Selecting the right nonprofit fiscal sponsorship model ensures compliance, efficiency, and financial sustainability. The right approach depends on your organization’s desired level of control, liability, and administrative responsibility. Crowded makes managing both models easier, streamlining oversight and automating compliance, whether your nonprofit takes full ownership of a project or transfers grant funds.

Understanding the Nonprofit Fiscal Sponsorship Model

The two most common models are Model A (Comprehensive Fiscal Sponsorship) and Model C (Pre-Approved Grant Relationship). Each has distinct advantages, and both can benefit from Crowded’s financial and administrative tools.

Model A: Comprehensive Fiscal Sponsorship

Under Model A, the fiscal sponsor assumes full legal and financial responsibility for the project. This means:

- The project operates as part of the fiscal sponsor.

- The sponsor owns the project’s assets and intellectual property.

- All financial transactions go through the fiscal sponsor.

- Project employees are legally employed by the sponsor.

Best for: Nonprofits wanting full integration of a project under their tax-exempt status.

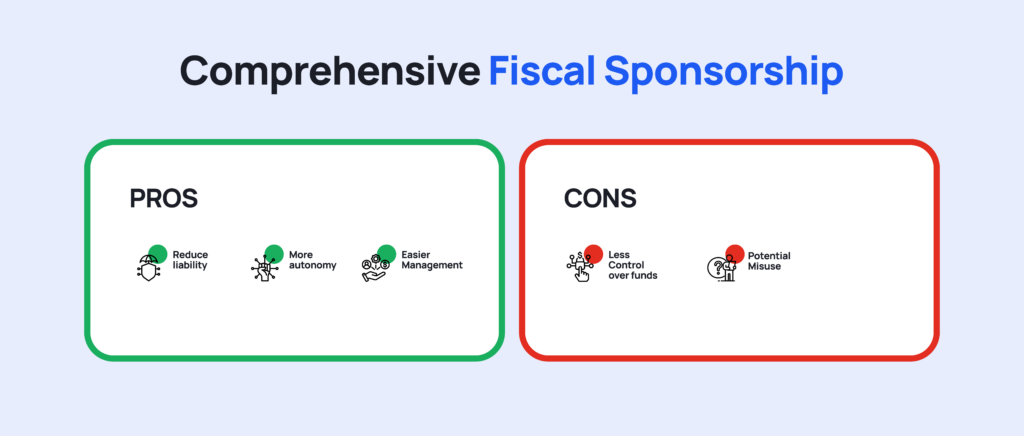

Pros of Model A Fiscal Sponsorship Model:

- Provides the highest level of oversight and compliance.

- Allows seamless administrative support for sponsored projects.

- Gives donors confidence that funds are properly managed.

Cons of Model A Fiscal Sponsorship Model:

- Requires more administrative capacity.

- Increases legal and financial liability for the fiscal sponsor.

How Crowded Helps With Comprehensive Fiscal Sponsorships:

- Comprehensive Sub-Accounts enable financial autonomy while keeping oversight.

- Secure Payment Solutions provide controlled spending with fraud protection.

- Centralized Reporting ensures compliance with minimal administrative burden.

Model C: Pre-Approved Grant Relationship

In Model C, the fiscal sponsor acts as a grantor, distributing funds while the project remains independent. Key aspects include:

- The project operates separately from the fiscal sponsor.

- The sponsor receives tax-deductible donations and regrants funds.

- The project manages its own employment, operations, and compliance.

Best for: Nonprofits supporting external projects while reducing administrative liability.

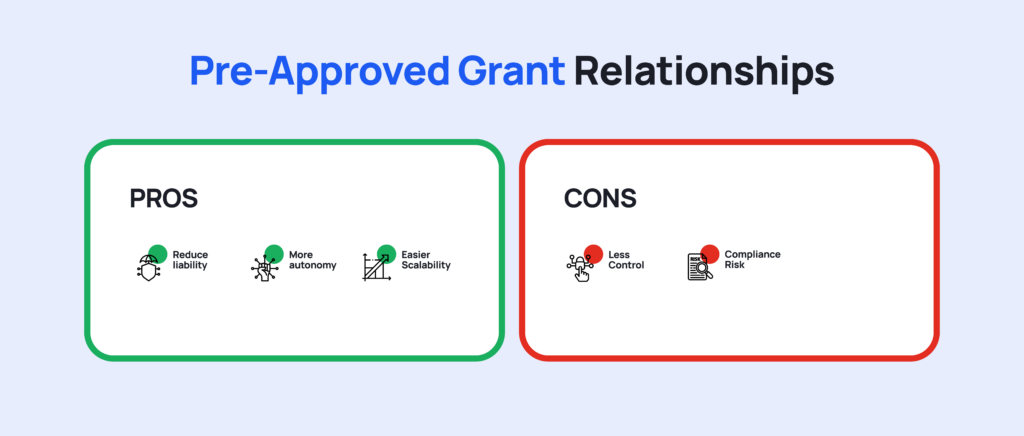

Pros of Model C Fiscal Sponsorship Model:

- Reduces liability and administrative responsibility for the fiscal sponsor.

- Allows projects more autonomy in their operations.

- Easier to scale and manage multiple projects.

Cons of Model C Fiscal Sponsorship Model:

- Less control over how funds are used.

- Requires careful compliance to ensure grant funds are used for charitable purposes.

How Crowded Helps with Pre-Approved Grant Relationships:

- Donor-Friendly Fundraising Tools ensure smooth tax-deductible donations.

- Automated Grant Disbursement ensures proper fund tracking and compliance.

- Flexible Financial Management provides per diem accounts for controlled spending.

Key Considerations When Choosing a Nonprofit Fiscal Sponsorship Model

To determine which fiscal sponsorship model is best for your nonprofit, consider the following:

- Level of Oversight & Control

- If your nonprofit wants to fully manage a project’s finances, operations, and employees, Model A is the best choice.

- If you prefer to act as a financial conduit with less direct oversight, Model C may be more appropriate.

- Administrative Capacity

- Model A requires significant administrative resources, including HR, accounting, and legal support.

- Model C is a lighter administrative lift but still requires compliance monitoring.

- Legal & Financial Liability

- With Model A, your nonprofit assumes legal and financial responsibility for the project.

- Model C shifts liability to the sponsored project but requires due diligence in fund management.

- Long-Term Goals

- If the goal is to incubate a project that will eventually become an independent nonprofit, Model A may offer the best structure.

- If the project is temporary or short-term, Model C provides flexibility without long-term commitments.

Empower Emerging Causes with Crowded’s Simplified Fiscal Sponsorship Solutions

To simplify and enhance fiscal sponsorship, Crowded provides the essential tools to support sponsored projects efficiently.

- Create Unlimited Subsidiary Bank Accounts– Use these accounts to give your projects the freedom to manage finances, while you maintain oversight.

- Onboard Project Heads as Sub Account Admins- Much easier than opening a full bank account! No EIN or incorporation documentation required.

- Projects Manage Funds Autonomously- Admins enjoy built-in payment processing, fundraising and transparent spending tools.

Final Thoughts

Choosing the right fiscal sponsorship model is essential to maintaining compliance, efficiency, and sustainability. Your nonprofit must assess its capacity, risk tolerance, and goals when determining whether to pursue a comprehensive sponsorship (Model A) or a grantor model (Model C).

Regardless of the model you choose, having a clear fiscal sponsorship agreement in place is critical to ensuring a transparent and successful relationship between your nonprofit and the sponsored project.

Your questions, answered.

What are the different types of fiscal sponsorships?

Besides Model A and Model C, other fiscal sponsorship models exist which provide varying levels of oversight, financial responsibility, and operational control.

Group Exemption – A fiscal sponsor serves as an umbrella organization for multiple affiliated projects or chapters, extending tax-exempt status and administrative support to them.

Independent Contractor Model – The fiscal sponsor hires contractors to complete specific projects, maintaining oversight while allowing for operational autonomy.

Technical Assistance Model – The fiscal sponsor provides specialized services such as grant writing, fundraising support, or compliance assistance, while the sponsored project remains independent.

Each fiscal sponsorship model offers different levels of control and flexibility. Selecting the right approach ensures compliance, efficiency, and sustainability for both the fiscal sponsor and the sponsored project.

Are fiscal sponsorship agreements for Model A and Model C the same?

No, fiscal sponsorship agreements for Model A (Comprehensive Fiscal Sponsorship) and Model C (Pre-Approved Grant Relationship) are not the same. While both define the legal and financial relationship between the fiscal sponsor and the sponsored project, they have distinct structures and responsibilities.

Can a fiscal sponsorship project accept tax-deductible donations?

Yes! Under both Model A and Model C, the fiscal sponsor’s 501(c)(3) status allows projects to receive tax-deductible contributions.

Is fiscal sponsorship a good alternative to starting a nonprofit?

Yes, fiscal sponsorship allows emerging projects to operate under an established nonprofit’s tax-exempt status, avoiding the time and costs associated with obtaining their own 501(c)(3).

What administrative responsibilities does a fiscal sponsor have?

Fiscal sponsors must manage finances, oversee compliance, and ensure funds are used appropriately. Crowded simplifies this process by offering automated financial tracking, subsidiary accounts for each project, and real-time reporting to reduce administrative burdens.

How can fiscal sponsors ensure compliance with IRS regulations?

Fiscal sponsors must maintain proper fund management, track transactions, and provide oversight to ensure funds are used for charitable purposes. Crowded helps maintain compliance by automating financial reporting, ensuring secure payment processing, and providing transparent financial tracking for all transactions.

What are the risks of becoming a fiscal sponsor?

Fiscal sponsorship involves financial and legal responsibility, depending on the chosen model. Model A sponsors take on full liability, while Model C sponsors must ensure grants are used appropriately. Crowded minimizes these risks by offering compliance safeguards, automated fund tracking, and real-time financial oversight.

Is Crowded only for fiscal sponsors, or can individual projects use it too?

While Crowded is designed to support fiscal sponsors in managing multiple projects efficiently, individual projects can also use Crowded’s fundraising and financial tools to streamline operations, track expenses, and ensure transparency.