Where DKE started

DKE’s banking and tax compliance were a major headache.

As a national organization with around 50 chapters, DKE lacked an official banking partner.

Each university chapter maintained its own local bank account without any oversight from the national level.

Many times, these accounts were housed at local credit unions or regional banks with archaic systems and no online banking option.

As a registered nonprofit, DKE has tax-exempt status for their entire organization – a group exemption. However, being young college students, chapters were unaware of which EIN they should be using and how to file the correct 990 form. These questions along with general banking questions and support are not given by your typical brick and mortar banks.

In addition to these larger concerns, DKE treasurers had some run-of-the-mill fraternity woes:

- Managing treasurer officer handovers

- Chapter funds commingling with personal through peer-to-peer payment apps

- Chasing members for dues collection

- Dealing with reimbursements and receipts

DKE was on the lookout for a solution for these issues. They also were looking for a platform that eased the financial stress on their chapter treasurers. Moreover, the lack of oversight over their chapters’ finances, inconsistent group exemption usage, rogue treasurers etc. had serious financial implications for the national organization.

Crowded helps DKE manage their finances and compliance

Centralized banking with Crowded

Once DKE partnered with Crowded and encouraged their chapters to sign up, they felt that they were in a better position to support their chapters. With all the chapters unified under Crowded, DKE is able to assist with transactions, tax filings and fraud assistance. They can ensure that funds aren’t trapped in dormant accounts. Through Crowded, DKE can monitor their subsidiary chapter finances and can step in when necessary.

Complete compliance with Crowded

DKE’s partnership with Crowded paved the way for total compliance with IRS regulations regarding nonprofit tax-exempt status. Crowded assisted DKE in creating dozens of EINS for chapters who did not have one, and added many chapters to their group exemption.

Compared to online providers or accountants who charge hundreds of dollars per annual tax filing, Crowded files the annual forms for DKE in a cost-effective way.

DKE is saving thousands of dollars per year, from the funds saved from tax exemptions, to using Crowded to provide them with annual 990 forms and manage their group exemption.

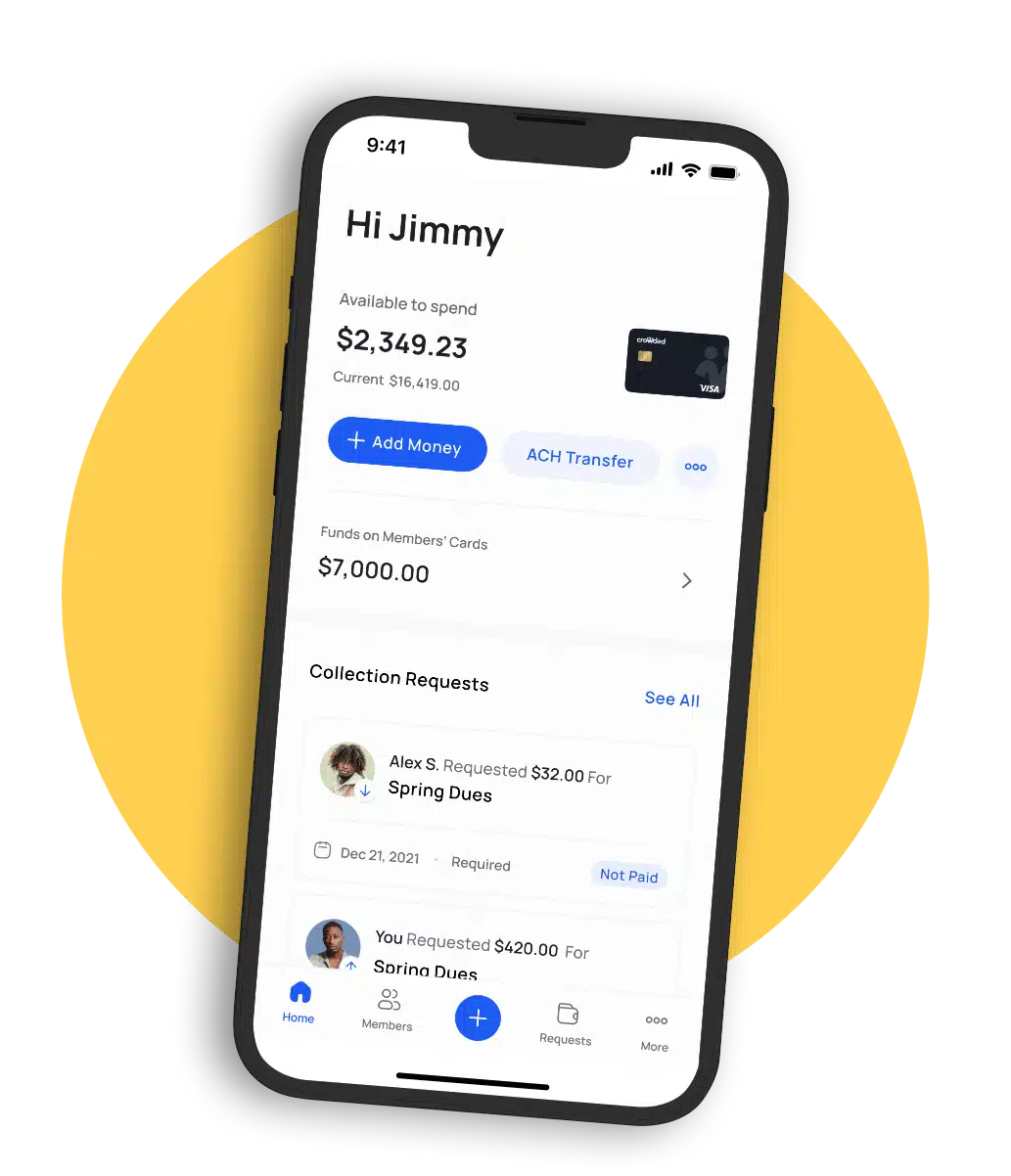

Collecting dues on Crowded

DKE chapters use Crowded’s online payment collection service to easily collect dues from their members. Chapter treasurers track who has and hasn’t paid, and send reminders from the Crowded platform. When DKE chapters host events or fundraisers, treasurers collect funds for supplies or accept donations through Crowded.

Convenience of Crowded’s Digital Access

For busy college students, managing their fraternity banking online is a huge help. For new DKE chapters, it used to take weeks to get a bank account set up and start collecting funds – from coordinating schedules to physically go to a bank, fill out lots of paperwork, etc. With Crowded, it takes days! When it comes to the end of the year, outgoing treasurers can hand over their account in a few simple steps. No need to coordinate schedules to go to the bank and fill out more paperwork.

Since our guys are young volunteers gaining experience, it’s awesome to partner with a company that has tools to fit their needs. Things like transition assistance between officers or digital cards (the physical frat card always goes missing!) keep our guys focused on their mission and not bogged down administratively.

-Turner, Director Of Administrative Services, Delta Kappa Epsilon

Spending chapter funds with Crowded digital debit cards

After DKE chapter treasurers collect dues and other funds from their members, they use Crowded’s Visa digital debit cards to spend. Treasurers issue digital debit cards on demand for their members to make purchases on behalf of the chapter. Treasurers receive a digital receipt for all goods bought, and best of all, there is no need for them to do any reimbursements!

DKE leverages Crowded Rewards to fundraise

The Rampant Lion Foundation is the 501(c)3 nonprofit arm of DKE that assists members with scholarship assistance. This foundation was previously using Amazon Smile to generate donations, but when that program shut down, they turned to Crowded Rewards as their alternative. Similar to Amazon Smile, DKE supporters do their regular shopping through Crowded Rewards and generate donations for The Rampant Lion Foundation. But, with Crowded Rewards, DKE supporters also get cashback – making it a win-win!

DKE saves 6,500 hours a year

since switching to Crowded

reimbursements

easy account setup

officer handovers

their previous provider