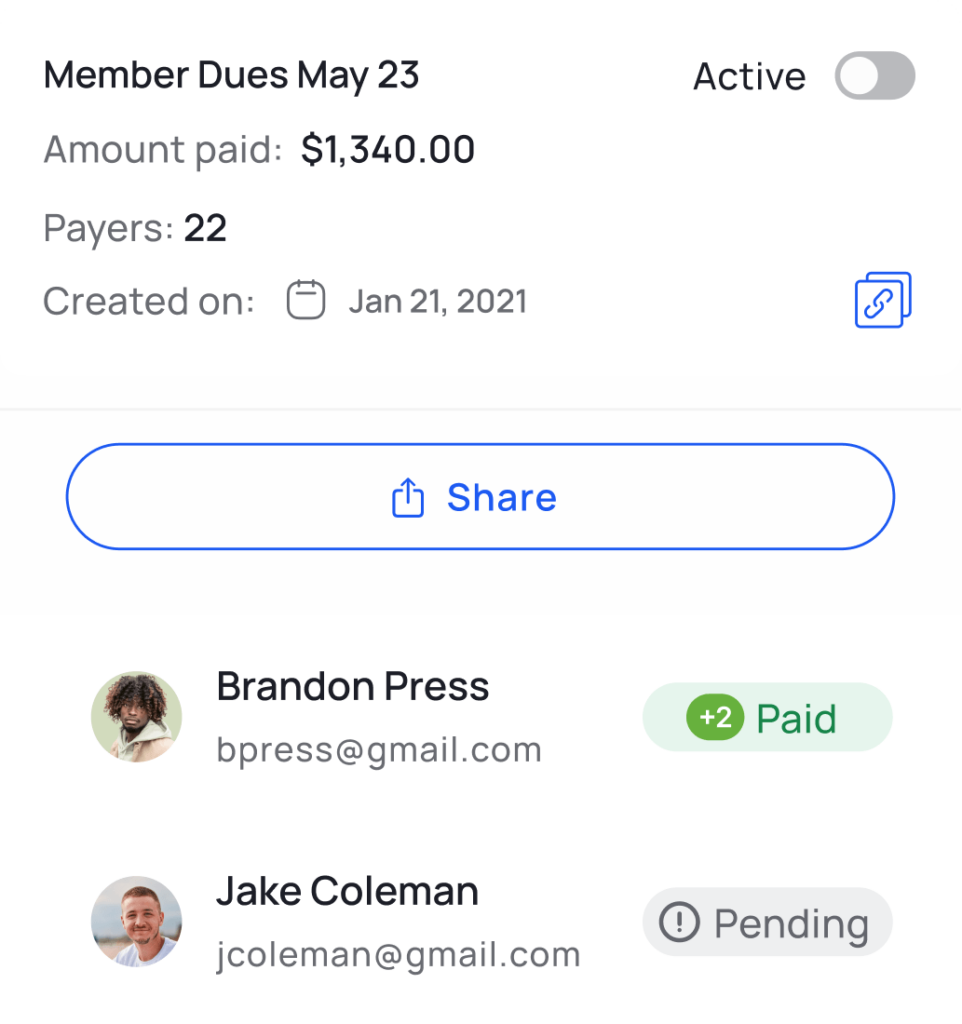

Tracking donation payments

Mobile point-of-sale

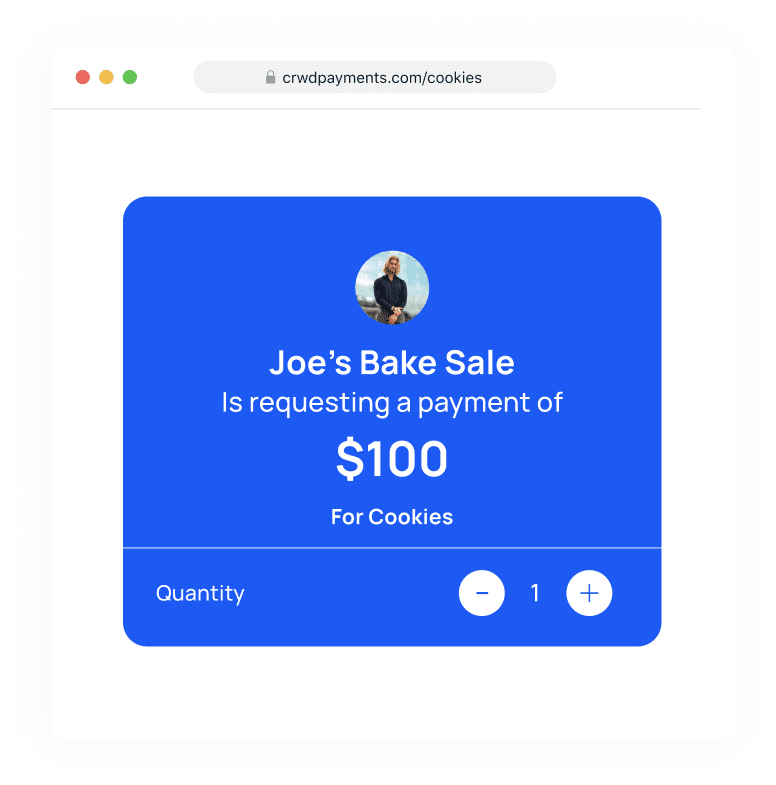

buy multiples

Want to learn more? View All

Looking for creative raffle basket ideas to boost your next nonprofit fundraiser? From “Wine & Cheese Night” to “Tech Treats,” explore 25 themed baskets proven to attract donors and drive revenue. Plus, learn how Crowded’s digital tools simplify ticket sales, fund tracking, and reporting—so you can focus on fundraising, not spreadsheets.

Sponsorship packages are essential tools for attracting and retaining nonprofit partners. Learn how to craft compelling tiers that showcase value, align with your mission, and drive long-term support. Download our free, editable template to get started today.

Looking for a low-effort, high-impact way to keep your campaign energy up? A goal thermometer is more than just a chart—it’s a proven tool to drive urgency, boost donor engagement, and visually track progress in real time. Whether you're hosting an event, launching a year-end appeal, or running a grassroots campaign, this guide shows you how to use a fundraising thermometer to inspire giving, keep your team aligned, and rally your community. Plus, grab a free printable goal thermometer template and learn how to pair it with Crowded to track donations effortlessly and accurately.

Want to chat? Contact us.

Crowded is a financial platform that offers nonprofit groups an easy way to collect, spend and manage money online.

With Crowded, you can avoid constantly transferring funds between payment apps and banks to access your charity’s money. Utilizing embedded finances, Crowded enables you to bank*, collect, and spend with just one platform.

We charge little to no fees.

When collecting funds through Crowded, you’ll have the flexibility to decide whether to cover processing fees or let your payers handle them. When we do charge fees, they are fair and competitive with industry standards.

With collecting with Crowded, you can avoid constantly transferring funds between payment apps and banks to access your group’s money. Crowded gets it all done in one platform.

Crowded accounts are free to set up – we have no minimum balances or subscription fees.

What do we charge for?

When processing payments, we charge 2.99%, min of 60¢ of the collection amount if paid by card and $5 for ACH payments.

You can always choose whether you want to cover these fees or ask your payers to handle them.

View our full fee schedule here.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by TransPecos Banks, SSB; Member FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by TransPecos Banks, SSB; Member FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

To provide the best experiences, we use technologies like cookies to store and/or access device information as specified in our Privacy Policy. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.