Discover 22 creative fundraising ideas to help your club maximize impact and engage the community. From unique events like pet parades to innovative services like pet sitting, these ideas will inspire excitement and support. Plus, learn how to streamline fundraising with tools like the Crowded app to make managing funds easier than ever.

nonprofit banking

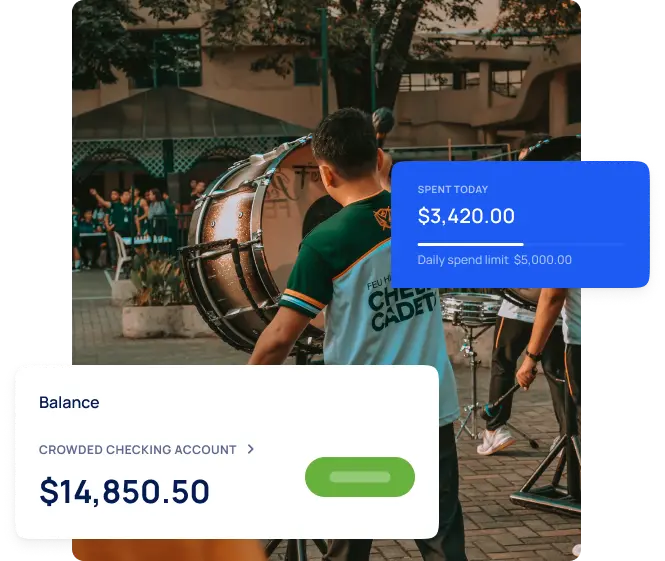

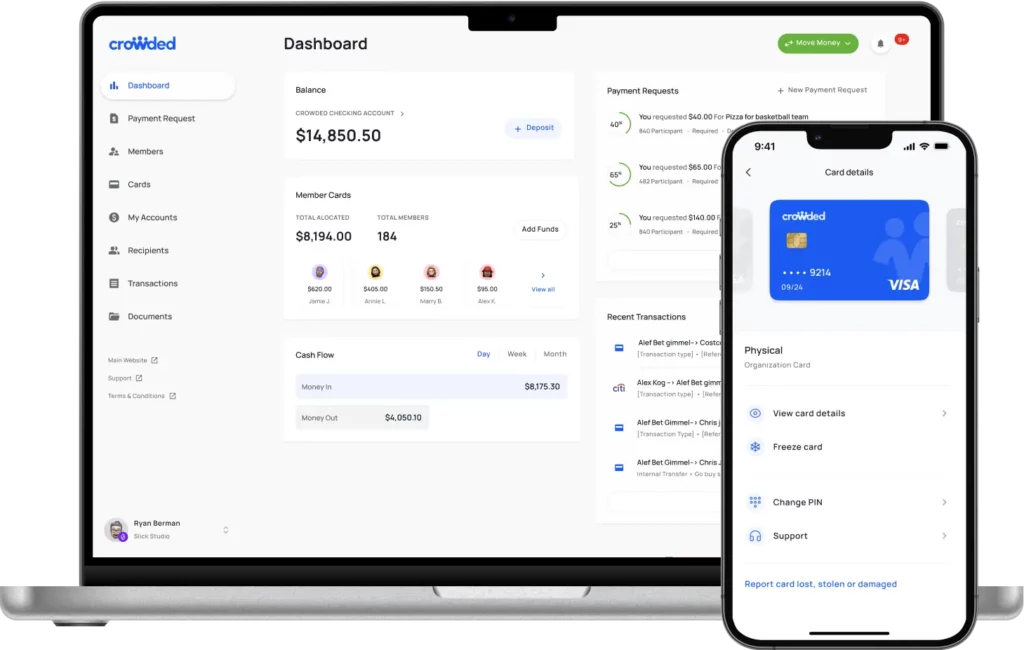

Banking* thats tailored for Booster clubs

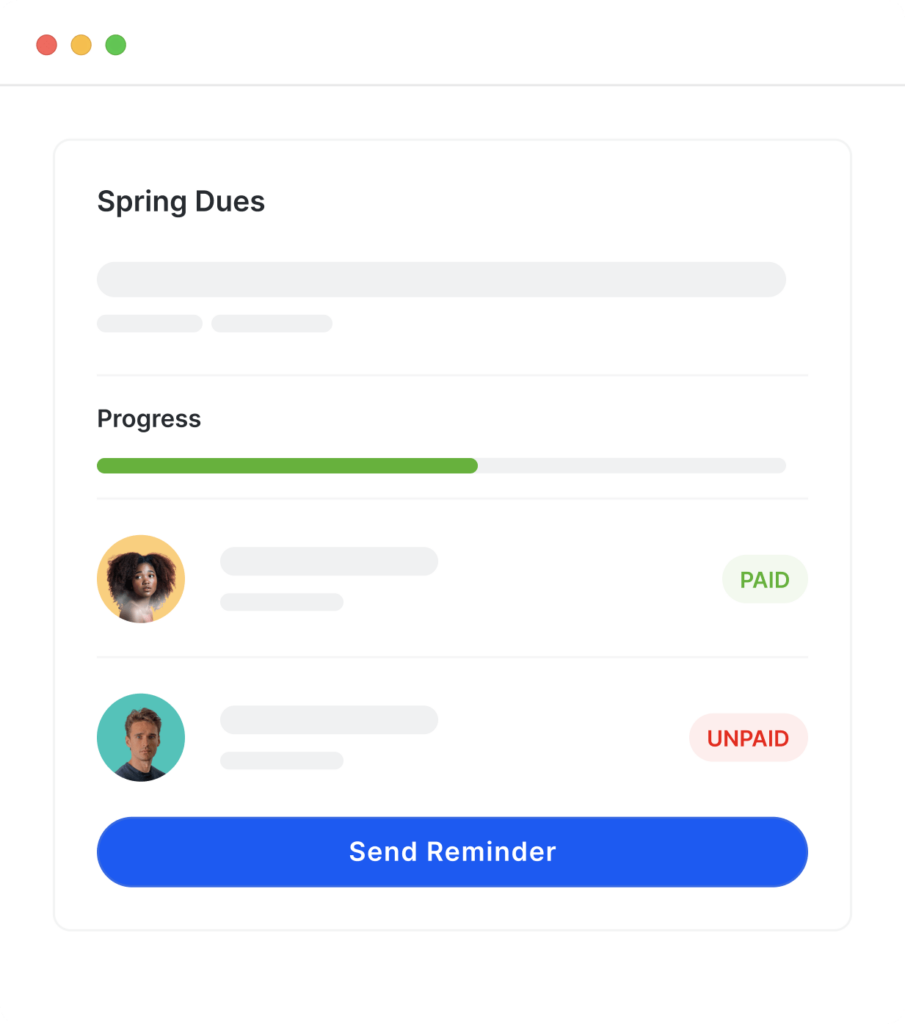

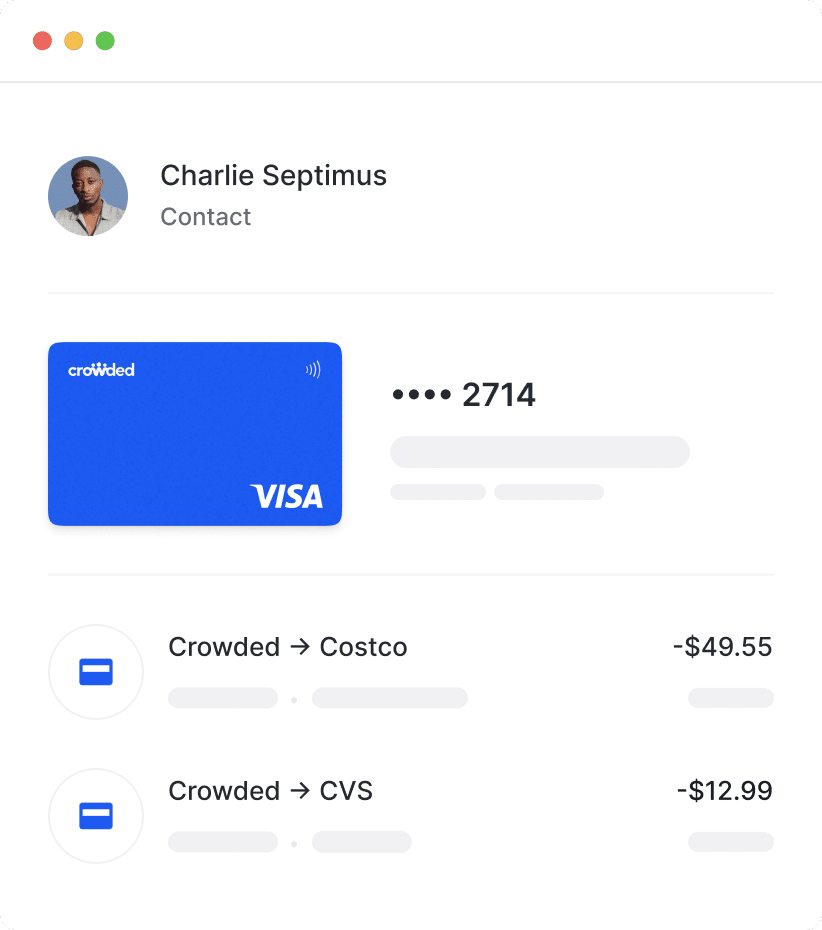

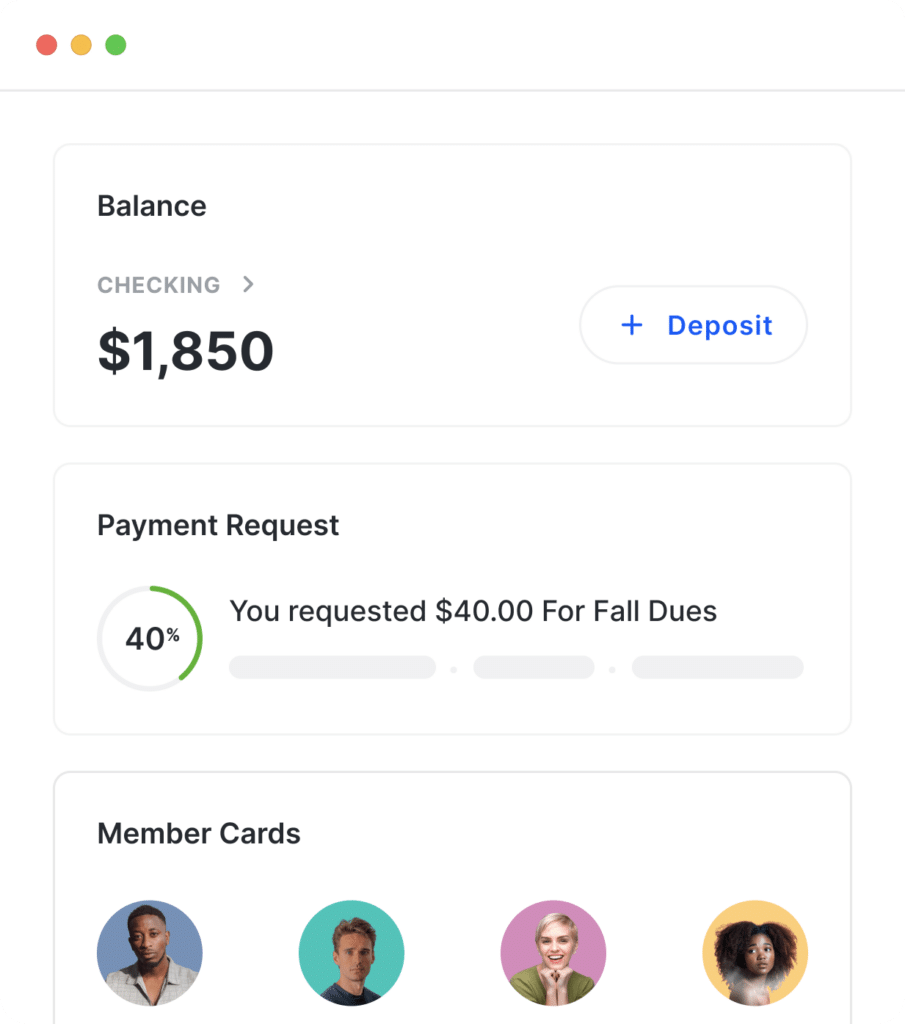

- Manage all of your banking digitally - from sign up to officer handover

- User-friendly banking dashboard.

- Easy officer handovers & account management.