While Venmo may seem like the obvious choice for payment and donation collection due to its widespread usage, it lacks the features, security, and the reliability necessary for organizational sustained use.

Continue reading to learn why Venmo and other peer-to-peer (P2P) payment apps like Cashapp, Paypal, Zelle etc. should absolutely be avoided by schools, charities, sports teams, fraternities and all types of nonprofits. Find out how to choose the right online payment collection solution for your nonprofit’s needs.

What Is Venmo?

Venmo is a popular platform for making personal, peer-to-peer mobile payments. It is owned by PayPal, the largest online payment processor in the world. Unlike PayPal, Venmo is specifically designed for quick personal transactions, such as paying back a friend for lunch .

Venmo handles over $244 billion in transactions annually! Part of this growth has been due to nonprofit organizations using Venmo for fundraising and business transactions. This usage can put all the different types of nonprofit groups that use Venmo for donation and payment collection at risk, as Venmo does not provide the same consumer protections needed for non-personal transactions.

Should nonprofits use Venmo?

Venmo is not the right option for collecting payments or donations for your nonprofit group. It lacks key safety and anti-fraud features that keep nonprofit’s funds secure. Its reporting capabilities make it hard for nonprofits to do proper accounting, and tracking the purpose of each transaction.

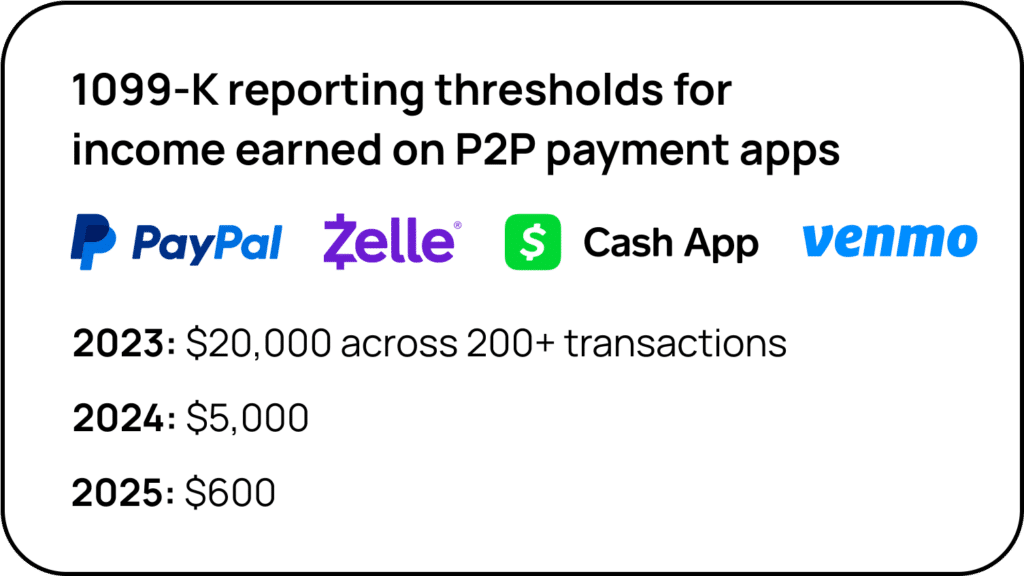

Furthermore, connecting your group’s Venmo account to your personal bank account can lead to tax implications, especially if you collect over $5,000 annually for your group in 2024 and $600 in 2025 and beyond.

Why Venmo isn’t the best choice for nonprofit groups

There are several reasons why Venmo may not be the best fit for nonprofit groups, including:

No solution for tax-exempt reporting

Venmo does not provide a solution for tax-exempt reporting, which is vital for nonprofit organizations. Payment collection software designed for nonprofits allows you to handle the entire reporting process seamlessly and organize all of your payments correctly. With Venmo, you will have to manually sort through all of your transactions afterwards when it comes time to file taxes. This means dealing with payments that have no payment details attached or having to scroll through months of payments to locate a specific payment you’re looking for.

No FDIC insurance

Venmo makes it too easy to keep funds within the app, so users can transfer and receive money with the utmost ease. But what they don’t say is, Venmo is not a bank, it is not insured by the FDIC up to $250k like all the other accredited bank institutions in the U.S.. Keeping a large amount of money, especially your nonprofit organization’s money, is unnecessarily risky.

Challenging accounting

Balancing your books with Venmo is tough. Unlike payment software designed for nonprofits, Venmo only provides a chronological list of transactions, making it difficult to distinguish reimbursements from donations or dues collection. There are no specific payment details unless the sender enters them on their own accord, and even so it is hard to keep the labeling standardized.

No ability to collect information

Venmo is not a good option for your nonprofit group if you want to collect information about your members or donors in addition to payments. There are no required fields for Venmo payments so if you want to know the full name, contact information, age, or group specific data, there is no way to get that data from Venmo. For nonprofits looking to build a donor database for donor retention, options are very limited with Venmo. For other nonprofits who want to collect waivers or forms for events from your members, Venmo doesn’t have a solution for that.

Open to fraud

Anyone can open a Venmo account and name it whatever they want. There have been many cases of fraud where people set up accounts with the same name and logo as a charity and people would donate there instead. Venmo, Zelle and these other P2P apps are constantly in the news for scams and frauds. And because Venmo is not FDIC insured, they aren’t obligated to pay you back.

For all these reasons, Venmo is an okay option for personal payments to friends and family, but we strongly discourage it for nonprofit usage.

Venmo Tax Implications

If you’re thinking about using Venmo regularly to collect payments, it’s best to be aware of the tax implications of using Venmo, Cashapp and other P2P apps. In 2021, the IRS stated that users would have to report income on goods and services over $600. That’s really low! Your nonprofit could hit that threshold simply by accident if they use these apps often enough.

Following a lot of pushback and turmoil from that decision, the implementation was pushed back a few years until the IRS can be sure to implement it fairly and thoroughly. Here’s a chart for where the tax reporting requirements stand for 2023-25.

These states have decided not to wait for the IRS and 2025, they have lowered the reporting threshold for 2023. If your nonprofit’s business address is located in these states, be aware!

Maryland: ≥ $600

Massachusetts: ≥ $600

Vermont: ≥ $600

Virginia: ≥ $600

Illinois: > $1,000 and 4+ separate transactions

Read more on Venmo’s FAQ page.

Other options for collecting payments for nonprofits

Billhighway

There are many other online payment processors, such as Billhighway, that offer nonprofits a way to collect dues from their members. However, this option is generally very expensive, charging a fee per member and a high percentage on each payment collection.

Cash and checks

Using checks and cash avoids the need for members to use any platform and keeps fees low. However, this option requires meticulous bookkeeping and dedicated staff. Doing all your payment collection and donation in cash and checks increases the risk of accounting and reporting errors, and misplacing funds.

Crowded

Choosing a nonprofit payment collection solution like Crowded makes it easy to collect payments online while keeping costs low. By selecting a solution that meets your specific needs, your organization can enjoy the benefits of both convenience and compliance.

Choosing the right payment collection solution can have a significant impact on the time and money required to run your nonprofit group

The benefits of using Crowded to collect payments for your nonprofit

Crowded offers a simple solution for online payment collection for your nonprofit, among other beneficial features. Our comprehensive platform provides the financial management tools you need for your organization to thrive, without any subscription fees or complex user manuals. Here are some of the benefits of banking* with Crowded:

Online payment collection

Collecting payments has never been easier when you choose Crowded for your nonprofit group. You choose an amount that you want to collect, give the collection a name, and then share a link to those who you would like to collect from. There’s no app download required for payers.

Our versatile payment solution allows you to create a payment link for a variety of needs, including membership fees and donations. It can be used for a range of membership groups, such as booster clubs, per diem payments, fraternities, sororities, PTAs, Girl Scouts, Boy Scouts, and more.

When your payers see the collection link, they can pay the collection link as many times as it fits their needs. Let’s say you’re a girl scout troop collecting for girl scout cookies, the purchaser can buy 4 boxes at once in one transaction.

Flexible payment methods

We offer flexible payment solutions so you can choose the method that makes the most sense for your group. These options include in-app payment collection, in-person payments with cash or on our mobile app, open payment links that can be accessed without having to log in to a website or app or share through a QR code.

We designed Crowded to make payment management easy for your organization and convenient for your members. Your members can pay using credit, debit, ACH transfers, cash or by check. Payments are made securely through Crowded, so your members can rest easy knowing their financial information is safe.

You can log into the Crowded dashboard to easily check the progress of your collections. The dashboard makes it clear to see who has paid, who hasn’t and send reminders to your contacts.

Collect Donations

When you create a collection using Crowded, you can leave the requested amount open. When you share the link, your payer’s choose how much to contribute, making it perfect for collecting donations! You will receive the names and emails of your donors for future fundraising marketing efforts, and you can issue donation letters. Place your donation link in your instagram bio, in your newsletters, or on a poster as a QR code for maximum visibility!

Low fees

As a nonprofit organization, your top priority is to ensure that the money you collect goes toward your activities, rather than administrative costs. Our fees are consistently the lowest on the market, see our full fee schedule.

How Crowded helps their nonprofits bank

Crowded provides free nonprofit bank accounts* with no subscription fees or minimum balances – perfect for nonprofits looking for an accessible and affordable solution. The money you collect through your collections go straight into your Crowded bank account*, without any need to withdraw and re-deposit your funds.

As you collect payments on our platform, you’ll also benefit from clear documentation for streamlined accounting and reporting. You can integrate your account to Quickbooks or Xero. You’ll never have to worry about reconciling accounts and records because they’re all in one place.

After collecting funds for your organization, you also need a way to spend them on your various expenses and purchases. Crowded makes that simple, too, with digital and physical Visa® debit cards for member spending. No more dealing with receipts and reimbursements. Instead, you can set budgets and track member spending directly through Crowded’s web and mobile app.

We make the administrative aspects of nonprofit banking simple and intuitive, too. You’ll always have the accounting and reporting you need to keep up with tax compliance. It’s also easy to hand over the operation of your nonprofit accounts whenever your organization finds itself with a new treasurer.

How you can get started with Crowded today

Getting started with Crowded is straightforward and will have you collecting payments and managing money online in no time. To begin, simply sign up for Crowded and create your account. The entire process takes place online, and you only need the essential documents required for any bank account. If you need help organizing these documents, we can assist you.

Not sure if Crowded is the right solution for your nonprofit organization? Interested in learning more about our features? You can schedule a demo with our team today to see how Crowded can benefit your nonprofit. We are happy to answer any questions you may have!