PayPal is a widely known and popular payment platform. Many individuals, businesses and nonprofits use the platform for all kinds of financial activities every day. But there is more than what meets the eye when it comes to PayPal (& their subsidiary Venmo) and nonprofits.

We’ve compiled 7 tough questions to ask yourself before using PayPal as a nonprofit to process payments and store funds.

1. Should nonprofits use PayPal to collect dues?

Many organizations use PayPal to collect dues. It is a widely used platform, it is considered trustworthy, and it allows for easy collection of payments.

Because PayPal is so widely used, they can charge a high processing fee for collecting payments – 3.49% + $0.49. This processing fee is relatively high and eating away at your organization’s funds!

When organizations process payments for dues with Crowded, for example, you’re only charged 2.99%. Although it might not seem like a big difference, but when considering all the money that an organization processes in a year, it adds up.

We’ve built a handy calculator to help you see how much you could save by switching from PayPal.

Dues Savings Calculator:

Crowded vs PayPal

Your nonprofit would save...

0

Sent!

In the meantime, take a look at our bank accounts that keep nonprofits tax compliant all year long.

Please leave your contact details and we’ll be in touch with more info about Crowded dues collection.

2. What are the tax implications of processing payments with PayPal?

If your nonprofit uses PayPal to process payments for dues, event tickets, fundraisers, etc. (goods and services) and you are not a certified 501c3 PayPal charity, be aware of the tax implications of using PayPal.

Any payment to a business account on Paypal is automatically considered a goods and services payment.

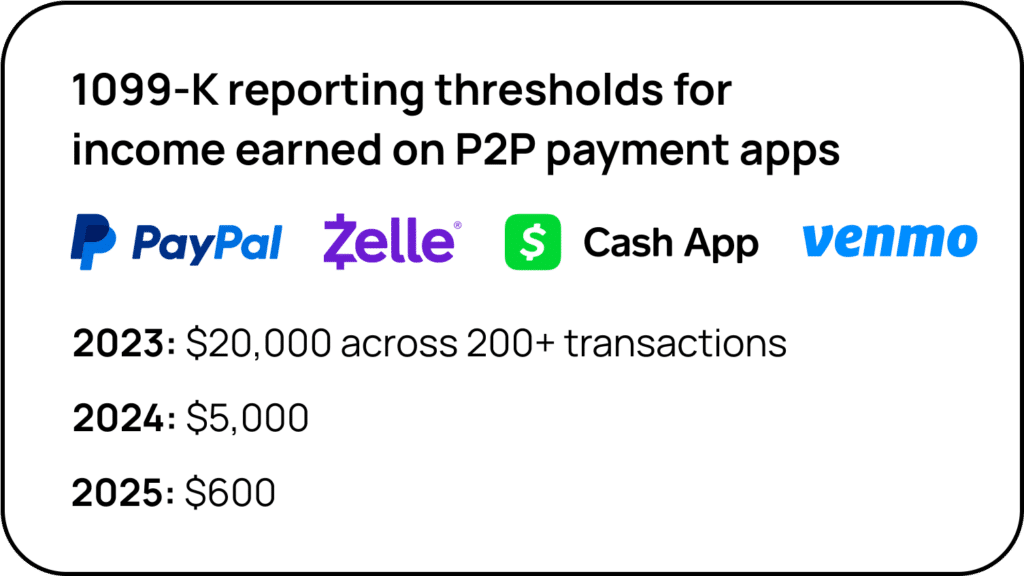

In 2021, the IRS stated that users would have to report income on goods and services over $600. Your nonprofit could hit that threshold simply by accident and need to report this income.

Following much pushback from that decision, the implementation was pushed back until 2025, which is slowly creeping up. Here’s a chart for where the tax reporting requirements stand for 2023-25.

These states have decided not to wait for the IRS and 2025, they have lowered the reporting threshold for 2023 and on. If your nonprofit’s business address is located in these states, be aware!

Maryland: ≥ $600

Massachusetts: ≥ $600

Vermont: ≥ $600

Virginia: ≥ $600

Illinois: > $1,000 and 4+ separate transactions

Read more on PayPal’s FAQ page.

3. PayPal Charity accounts: Who can use them?

You might see that PayPal gives special rates and offerings for charities, but be aware that this does not apply to all nonprofits. They offer a special payment processing rate for donations to certified 501(c)(3) nonprofits only, which allows nonprofits to keep more of their donations and to maximize their impact (1.99% + a fixed fee depending on the country).

However, any other type of 501(c) nonprofit or non-certified nonprofits that is collecting funds for anything from dues and event tickets to donations is not eligible for this special low rate and must function as a regular business on PayPal with their standard fee rates.

4. Is PayPal safe for storing nonprofit funds?

When accepting payments and donations and making payments on PayPal’s platform, it’s easy to build up a balance in a PayPal account. When you read the fine print, you’ll see that your balance on PayPal is covered by FDIC insurance, but ONLY if you have met one of these conditions: gotten a PayPal Debit Card, enrolled in Direct Deposit, or bought or received cryptocurrency.

If you have NOT done one of these actions, PayPal will invest the money in your balance account, and keep any profits and/or interest they might make (It’s written in PayPal’s legal documentation). Your money kept in PayPal in this case is not insured and could be lost at any point.

Paypal might seem as trustworthy as a bank, but the funds kept on there are not FDIC insured unless you meet the certain criteria.

Make sure your nonprofit never loses a cent by keeping its money in an FDIC-insured institution.

An Alternative to PayPal for Nonprofits

Crowded offers a simple solution for online payment collection for nonprofits. Here’s how simple it is to collect with Crowded:

- Choose an amount that you want to collect

- Name the collection

- Share the link or QR code with those who you would like to collect from.

Collect Donations

When you create a collection using Crowded, you can leave the requested amount open. When you share the link, your payer’s choose how much to contribute, making it perfect for collecting donations!

You will receive the names and emails of your donors for future fundraising marketing efforts, and you can issue donation letters. Place your donation link on your website, social media platform s, or on a poster as a QR code for maximum visibility!

There’s no app download required for payers, and they can pay with Apple Pay or Google Pay! Payments are made securely through Crowded, so your members can rest easy knowing their financial information is safe.

The nonprofit treasurer can log into Crowded to check the progress of the payment collections. The dashboard makes it clear to see who has paid, who hasn’t and send reminders to your contacts.

5. What is the PayPal Giving Fund and is it trustworthy?

The PayPal Giving Fund is a registered 501c3 nonprofit organization that is a donor advised fund run by PayPal. Registered charities can register for the PayPal Giving Fund to be eligible to receive donations.

Donors pick their desired end-point charity, but send the donation to PayPal Giving Fund. The PayPal Giving Fund will attempt to send the donation to the donor’s chosen nonprofit, however, they don’t guarantee it. PayPal Giving Fund has exclusive, legal control over all donations.

Collecting donations through the PayPal Giving Fund offers attractively low fees, but be aware that they score a low 1.6 star rating on Google, with many past donors complaining that their donations never arrived at the nonprofit they specified and charities saying that they never received their funds.

The cost and convenience of PayPal Giving Fund might be alluring, but it’s best to weigh the risks involved. Instead, turn to a fundraising platform you can trust, with transparency and flexible fees.

When you collect donations with Crowded, you can do so 100% for free. Crowded’s platform and accounts are free, and you can ask your donors to cover the cost of their donation. Your nonprofit will be able to securely accept and keep all of your donations, unlike with PayPal!

6. Does PayPal require payer or donor information?

If your nonprofit wants to collect personal information about members or donors in addition to payments, like full name, email or phone number, PayPal does not require it for payers. It is not required or even an option when making a payment or donation through PayPal or to the PayPal Giving Fund. Like so:

For nonprofits looking to build a donor database for donor retention, missing out on this donor information can be a big setback.

For membership-based organizations, not having the contact information of members when paying can be an unnecessary obstacle!

7. Is PayPal secure against fraud?

Anyone can open a PayPal account and name it whatever they want. There have been many cases of fraud where people set up accounts with the same name and logo as a charity and people would donate there instead. PayPal, Venmo, Zelle and these other P2P apps are constantly in the news for scams and frauds. And because sending or receiving payments is insured with PayPal, they aren’t obligated to pay you back.

A powerful tool for nonprofits to manage finances

Instead of turning to Paypal with your nonprofit’s funds, imagine a %100 digital nonprofit bank account* with no subscription fees or minimum balances. The money you collect through your collections goes straight into your bank account*, without any need to withdraw and re-deposit funds.

As you collect payments, you benefit from clear documentation for streamlined accounting and tax reporting.

You can integrate your account to Quickbooks or Xero, or utilize Crowded’s ai-generated 990 Forms. You’ll never have to worry about reconciling accounts and records because they’re all in one place.

After collecting funds, you need a way to spend them on your org’s expenses. Crowded simplifies that with digital and physical debit cards. No more dealing with reimbursements. Instead, set budgets and track spending directly.

It’s all possible, but only with Crowded!