Attention treasurers! Knowing how to fill or request a W-9 form for nonprofits could save you countless headaches. Did you know that when hiring contractors, or when offering services to an outside organization, your nonprofit risks losing over $560 by not submitting the appropriate reports? This guide is essential reading for nonprofits collaborating with external entities, simplifying the reporting process into a straightforward guide. Avoid potential fines in minutes and explore dynamic ideas, as this guide will make employee tax compliance effortless—even for the most complex projects.

What is a W-9 form for nonprofits?

The W-9 form provides the necessary taxpayer information (such as name, address, and Taxpayer Identification Number (TIN)) that a nonprofit or business needs to accurately complete a 1099-NEC form, which reports payments of $600 or more made to independent contractors or vendors for services rendered during the tax year.

Requesting a W-9 form:

When to request a W-9 form for as a nonprofit:

- Paying for a Service- If a nonprofit is paying for services performed by someone outside its organization, it should request a W-9 form with its TIN

- Renting out Facilities– If a nonprofit rents out facilities to another entity, it might request a W-9 form when reporting rental payments

- Awarding Grants- When giving grants, nonprofits may request a W-9 form to ensure correct tax filing of the partnership

How to request a W-9 form as a nonprofit:

- As soon as you contract a third-party, request that they fill out the W-9 form to simplify the process when it’s time to file the 1099-NEC form.

- Use the following information provided in the W-9 form to report the tax details for the 1099-NEC:

Name

Mailing address

Account number

Taxpayer number - Complete the remaining sections of a 1099-NEC using records from your nonprofit.

- Ensure that a copy of the completed 1099-NEC is provided to the third party by January 31, so they can report the income on their tax returns.

- Submit the 1099-NEC form to the IRS either via paper (Deadline: February 28) or electronically (Deadline: March 31).

Completing a W-9 form:

When to complete a W-9 form for nonprofits:

- Receiving Payments- If a nonprofit is receiving payments from an entity outside its organization, it may need to complete the W-9 form for nonprofits to provide its taxpayer identification number.

- Grant Reporting- Some funders may require nonprofits to submit the W-9 form for nonprofits as part of the grant application or funding process to verify the organization’s tax-exempt status and ensure correct reporting.

How to complete a W-9 form for nonprofits:

Complete a W-9 form for nonprofits promptly upon request from a third-party to streamline their process when it comes time for them to submit the 1099-NEC form.

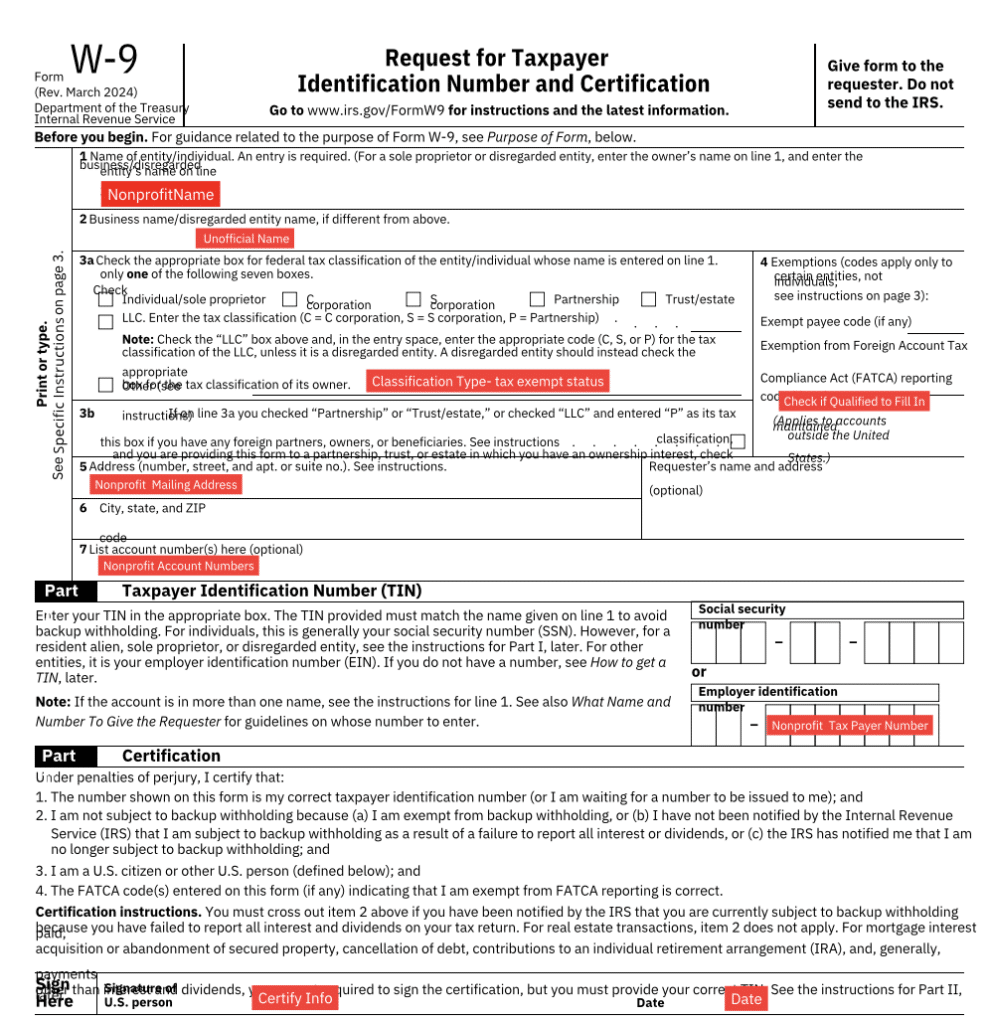

Fill out all the necessary information

Line 1 (Organization’s Official Name)

Enter your nonprofit’s corporation name as it appears on Article of Incorporation

Line 2 (Organization’s Unofficial Name)

Leave blank if you operation solely under your corporation name

Line 3 (Federal Tax Classification)

Most nonprofits are organized as corporations, so they should select this option. Specifically, a 501(c)(3) nonprofit is considered a corporation for tax purposes.

If your organization is not structured as a corporation but is still a tax-exempt nonprofit they should fill out ‘other.’ For example, some nonprofits may operate as associations or unincorporated groups.

Line 4 (Exemptions)

If your nonprofit organization is exempt from backup withholding and FATCA reporting, please enter the applicable codes in the designated area. Here are the relevant codes for organizations exempt from federal income tax under section 501(a):

Exempt payee code: 1

Exempt from FATCA reporting code: A

Line 5+6 (Address)

Provide the mailing address for your nonprofit organization

Line 7 (Account Number)

You may include any account numbers that the third party may need in Line 7, but this is optional.

Part I (TIN)

Enter your TIN as assigned by the IRS. Since an EIN is necessary for operating as a nonprofit organization, always provide your EIN in this form and leave the Social Security number field blank.

Part II (Certification)

Under “Part II,” you must certify the following conditions:

The information provided is accurate.

You are not subject to backup withholding.

You are a U.S. citizen or individual.

All that is required in this section is your signature and the date.

Make sure the third-party uses your tax details included in the W-9 form when completing the 1099-NEC.

Request a copy of the completed 1099-NEC by January 31, to report the income on you tax returns.

Get a Free Nonprofit Loan Get a free + customizable W-9 & 1099-NEC Template!

In conclusion

By following this easy guide, you can ensure your nonprofit stays tax-compliant while navigating the ins and outs of third-party financial transactions. When utilized properly, third-party contractors could be incredibly beneficial to the success of a nonprofit. From providing access to more specialized skills to providing the flexibility of an adjustable project-based workforce, third-party contractors can bring fresh perspectives in pursuing your nonprofit’s mission. And, providing services to third-parties could be a lucrative means of funding your nonprofit’s mission.

Crowded is a dedicated banking* platform for nonprofit groups

From providing access to more specialized skills, to providing the flexibility of an adjustable project based workforce, third party contractors can bring fresh perspectives in pursuit of your non profits mission.

How you can get started with Crowded today

Getting started with Crowded is straightforward and will have you collecting payments and managing money online in no time. To begin, simply sign up for Crowded and create your account. The entire process takes place online, and you only need the essential documents required for any bank account. If you need help organizing these documents, we can assist you.

Not sure if Crowded is the right solution for your nonprofit organization? Interested in learning more about our features? You can schedule a demo with our team today to see how Crowded can benefit your nonprofit. We are happy to answer any questions you may have!

Your questions, answered.

What is the difference between 1099-K and 1099-NEC?

While a 1099-NEC reports on non-employee compensation, a 1099-K reports on transactions made through payment cards and P2P payment apps. Money collected through Crowded is not considered income on goods and services, and is thus exempt from 1099 K reporting. Money collected through Venmo, Paypal, Cashapp and other P2P apps must adhere to specific tax implications with the IRS stating that users would have to report income on goods and services over $600.