With Crowded, you can raise funds for your organization in 2 ways:

The good news is that you don’t need to pick just one. Create unlimited collection links of either type for your organization, and watch the payments roll in!

This guide will focus on the second option, for a step-by-step run-through of the first option, see Guide to Collecting Payments.

Need help creating a fundraiser? See here a complete rundown of the process. Or watch this walkthrough video by Rachel the Product Marketing Manager!

To give donors a variety of donation amount options, select “Fundraise”.

This option allows your donors to opt into making repeated donations on an annual or monthly basis. Make sure the switch is turned on to get maximal funding!

Recurring Donations is a Pro feature, but can also be enabled during a free trial!

This name will allow you to identify the purpose or event that you are fundraising for. Be sure to choose a clear & descriptive name that will be easily recognizable to your donors.

Let your donors know how much your organization is raising, to help motivate them to donate higher amounts to hit your goal. Skip this step if you’re not interested in adding a goal.

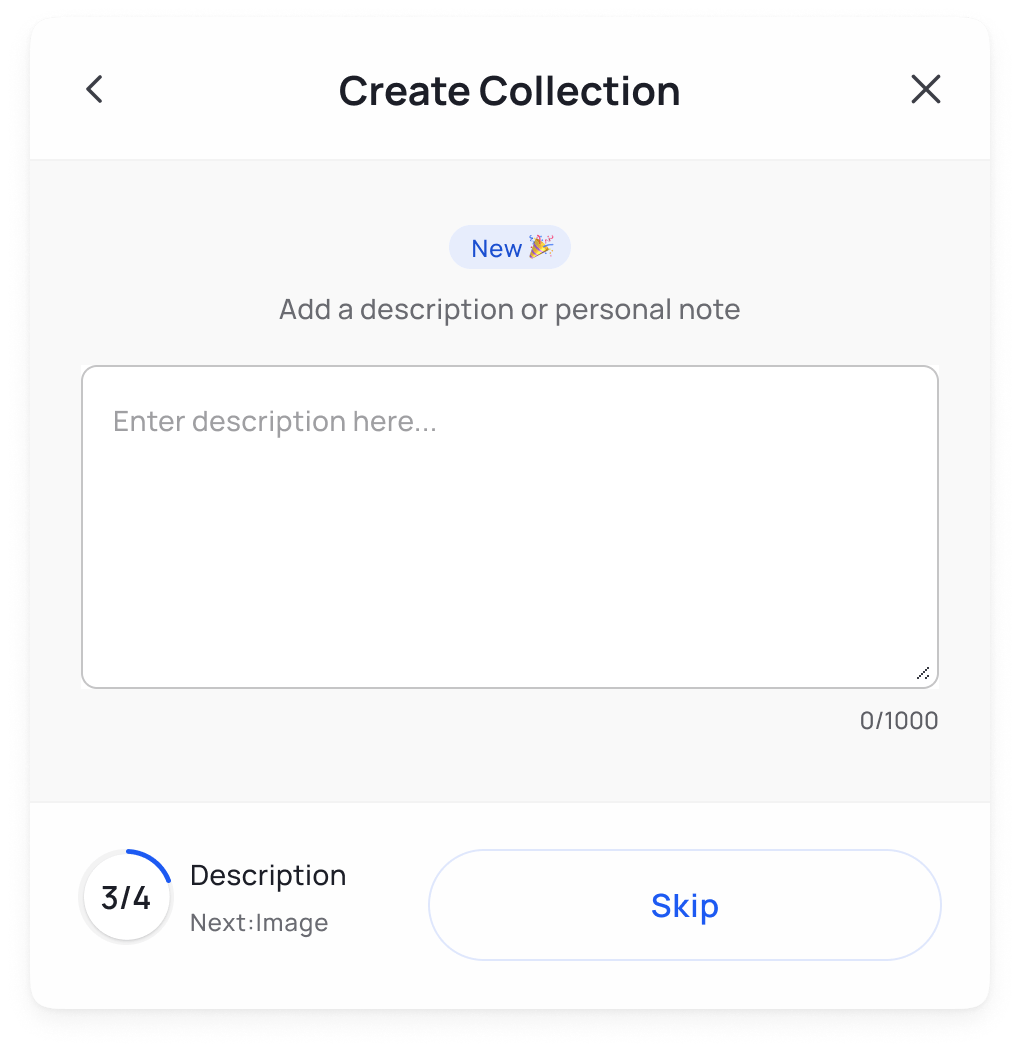

Give donors context to your fundraiser, an overview of your organization, or add a personal note. Skip this step if you’re not interested in adding a description.

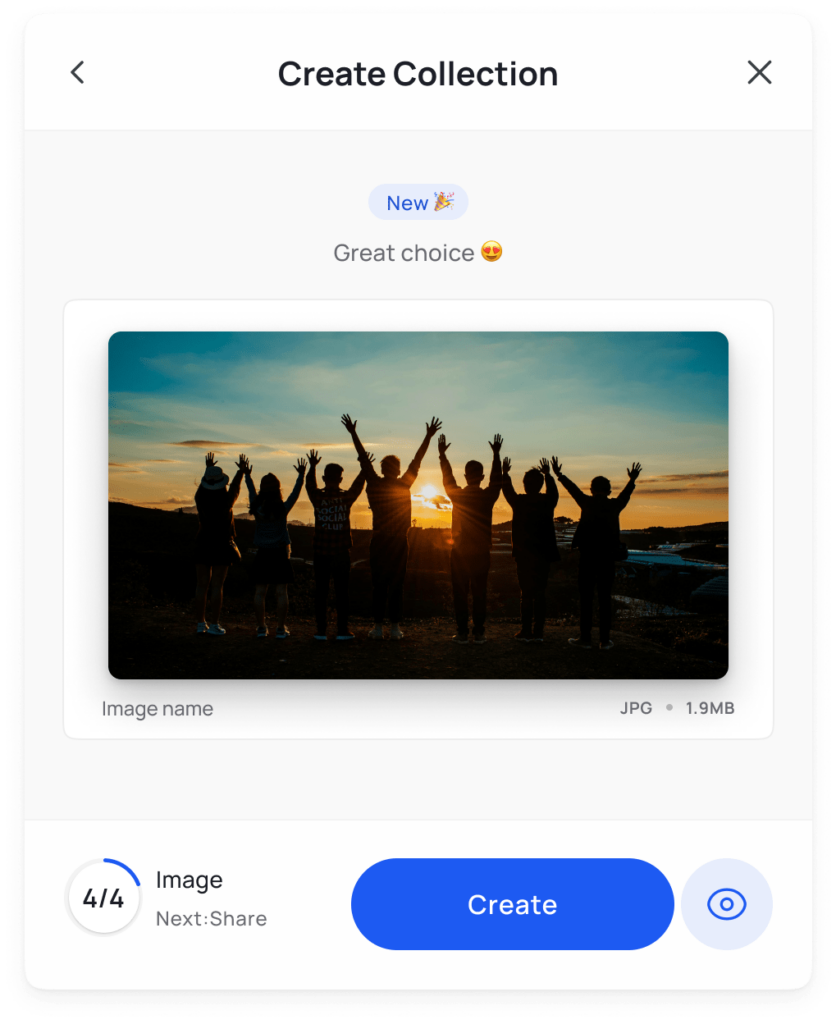

Attach an image to give a visual to your donation page – pictures are worth a thousand words! We recommend that the image has a ratio is 16:9, is a JPG or PNG, and is under 10 MB. This is also optional, skip if not desired and add later.

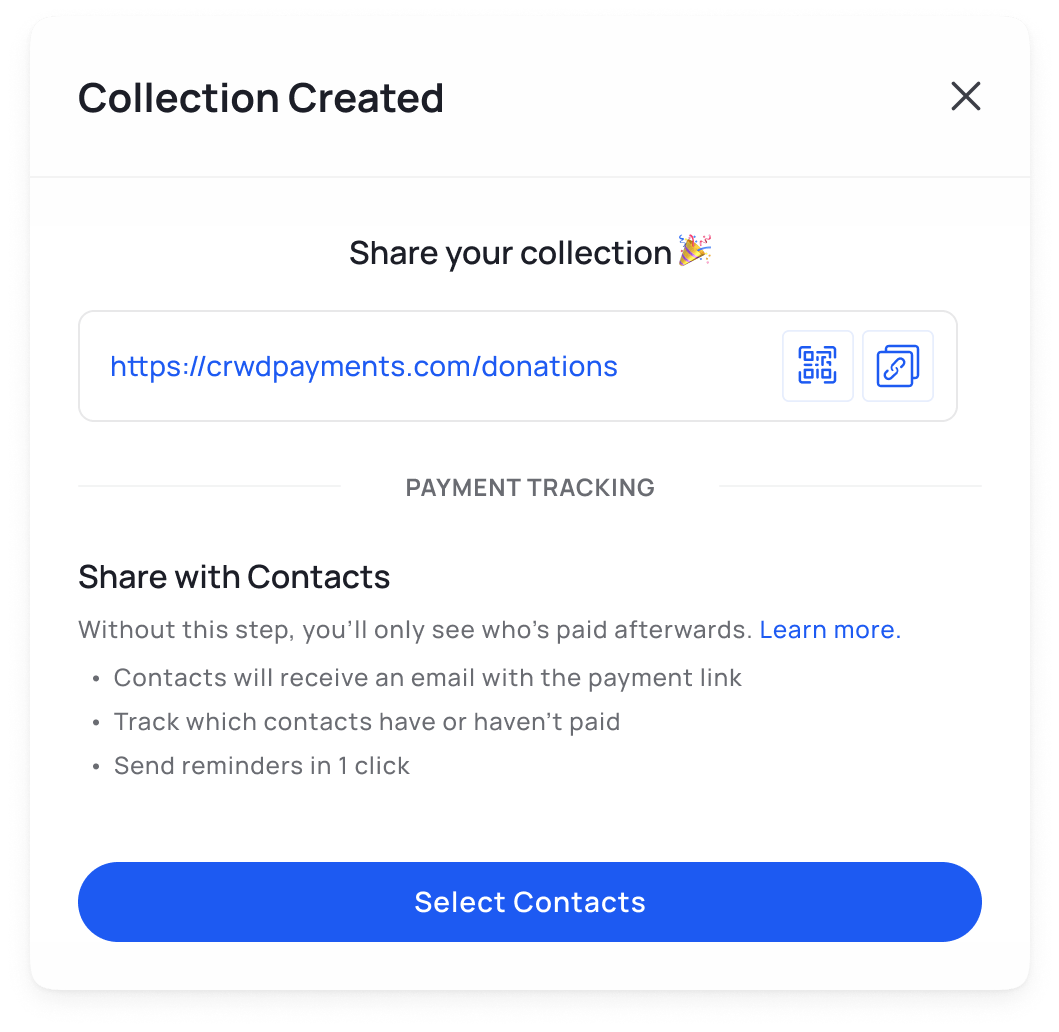

The collection is now created and ready to accept donations!

There are a few ways to share this collection:

If you’ve uploaded donor lists or member lists as contacts to Crowded, you can use our built-in email feature to send the link to your payers. See here for a guide to uploading contacts.

Tip: If you only want to send to a certain subsection of your organization, use tags to categorize, and only send to tagged contacts.

Copy the generated collection link and paste it into your preferred communication channel with your donor community, such as email, messaging apps, or social media.

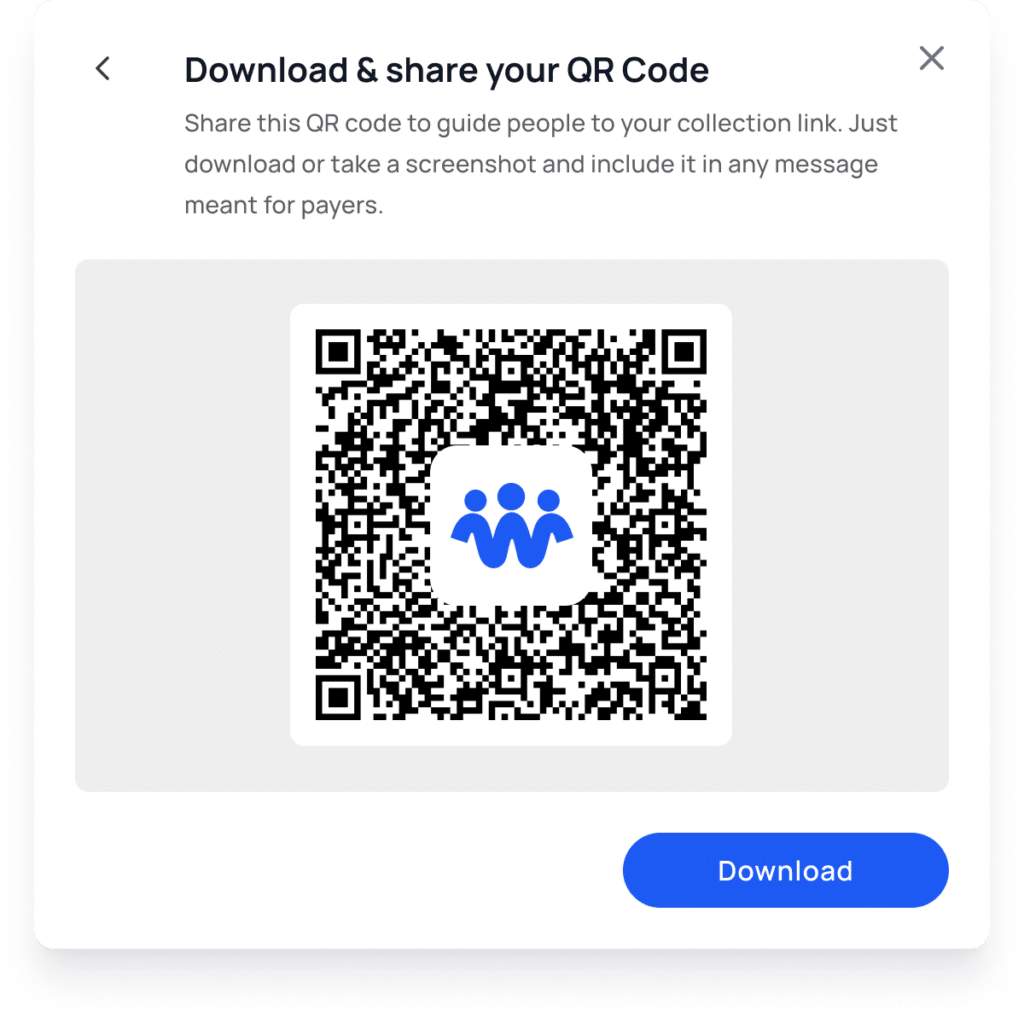

Share your collection link with a QR code. Download or screenshot the QR code and share with your payers.

Tip: Place the QR code on a printed poster or card to allow sharing of your link offline

Now all there is to do is sit back, relax, and enjoy the incoming donations. Track all incoming donations, send reminders, edit collections, and share with additional contacts from the Collections dashboard.

Check out our 5 Tips to Raise More to optimize your fundraising!

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by TransPecos Banks, SSB; Member FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

* Crowded Technologies Inc is a financial technology company and is not a bank. Banking services provided by TransPecos Banks, SSB; Member FDIC. The Crowded Technologies Inc. Visa® Debit Card is issued by TransPecos Banks, SSB pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

There are no fees associated with account opening, but transaction fees may apply; please refer to the Crowded Business Deposit Account Agreement for more details on account transaction fees.

** Accounts are eligible for pass-through deposit insurance only to the extent pass-through insurance is permitted by the rules and regulations of the FDIC, and if the requirements for pass-through insurance are satisfied. There may be a risk that pass-through deposit insurance is not available because conditions have not been satisfied. In such cases, funds may not be fully insured in the event the insured depository institution where the funds have been deposited were to fail.

To provide the best experiences, we use technologies like cookies to store and/or access device information as specified in our Privacy Policy. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.