what to use Crowded for?

Stay organized - create a collection for all reunion expenses

- Food and drinks 🌭

- Trips and add-ons 🎭

- Fundraisers 🎟️

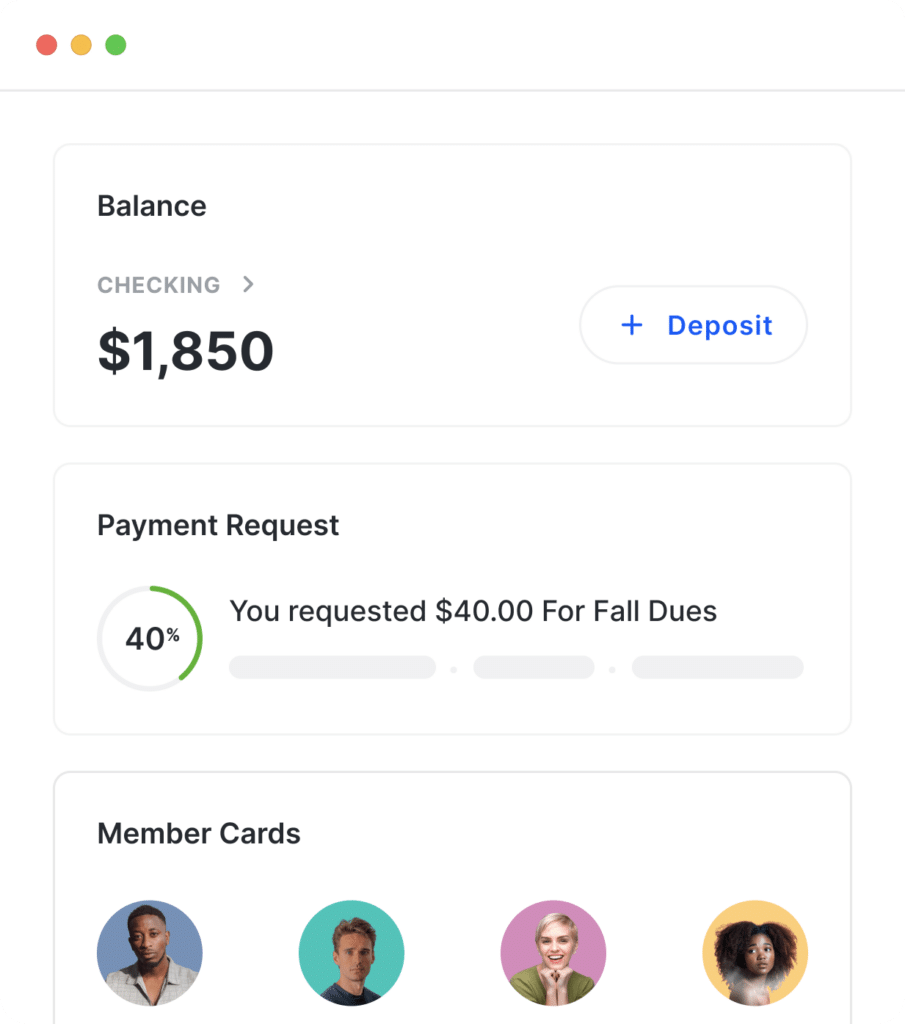

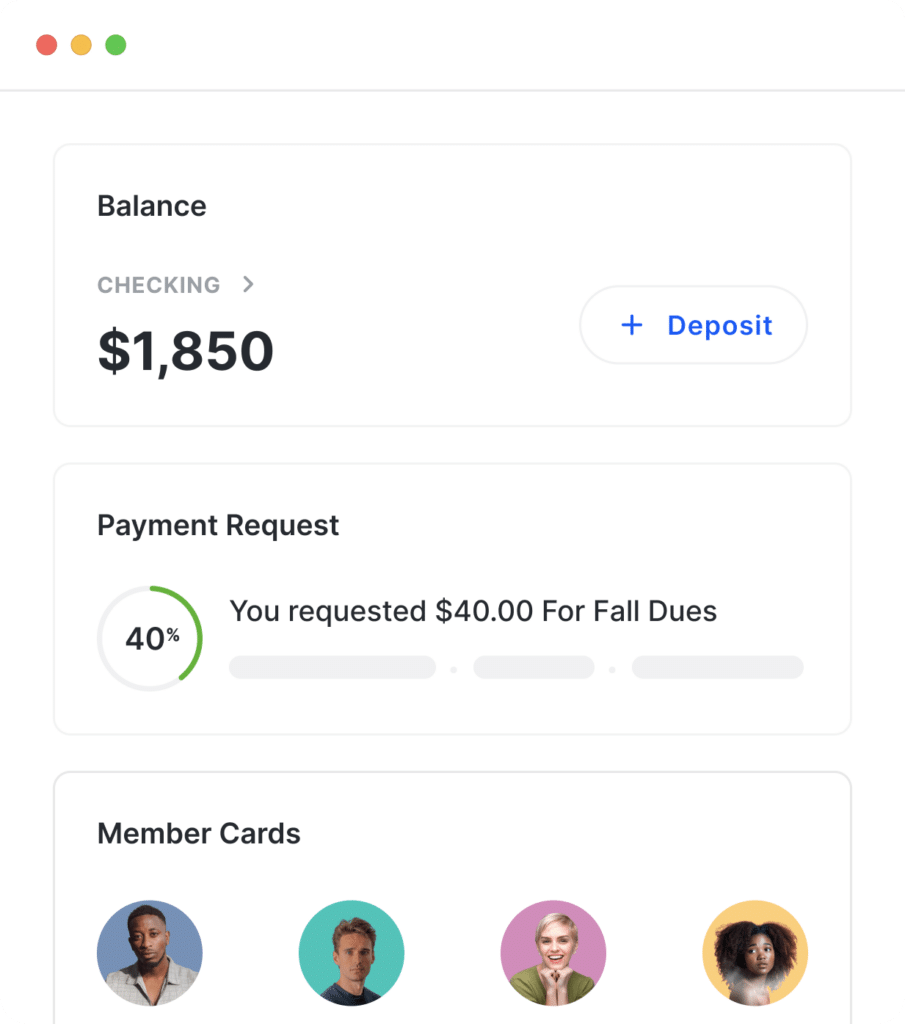

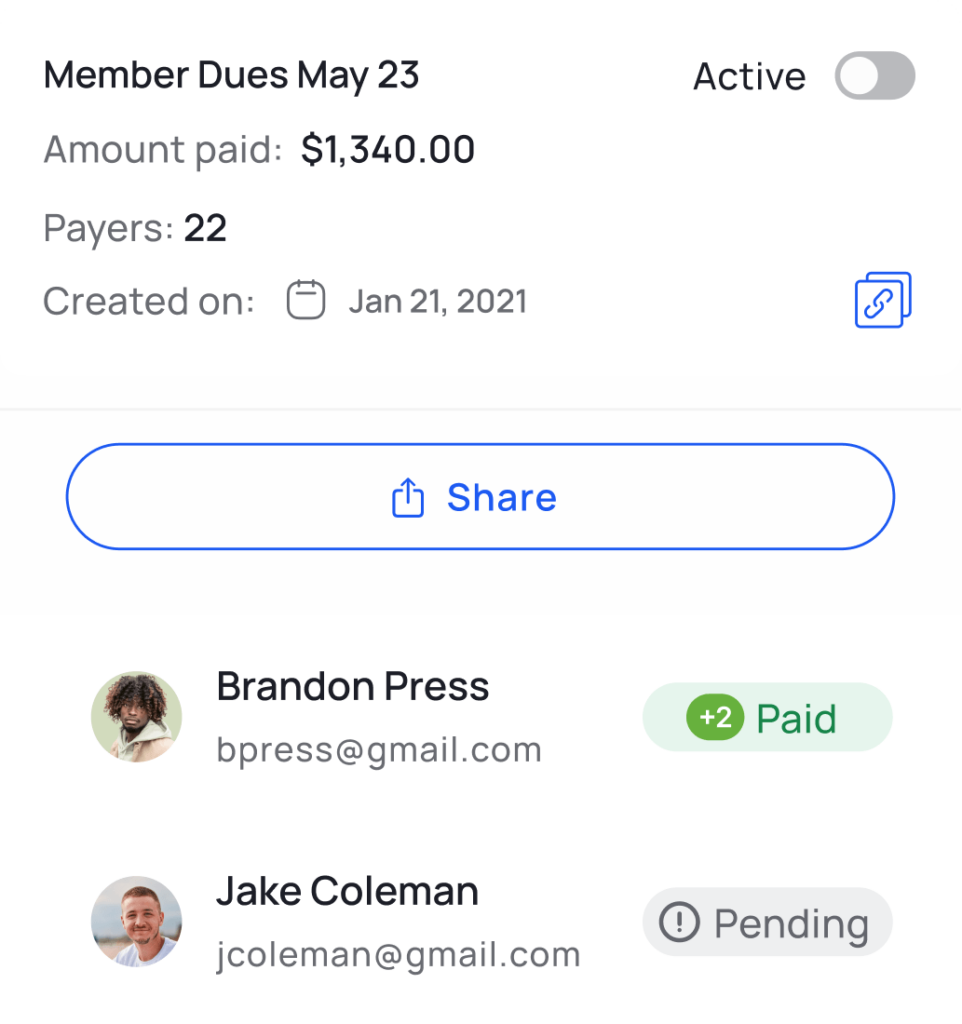

Manage dues, donations,

events & more

Manage dues, donations,

events & more

Manage spending with digital

debit cards

Set up a passive fundraising

program for consistent donations.

Stay compliant with tax regulations

reunions

Say hello to effortless financial management for your reunion, from easy payment collection and budgeted debit cards to modern banking* tools.

what to use Crowded for?

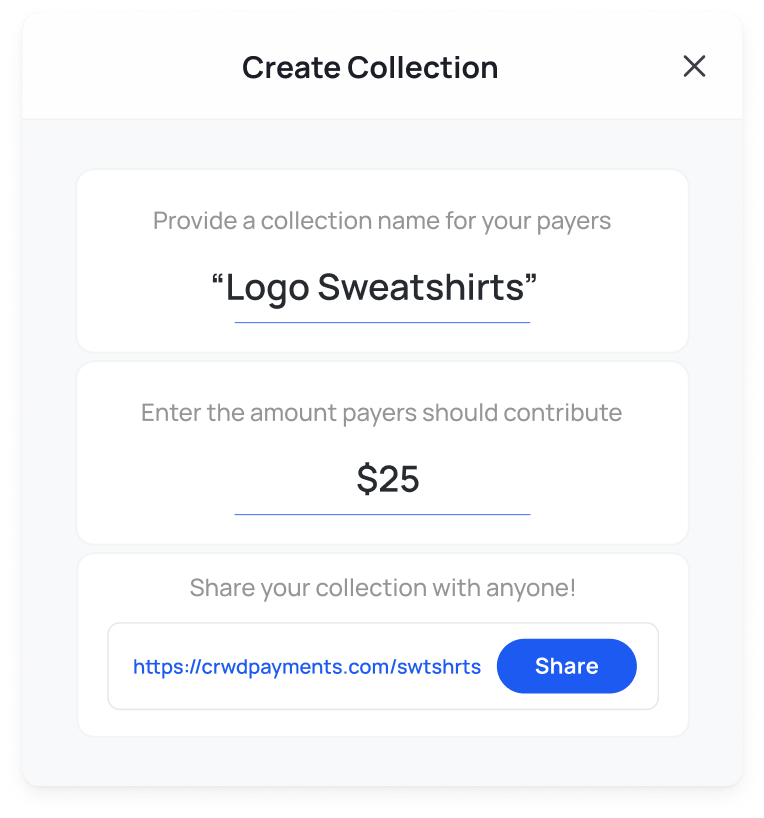

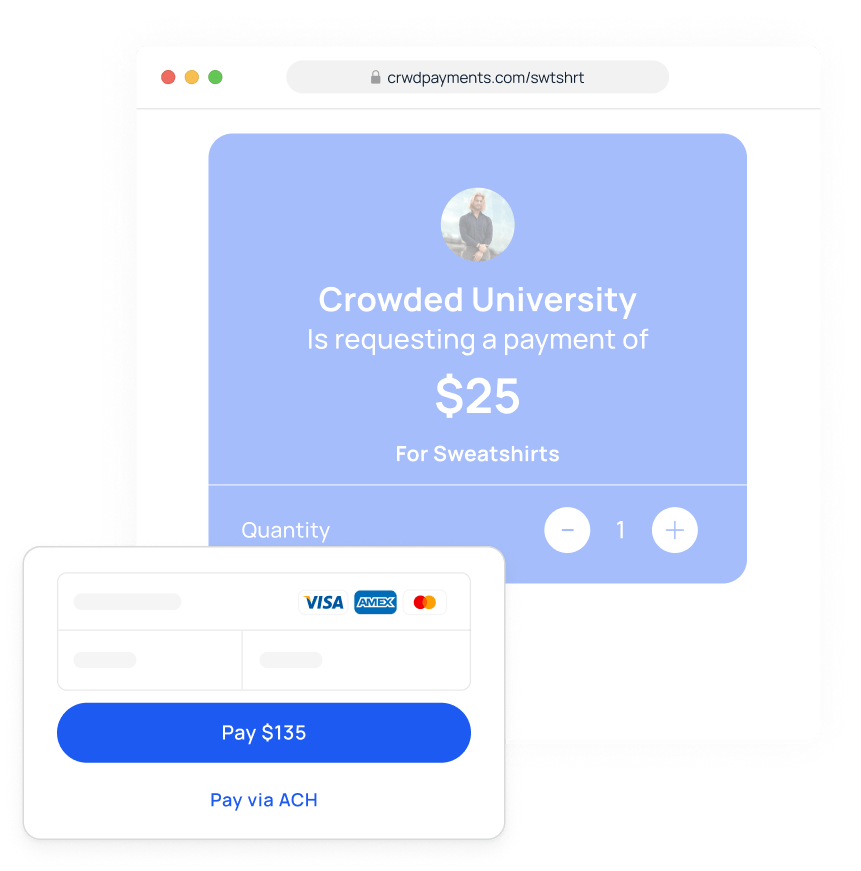

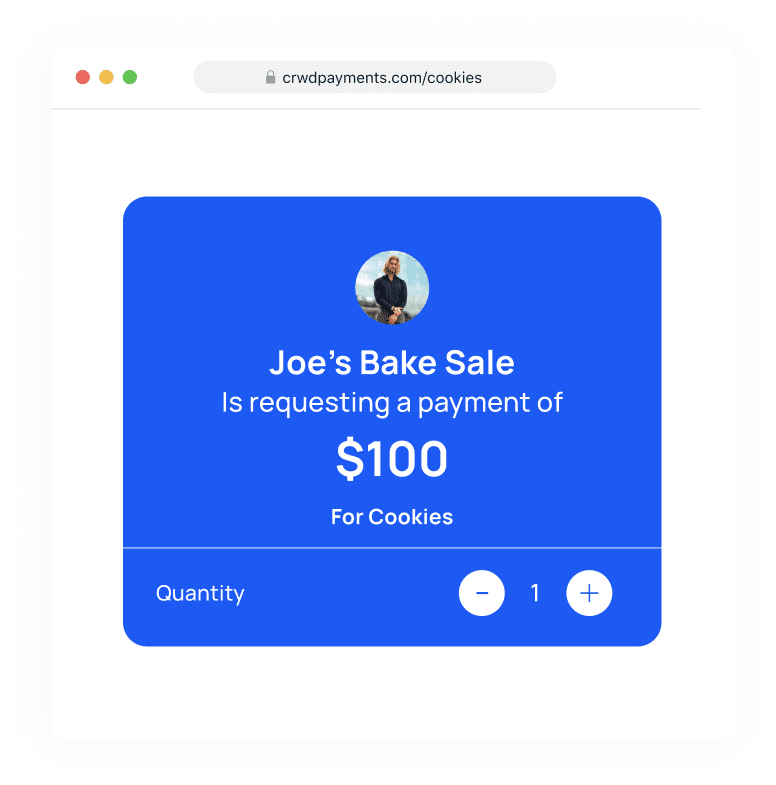

Collection links

Mobile point-of-sale

share with your community

pay for multiples

Tracking reunion payments

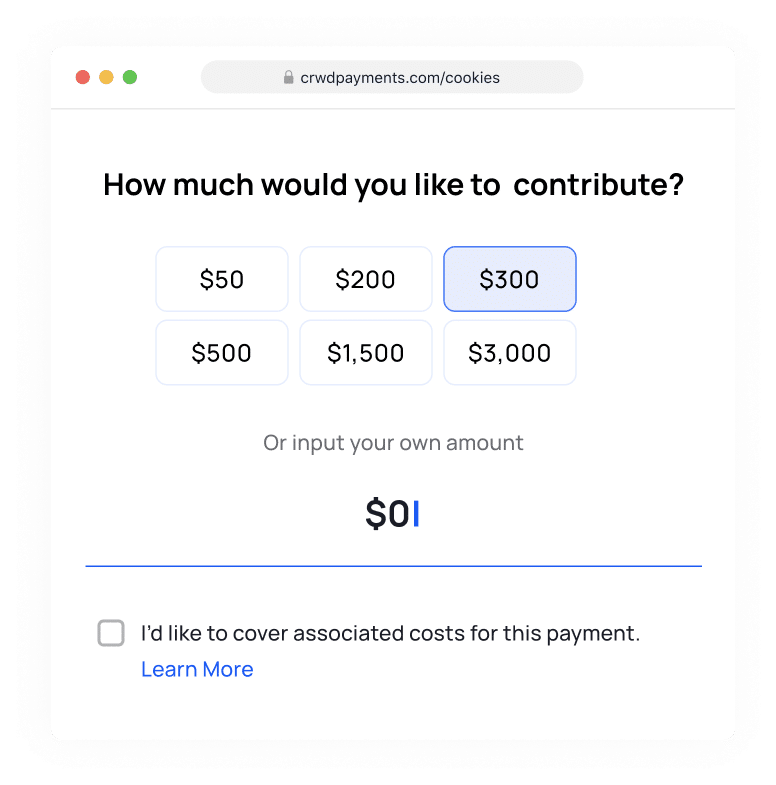

collect donations

Warminster, PA

National banking partner

Banking partner to student clubs

Banking partner to student clubs

Dallas, Texas

Official banking partner across 40+ chapters

New York, New York

Rochester, New York

Official banking partner serving all active chapters

Official banking partner serving undergrad and alumnae chapters

Official banking partner for camps across the south and southwest

Official banking partner serving 400 chapters

Official banking partner serving alumnae chapters

Official banking partner serving 300+ chapters.

Official banking partner serving 500 chapters.

University of North Carolina

Official banking partner serving 50 chapters.

Official banking partner serving 56 chapters.

Northwestern University

Want to chat? Contact us.

Crowded is a financial platform that offers nonprofit groups an easy way to collect, spend and manage money online.

With Crowded, you can avoid constantly transferring funds between payment apps and banks to access your reunion’s money. Utilizing embedded finances, Crowded enables you to bank, collect, and spend with just one platform.

We charge little to no fees.

When collecting funds through Crowded, you’ll have the flexibility to decide whether to cover processing fees or let your payers handle them. When we do charge fees, they are fair and competitive with industry standards.

Venmo & Paypal? Great for friends, not for your reunion. Here’s why Crowded is the better app for collecting dues & for events:

Crowded accounts are free to set up – we have no minimum balances or subscription fees.

What do we charge for?

When collecting payments, we charge 2.99% of the collection amount if paid by card and the the lesser of 2.99% or $5 for ACH payments.

You can always choose whether you want to cover these fees or ask your payers to handle them.

View our full fee schedule here.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by Blue Ridge Bank, N.A. and TransPecos Banks, SSB; Members FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by Blue Ridge Bank, N.A. and TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by TransPecos Banks, SSB; Member FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

To provide the best experiences, we use technologies like cookies to store and/or access device information as specified in our Privacy Policy. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.