Managing a booster club is not just fun and games! Sometimes, booster club treasurers manage money streaming in from many different sources and in different forms.

For example, a booster club can collect for dues from parents and a lemonade stand fundraiser. The money earned from these two collections could be coming in the form of cash, Zelle, check, Venmo, credit card and more.

The booster club treasurer needs to account for cash and checks physically, while funds could be sitting in various fundraising platforms like Eventbrite or Cheddar Up or P2P payment apps like PayPal or Venmo.

In short, there is a clear need for organization and transparency with booster club funds, or else money will simply get lost! The easiest way stay organized with your booster club funds is to turn to an online payment collection provider.

How online payment collection can help you manage your booster club

To efficiently manage payment collection for your booster club, you need tools that simplify the money-collecting process. Online payment collection apps designed for booster clubs can do just that.

Streamline payment collection

Online payment apps significantly reduce the time spent collecting payments for your booster club, both for the treasurer and for the payers. Parents can pay dues directly by credit card or ACH through an online link simplifying and uniting the process. Collecting payments on one platform prevents payments from being forgotten or lost.

Consolidate multiple platforms into one

Instead of operating independent accounts for events, payments, spending, accounting, banking, fundraising, and more (e.g. Eventbrite, Cheddar Up, Chase, TurboTax, GoFundMe), find a platform that does it all! Using too many platforms leaves room for information or money to get lost. It also can get costly very quickly. Turn to a platform that can consolidate your booster’s solutions into one! (Hint: use Crowded)

Effortless Recorded Transactions

Online payment collection apps also automatically record every payment your booster club receives, which significantly reduces the administrative burden on the booster club treasurer. You can easily access records, setting you up for success when filing your annual taxes to the IRS. With Crowded, you can even file the booster’s annual 990 Form in-app and affordably.

Say away from collecting booster club payments with Zelle, Venmo & Paypal

If your booster club is regularly using these apps to collect payments, it’s best to be aware of the tax implications, security risks and organizational challenges.

Tax implications of using Zelle, Venmo & PayPal

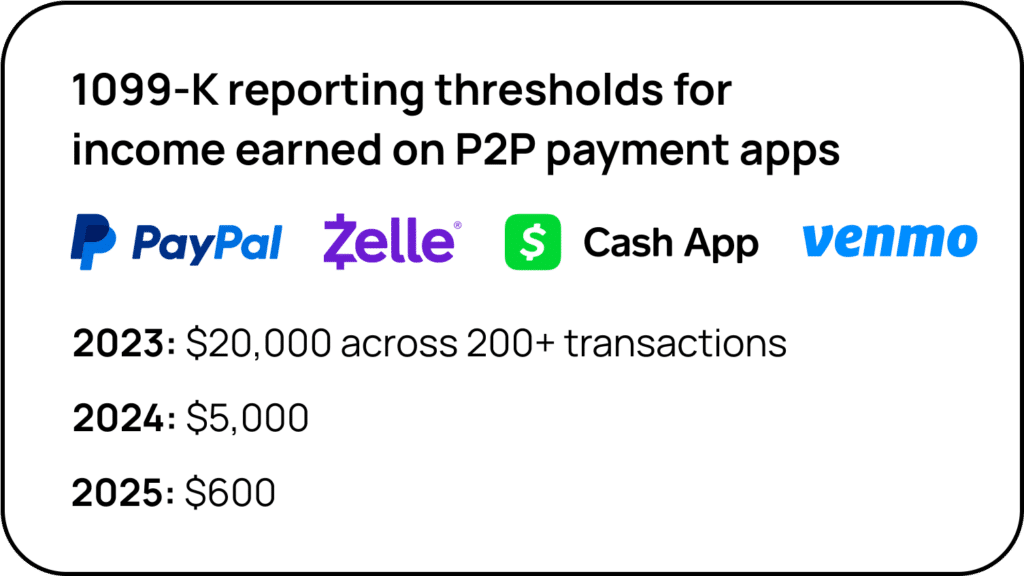

In 2021, the IRS stated that businesses selling on these apps have to report income on goods and services over $600. That’s really low! Your booster club could hit that threshold simply by accident by using these apps to collect for a few events.

Following a lot of pushback, the implementation was pushed back a few years. Here’s a chart for where the tax reporting requirements stand for 2023-25.

These states have decided not to wait for 2025, they have lowered the reporting threshold for 2023. If your booster club is located in these states, be aware!

Maryland: ≥ $600

Massachusetts: ≥ $600

Vermont: ≥ $600

Virginia: ≥ $600

Illinois: > $1,000 and 4+ separate transactions

Open to fraud

Anyone can open a Zelle, Venmo or PayPal account and name it whatever they want. There have been many cases of fraud where people set up accounts with the same name and logo as an established organization and people send their money to the fake one by accident. Venmo, Zelle and these other P2P apps are constantly in the news for scams and frauds. And because these apps are not insured, they aren’t obligated to pay you back.

Disorganized payments

Unlike payment software designed for booster clubs, apps like Venmo and Zelle only provide a chronological list of transactions, making it difficult to distinguish reimbursements from donations or dues collection. There are no specific payment details unless the sender enters them on their own accord, and even so it is hard to keep the labeling standardized.

5 must-have features for an online payment platform for booster clubs

Now that you understand the pitfalls of using a P2P payment app like Zelle, and you’re sold on the need for a dedicated platform for collecting booster club payments online, it’s just a question of which one to use!

Conduct a brief survey with the members of the booster club about payments. Ask what is hard for them with your booster’s current system and what features they would want with an online payment platform. Make a list of must-haves and nice-to-haves for your potential payment platform.

Here are our top 5 must-have features to look for when picking an online platform for booster club payments:

1. Accepts many different payment types

With the right payment solution, you can offer your members multiple payment methods for booster club expenses, allowing them to make secure payments in the way that is most convenient for them. Start accepting credit, debit, and ACH payments in addition to Zelle, Venmo, checks and cash with the right platform.

2. Flexible payment options

There are many types of payments that booster clubs need to collect, from event tickets to donations. Online payment apps simplify the management of these payments.

They offer options for collecting donations, in-person payments, multiple payments at once, or recurring payments. By utilizing a payment platform, you streamline your payment collection needs as a booster club.

3. Spending tools

The right payment collection app can not only make collecting funds easier but also simplify spending. Booster clubs make a variety of payments, such as paying invoices, purchasing equipment, or acquiring resources for fundraising efforts.

A platform that can also issue debit cards with the money collected can eliminate the need for an external bank account and constant reimbursements. Using a platform with spending capabilities allows for transparent club spending and eliminates the possibility of embezzlement or fund mismanagement. Learn more about Crowded’s expense cards.

4. Auto-generated annual 990 forms

Turn to an online payment collection provider who can also handle your tax compliance requirements as a registered nonprofit organization with the IRS. Crowded offers quick, easy and affordable 990 form filings, auto-generated from booster club’s Crowded data. Tax season doesn’t get easier than that!

5. Secure Fund storage

Ensure that all the funds your booster collects are secure. The best way is to look for a platform with an embedded bank account. This will eliminate the need for constant transferring of funds between platforms and allows you to rest easy knowing that the booster club’s funds are in good hands.

How Crowded can help your booster club with online payment collection

Crowded checks off all 5 must-haves for boosters looking for an online payment collection tool! Crowded makes it easy to collect funds for anything your booster needs: membership fees, events, equipment, uniforms, travel, and tournaments. The best part is that you can create a payment request for anything, and there are no extra cost for your booster club.

So how does it work? Crowded offers free accounts for booster clubs with no subscription fees. Any processing fees related to payment collection can paid by your members or charged to your org. Crowded’s fees are super low and competitive:

Venmo* | Cheddar Up | Square | Crowded | |

|---|---|---|---|---|

Card processing fees | 1.9% + $0.10 | 3.59%+$0.59 | 2.9%+$0.30 | 2.99% |

No monthly fees | ||||

Outgoing ACH fee | .75% | 1% | $2.49 | |

Payment Tracking | ||||

Payment Reminders | ||||

Collection Links |

*only for 501c3 nonprofits

Don’t believe us? See how the volunteer-run local water polo team used Crowded to manage the team finances! Read case study

Ready to use Crowded to make money management stress-free for your booster club? Sign up for Crowded online or to learn more about how you can customize Crowded for your booster club book a time with someone on our team.