Have you ever wondered about incorporating your nonprofit but weren’t sure what it entailed or if it was worth the effort?

This nonprofit incorporation guide covers everything you’ll need to know about incorporating your nonprofit and answers the most common questions, so you can focus on what matters: making a difference.

What is nonprofit incorporation? Should your organization incorporate?

Incorporating your nonprofit is the process of giving your organization a legal identity. It makes it eligible for tax-exempt status with the IRS and allows your organization to conduct critical business activities such as opening a bank account, signing contracts, and owning property.

Incorporating your nonprofit offers more benefits than just saving money on taxes. It can shield you and your members from personal responsibility for debts and liabilities. In addition, incorporation enhances your nonprofit’s credibility, by becoming a legitimate, formal entity. This legitimacy can attract more members and supporters who are more willing to support an incorporated nonprofit.

Whether you’re starting a local sports league or founding a college club, incorporating your nonprofit club is crucial. It protects your organization and ensures its success in the long run. Get started before tax season arrives; begin the incorporation process for your nonprofit today and start building a solid and sustainable organization.

Why should a nonprofit incorporate?

When you incorporate your nonprofit, it is officially recognized in the eyes of the law. But it’s not just boring legal stuff – many benefits come with incorporating. Here’s what you can expect to gain:

- Legal recognition: Incorporating your nonprofit club gives it legal recognition, which is essential for securing funding, partnerships, and grants.

- Access to nonprofit banking: One of the requirements for nonprofit business bank accounts is incorporation, so getting incorporated unlocks that! A dedicated nonprofit bank account will allow your nonprofit to manage your finances separately from any personal accounts and will make it easier to comply with compliance requirements.

- Tax exemptions: Nonprofit organizations are exempt from federal income taxes (although you must separately apply for tax-exempt status), and many states also offer tax exemptions for nonprofits. You can keep every dollar you bring in and put it toward creating a better experience for your members and increasing your impact.

- Access to funding: Incorporating your organization is generally one of the fundamental requirements for grants, as it demonstrates that the money is being used properly. This provides greater accessibility to a wide range of grants from established organizations that provide funding for specific types of groups.

- Greater credibility: Incorporating your nonprofit membership club provides increased credibility, letting interested parties know that you’re the real deal and that your specific organization is worth participating in.

- Longevity: Incorporating your organization establishes it as a separate entity, enabling it to continue working in the future after the founding members are no longer part of the organization. You can also define rules for making important decisions regarding the future of your club, such as leadership, spending, and more.

- Protection against personal liability: Forming a nonprofit corporation provides protection against personal liability for organizers and members. If your membership club incurs some type of debt or liability, you could be held personally responsible if the organization isn’t incorporated.

When you incorporate your nonprofit club, you’re laying the groundwork for a solid foundation to help your organization grow and make a bigger impact. It’s a crucial step that can set you up for success!

Five steps to follow to incorporate your nonprofit organization

1. Decide on your nonprofit’s official details

When you incorporate your nonprofit, you will need to set some details in stone.

For example:

- Legal Name

- Address

- Three trustees (and their addresses)

It’s best to think thoroughly about these, because the name of your nonprofit and your official mailing address are important, and you do not want to go through the hassle of changing it later.

2. Create a purpose statement for your nonprofit

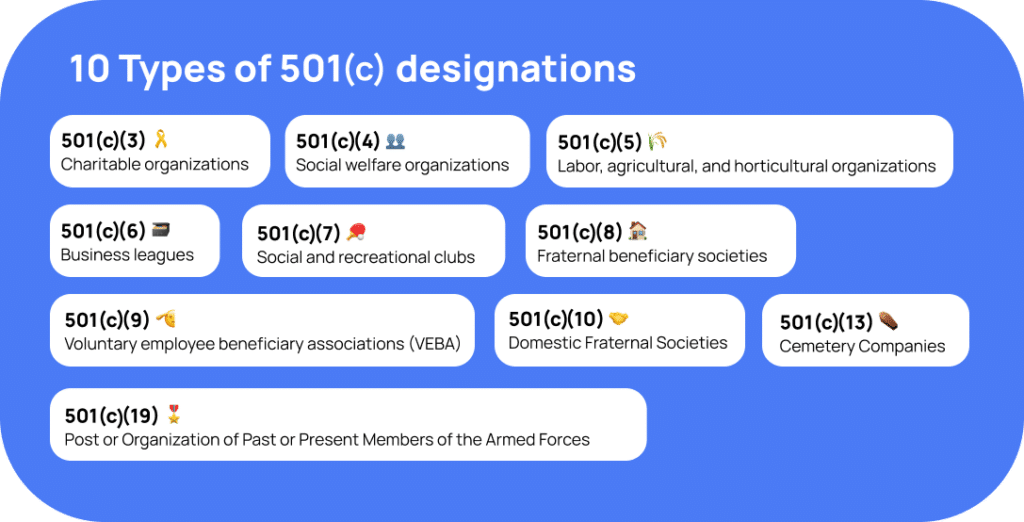

Think about which type of nonprofit you want to be. There are many different types, all under the 501(c) designation by the IRS. Your nonprofit’s purpose should reflect your chosen type, as well as briefly describe your proposed activities and goals. Generally the purpose statement should be 300 characters or less.

Heres an excerpt of a few 501(c) types:

3. Create a set of bylaws for your nonprofit

Bylaws for nonprofits are a set of rules that your nonprofit will be legally bound to abide by. These bylaws should outline how your nonprofit will operate, elections, board member responsibilities, membership qualifications and more.

Your board members can change these bylaws in the future, so don’t feel like they must be set in stone. However, having a solid foundation is crucial, so take the time to draft bylaws that accurately reflect your organization’s values and goals. Then, with well-crafted bylaws in place, your organization will have a clear path forward and be equipped to succeed.

Get a Free Nonprofit

Bylaws Template

When creating a nonprofit, creating a set of bylaws is one of the requirements for incorporating. Luckily for you, if you submit your email, we’ll send you a free nonprofit bylaws template.

At this point, you can turn to an incorporation service to take care of the rest!

4. File for your employee identification number (EIN)

This step could be done before or after filing for incorporation. The EIN is crucial for opening a bank account and filing for tax-exempt status. Don’t worry; the process is relatively straightforward.

To get your EIN, you’ll need to fill out the IRS’s Form SS-4, which asks for basic information about your nonprofit, including its legal name, address, and the names of your organization’s leaders. Once you submit this form, which can be completed online, you’ll receive your EIN, allowing you to move forward and file for tax-exempt status. You can also take advantage of Crowded’s EIN service, where you can apply for an EIN for only $20!

5. Draft your articles of incorporation

In order to incorporate your nonprofit organization, the first crucial step is to create articles of incorporation, which you will need to file with the Secretary of State’s office in your state. Your state will likely have specific requirements for these articles, which you can find on the Secretary of State’s website. Before you begin drafting your articles, make sure to gather important information about your nonprofit, such as its name, purpose, address, and the names of your trustees.

6. File articles of incorporation

Once you have all the necessary information, start drafting your articles of incorporation, and be sure to include any required language for nonprofits in your state. When you’re finished, file the articles with your state’s Secretary of State office, which may require a filing fee.

And that’s it! If the state secretary accepts your documents, your nonprofit is officially incorporated. Make sure to save your certificate of incorporation in a safe place, as it will be used as proof of your incorporation for opening a bank account and other actions.

As a nonprofit, you’ll want to file for tax-exempt status from the IRS. This step is not required for incorporation, as your nonprofit is already incorporated. It is necessary though, if you want to be tax-exempt on your organization’s activities and spending. It is the last step in officially getting your nonprofit up and running.

7. File for tax-exempt status

Finally, the last step is to file the Federal Tax Exemption Application with the IRS to obtain tax-exempt status. Before filing, make sure you have a board of directors in place, bylaws implemented, and a conflict of interest policy. You will have a different form to fill out depending on which 501(c) type your organization is.

See this chart to help you figure it out:

The Form 1023 will require information on your nonprofit’s planned operations, projected budget, fundraising activities, and governance practices. There is a filing fee to file any of these forms, so be sure to budget for it. Smaller nonprofits may also qualify for the simplified Form 1023-EZ, a shorter form you can complete online.

Help! The nonprofit incorporation process is overwhelming

If your nonprofit doesn’t have the capacity to completely manage the incorporation process for your nonprofit, that is ok! There are many providers who sell incorporation services packages.

Crowded, for one, can get your organization your Articles of Incorporation and EIN in one smooth process, and it won’t hurt your nonprofit’s wallet. The Crowded incorporation application is simple.

- Organize the required documents like your nonprofit’s bylaws and purpose

- Begin the Crowded bank account* application, and indicate that you would like to use Crowded’s Incorporation Services.

- Apply for an EIN if necessary within the Crowded platform

- Start the Incorporation application and fill in the required information about your nonprofit

- Crowded will handle the application (and application fee) to the state agency.

- You will receive your Certificate of Incorporation in your email in a few days!

See! It’s painless. It is also the cheapest on the market. Check out how we stack against our competition:

LegalZoom | MyCorporation | NorthWest | Bizee | ||

|---|---|---|---|---|---|

EIN | $20 | $79 | $79 | $50 | $199 |

Incorporation | $95 | $224 | $257 | $179 | $79 |

Registered agent fee | Free | $249 | $120 | $125 | $119 |

Total | $115 | $552 | $456 | $354 | $397 |

Is an attorney or accountant necessary for the incorporation process?

While working with an attorney or accountant when starting a nonprofit is not always necessary, it can be a good idea for larger organizations with complex details to work out. However, smaller groups can likely manage without professional help.

If you decide to work with an attorney, they can provide valuable assistance when drafting bylaws for your club. While templates and examples are available online, it’s important to ensure that your bylaws meet the requirements of your specific state and the IRS. Additionally, an attorney can offer guidance on other legal aspects of starting a nonprofit.

While an accountant may not be essential at the outset of your nonprofit, they can provide significant value as your organization grows and you need to navigate tax reporting requirements and manage your finances. However, software solutions can now help you manage these tasks yourself, especially for smaller organizations. As always, staying informed and ensuring your financial records are accurate and up-to-date is essential.

How to keep track of your funds after you incorporate

Starting and managing a nonprofit can be challenging, especially when it comes to day-to-day financial operations. That’s where Crowded comes in – we offer a comprehensive platform to help you manage your nonprofit’s banking*, collection, and spending needs, including setting you up for success for your yearly tax reports.

With Crowded, you’ll have a single platform to manage all income and expenses and we provide digital Visa® debit cards for officers and members to make purchases seamlessly. Plus, streamlined dues collection makes it easy for members to pay their membership fees on time while giving you control over the key income that drives your club.

Crowded’s clear and accurate record-keeping helps ensure your 501(c) organization stays tax-compliant. You can access records easily through the app and web portal, with features catering to larger groups’ needs and the simplicity required by smaller clubs.

If you’re starting a nonprofit, Crowded can help you do it right from the beginning. By utilizing Crowded’s incorporation services and empowering your organization with all the financial tools you need in one platform, you can focus more on your activities and worry less about finances. Sign up to set up your free account today to see how Crowded can benefit your nonprofit.