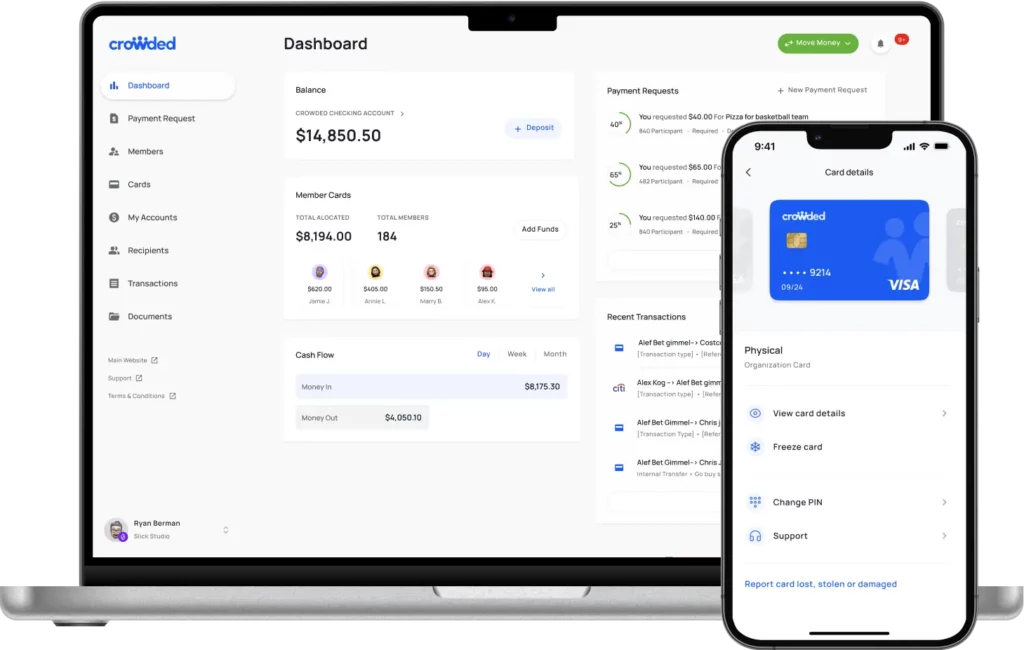

Crowded is a financial platform that offers multi chapter membership groups easy ways to collect, spend and manage money online.

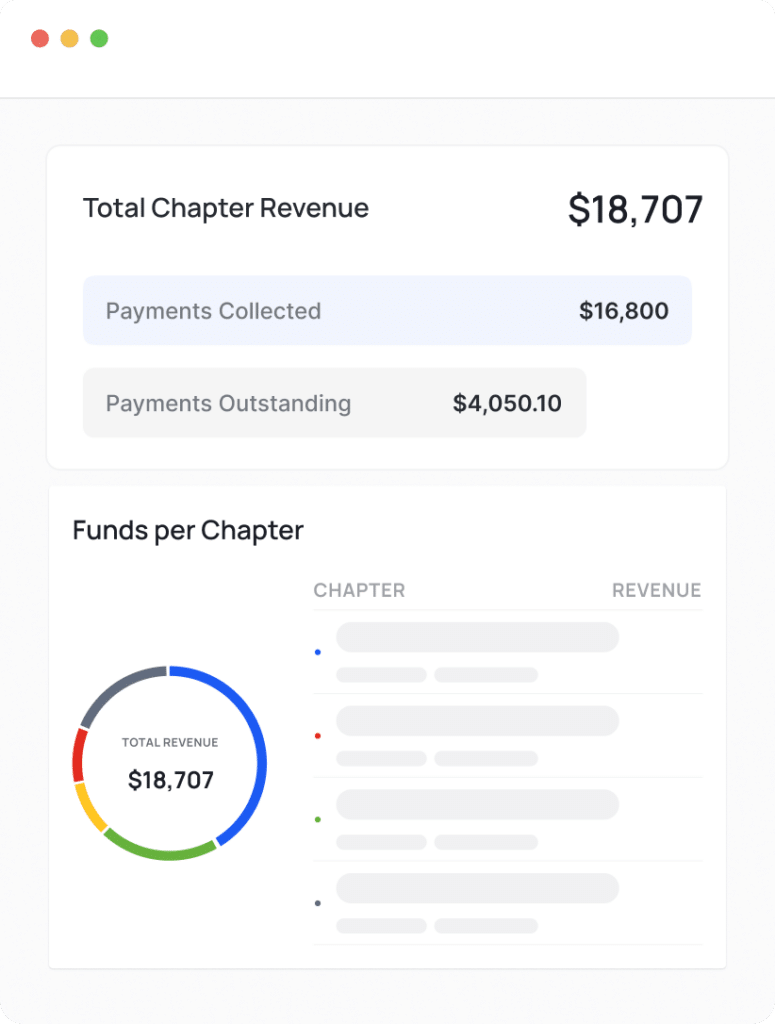

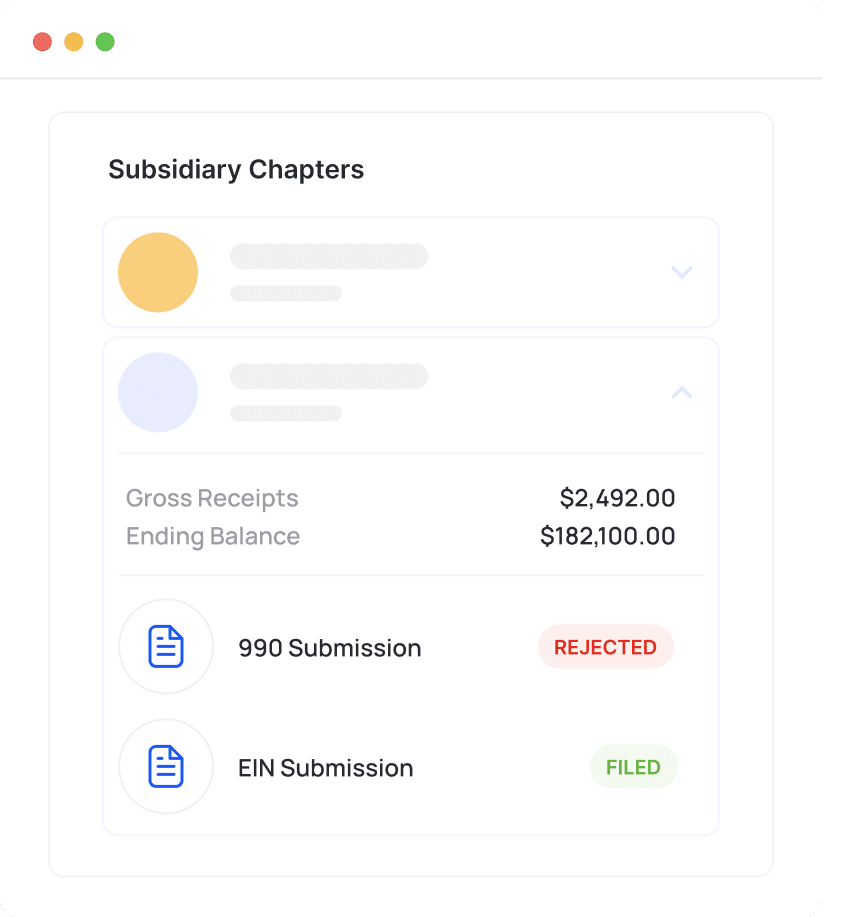

Specifically for multi chapter organizations, Crowded’s banking dashboard allows the national/regional level to maintain oversight over their subsidiary chapters’ finances.

Instead of each of their subsidiaries maintaining separate bank accounts that the national level has no access to, with Crowded each chapter is organized under the main organization. This is better for 2 reasons:

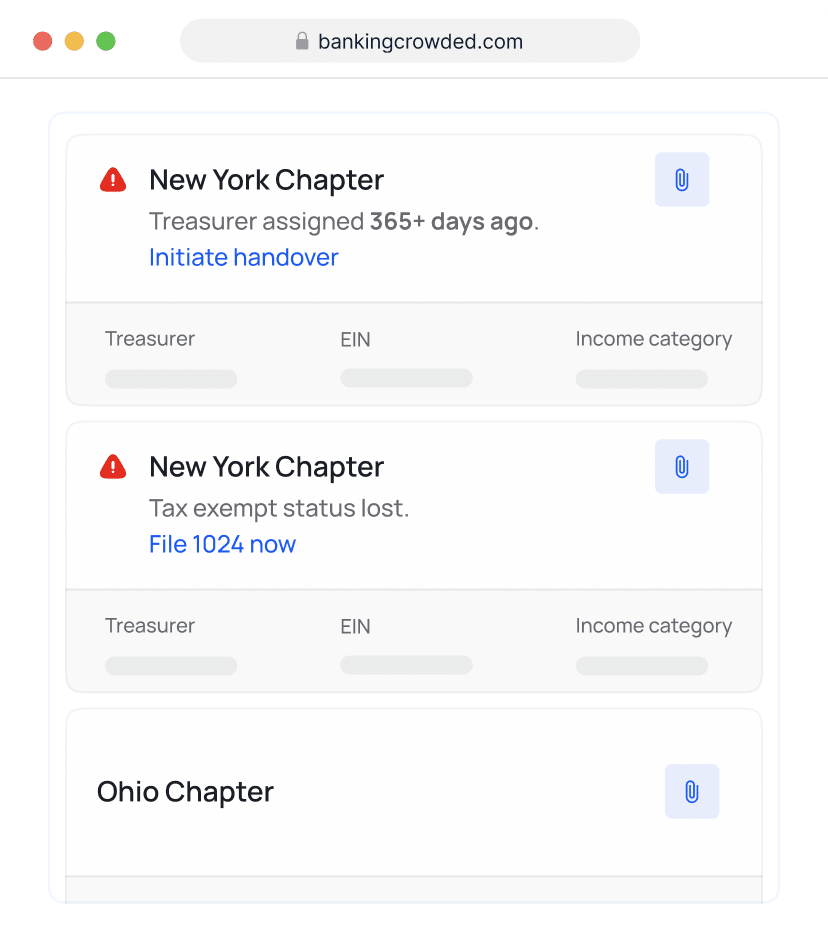

- In the case of a defunct chapter or botched officer handover, the national level can step in easily through the Crowded platform.

- Maintaining chapters under a single address makes compliance with IRS group exemption guidelines much easier.

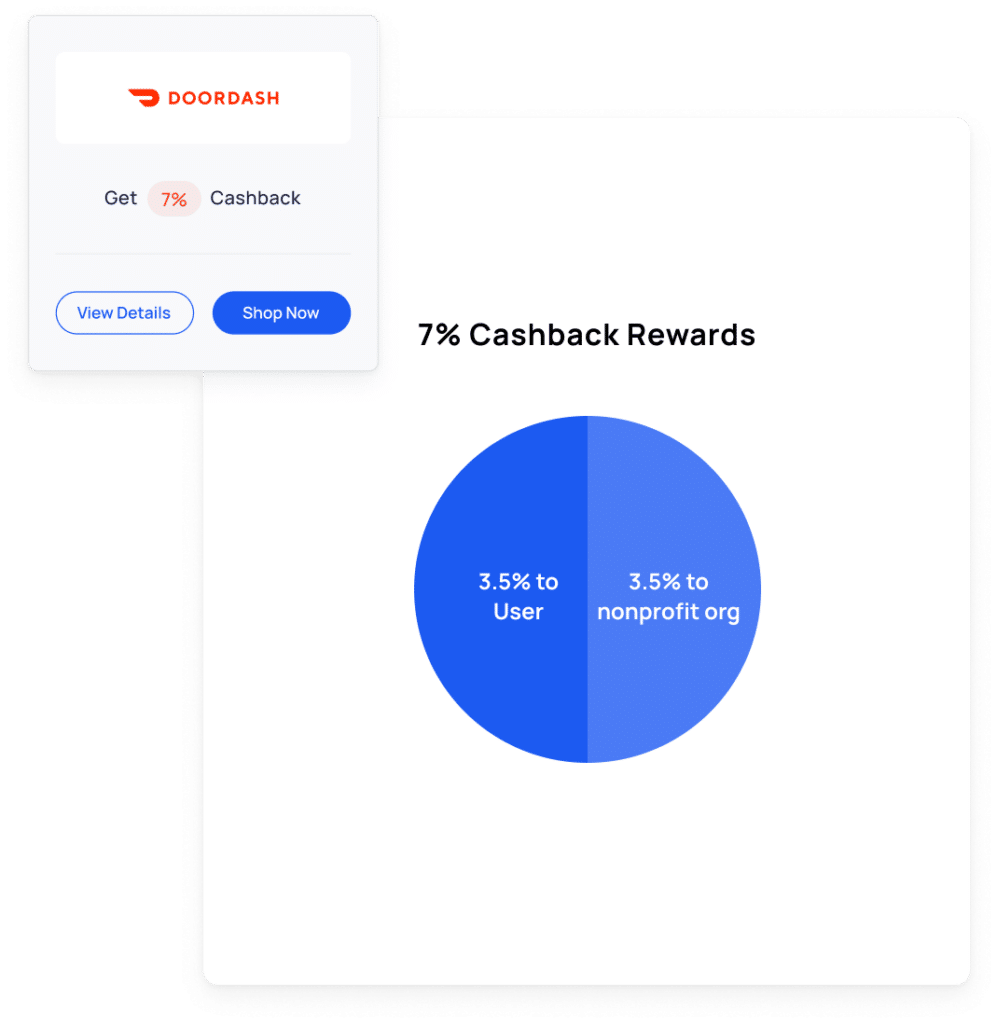

Organizations can also raise extra funds through Crowded Rewards, where their supporters donate with ever purchase.